[ad_1]

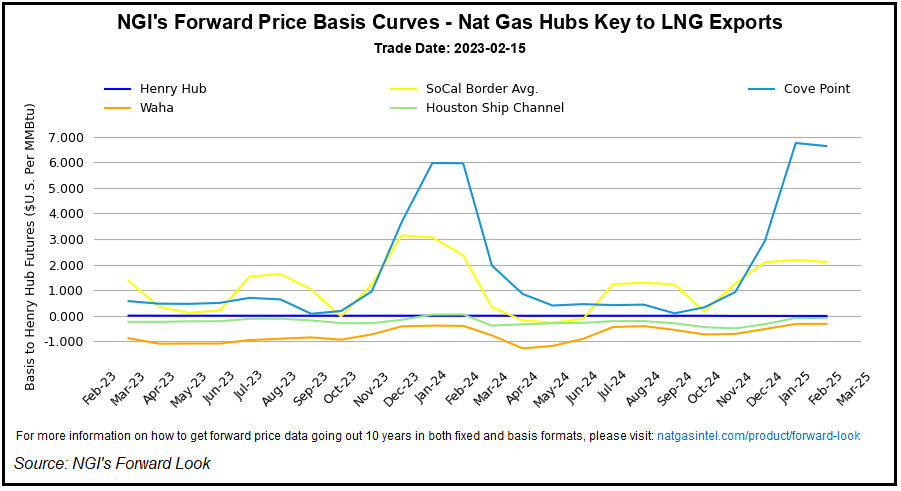

A dichotomy of steep beneficial properties for the West and hefty losses in every single place else performed out in pure fuel forwards markets in the course of the Feb. 16-22 buying and selling interval, NGI’s Ahead Look information present.

This dynamic largely mirrored the most recent climate maps from Maxar’s Climate Desk, which confirmed shades of blue colder-than-normal temperature deviations blanketing a lot of the western half of the Decrease 48 into the second week of March. Hotter temperatures, in the meantime, had been seen masking the jap Decrease 48.

The most recent 11- to 15-day outlook from Maxar Thursday pointed to “continued beneath to a lot beneath regular temperatures within the West and above regular protection within the South.”

March mounted costs for SoCal Citygate surged 79.3 cents greater to $6.125, whereas PG&E Citygate jumped $1.200 to $6.627. Northwest Rockies jumped 95.3 cents to $4.565.

Elevated West Coast costs have been a recurring theme this winter, and regional storage information proceed to level to tight situations within the area.

Storage within the Vitality Info Administration’s (EIA) Pacific area has tracked properly beneath the low finish of the 2018-2022 vary in 2023. Regional inventories stood at 108 Bcf as of Feb. 17, versus a 187 Bcf five-year common, based on EIA.

In the meantime, with typically milder temperatures and a swelling storage surplus for the Decrease 48 as an entire, reductions had been widespread at regional hubs east of the Rockies in the course of the Feb. 16-22 interval.

March mounted costs at benchmark Henry Hub shed 30.0 cents week/week to fall to $2.179.

Within the Midwest, Chicago Citygate dropped 33.2 cents to $2.225. In New England, Algonquin Citygate shed 89.4 cents to finish at $4.573.

‘Flattening’ Surpluses Forward?

Nymex pure fuel futures confirmed indicators of gaining some upward momentum in the course of the interval because the market seemed partly to the restart of the long-idled Freeport LNG terminal to assist agency up assist for costs heading into the spring.

After rallying 10.1 cents on Wednesday and tacking on one other 14.0 cents on Thursday, the March contract completed buying and selling on a excessive notice Friday. March finally rolled off the board at $2.451, a day/day achieve of 13.7 cents. The April contract added 11.6 cents Friday to settle at $2.548.

Helped by the returning demand from the Texas liquefied pure fuel export facility, the subsequent 30-45 days might “mark a turning level for pure fuel,” based on EBW Analytics Group analyst Eli Rubin.

Throughout this time-frame the market may stay up for potential beneficial properties in coal-to-gas switching within the energy sector and to decelerating manufacturing progress, the analyst stated.

These components might result in “a flattening of storage surpluses” and open “a pathway to a stabilization and modest restoration for Nymex futures,” Rubin stated.

On the manufacturing entrance, volumes out of the Northeast have been uncharacteristically flat this winter, which might signify a “bearish sign for pure fuel provide in 2023,” based on EastDaley Analytics.

In previous winters, Appalachian producers have tended to extend output in the course of the fourth quarter “to make the most of greater seasonal demand and costs,” the agency stated in a latest analysis notice. “This season, regional manufacturing as a substitute has stayed roughly flat.”

Pipeline samples counsel regional output hovering across the 33 Bcf/d mark this winter, with that quantity dropping throughout weather-related disruptions in December and early February, based on East Daley’s estimates.

That’s in distinction to the year-earlier interval, when Marcellus and Utica shale manufacturing grew from roughly 33 Bcf/d in early October to a peak of round 35 Bcf/d by the top of 4Q2021, East Daley stated.

“East Daley has been calling for an oversupply of pure fuel in 2023, and we have now simply began to see the market reply,” the agency stated.

East Daley’s most up-to-date provide and demand modeling confirmed a 3% drop in regional manufacturing this yr.

“We can be following steerage intently this quarter to see if Appalachian producers keep the present ‘upkeep mode’ mindset, or if some counsel pulling again on manufacturing,” the agency stated.

Upside Seen For International Costs

In the meantime, from a worldwide standpoint, the pure fuel market finds itself in a “very totally different setup” from the one which drove elevated costs on provide adequacy fears stoked by Russia’s invasion of Ukraine final yr, analysts at Goldman Sachs noticed in a latest notice.

“Storage ranges are properly above common, pushed by a really gentle winter, sturdy conservation efforts by households, a deeper-than-normal vacation drop in industrial exercise and destocking throughout a number of industrial sectors,” the Goldman analysts stated.

“This has eliminated the urgency for European costs to do the very factor that ensured wholesome storage injections final yr, particularly fuel demand destruction, leading to European fuel costs greater than 60% down from the beginning of this winter.”

This raises the query of whether or not the situations maintaining present storage ranges excessive will endure.

“We imagine not and, therefore, we see upside threat to costs later this yr and, specifically, in 2024,” the Goldman analysts stated. Right here the ahead curve is “practically flat versus 2023,” despite the fact that analysts imagine “fundamentals might probably lead costs to greater than double from the present” summer time ranges.

[ad_2]

Source_link