[ad_1]

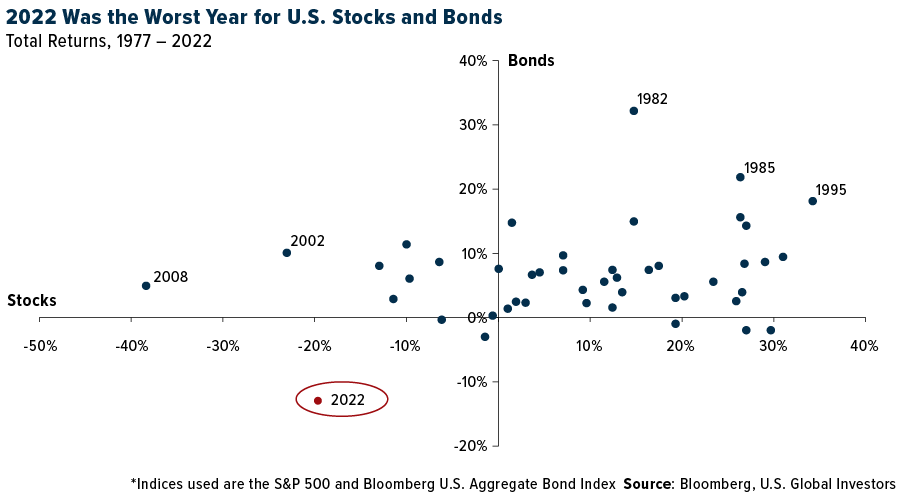

Traders who use a 60/40 portfolio had a tough 12 months. Up to now, placing 60% in shares and 40% in bonds has usually helped traders hedge in opposition to losses in both asset class. However 2022 had different concepts.

Under is a scatter plot of returns for the S&P 500 (the x-axis) and the Bloomberg U.S. Mixture Bond Index (y-axis), which tracks a basket of presidency and company debt in addition to mortgage-backed securities. In 45 years of information, 2022 ranks as one of many worst years for shares and absolutely the worst 12 months for bonds. Treasuries had their losingest 12 months ever.

What does this imply for the 60/40 portfolio? This new 12 months, ought to traders proceed to rebalance to replicate 60% shares and 40% bonds, or is the mannequin damaged?

To reply that, it’s necessary to recollect above all else that 60/40 is primarily for long-term traders. There could also be hiccups—2002, 2008 and now 2022—however over the long term, these are usually smoothed out by the better-performing years.

Between 1977 and 2021, the 60/40 combine resulted in a pretty annual equal charge (AER) of 11.86% for shares and 6.92% for bonds, in keeping with Bloomberg information. If we embrace 2022 within the combine, the AER falls barely to 11.10% for shares, 6.45% for bonds.

So going ahead, I believe 60/40 can nonetheless work for a lot of traders who’ve a protracted sufficient timeline and might abdomen occasional drops and surprising swings.

The ten% Golden Rule

After all, there are numerous extra asset courses to spend money on moreover shares and bonds. That features gold, which I’ve at all times beneficial traders have 10% of their portfolio in—5% in bodily bullion, the opposite 5% in high-quality gold mining shares, mutual funds and ETFs. I name this the ten% Golden Rule.

In 2022, gold was top-of-the-line property to have publicity to. The yellow steel was primarily flat for the 12 months, down a negligible 0.28%. That’s regardless of the U.S. greenback strengthening to its highest degree in 20 years.

That’s additionally regardless of rising bond yields, not simply right here within the U.S. however throughout the globe. Keep in mind when the quantity of negative-yielding authorities bonds all over the world was $10 trillion, $15 trillion, $18 trillion? That was solely two to a few years in the past.

At the moment, the quantity of presidency debt that trades with a unfavorable yield has formally dropped to $0.

You’ll suppose that on this surroundings, the gold value would endure. In any case, the dear steel generates no earnings. And but, gold has remained extremely resilient, as you’ll be able to see under.

I consider gold will proceed to carry out comparatively nicely in 2023, particularly if we see the Federal Reserve change course. That appears much less and fewer probably, although, as the roles market within the U.S. stays surprisingly sturdy. With as we speak’s Bureau of Labor Statistics (BLS) report, December marks the sixth straight month that the variety of new jobs created exceeded 264,000.

Have Bonds Peaked? That Would Be Good Information for Dividends

Once more, bonds had a horrible 12 months, that means yields spiked. (Bond yields rise when costs fall, and vice versa.) The 2-year yield peaked at 4.72% on November 7, the five-year at 4.44% on October 20 and the 10-year at 4.24% on October 24. Since then, all three maturities have contracted as inflation has moderated and rate of interest hikes have been smaller than these earlier within the 12 months.

This may very well be excellent news for dividend-paying shares. A few years in the past once I labored as a junior analyst, I realized that the five-year yield particularly was correlated with dividend-paying shares. When the yield on the five-year observe constructed momentum by crossing above its 50-day transferring common, dividend-paying shares grew to become much less engaging. And conversely, when the yield fell under the transferring common, shares started to recuperate.

We’re seeing that play out now. Check out the chart under. The S&P 500 Dividend Aristocrats Index, which tracks shares which were rising their dividends for not less than 25 years—suppose legacy firms like Clorox, McDonald’s, Johnson & Johnson and AT&T—hit its 2022 low when the five-year yield was nicely above its 50-day transferring common. Shares started to rebound when the yield fell under its transferring common.

It could be troublesome to see within the chart, however the five-year yield is as soon as once more buying and selling under the important thing transferring common, that means momentum is slowing, and I consider that is constructive for dividend-paying shares.

Asian Airways Are Hovering

On a closing observe, I shared with you that the Chinese language authorities has introduced a change to its zero-Covid coverage; specifically, inbound vacationers will not be required to quarantine upon return. It’s been a protracted three years, and bookings have soared as Chinese language vacationers plan to fly abroad.

As you’ll be able to see above, shares of Asian airways have responded positively, with a number of leaping 20% within the final quarter of 2022 alone.

Hong Kong’s Cathay Pacific is trailing its friends, however I consider there may very well be a reversal of fortune because the service is presently including extra flights and locations for its clients. It’s additionally not too long ago introduced again its first-class service on sure fashionable routes for the primary time in three years, which feels like an excellent purpose to have fun.

You’re invited to a free occasion occurring this upcoming Tuesday! Be part of me, Peter Krauth and Gwen Preston for a webinar on the inexperienced power transition. The webinar will happen on Tuesday, January 10, at 1:00pm Jap time. Enroll by clicking right here!

Index Abstract

- The most important market indices completed up this week. The Dow Jones Industrial Common gained 1.46%. The S&P 500 Inventory Index rose 1.45%, whereas the Nasdaq Composite climbed 0.98%. The Russell 2000 small capitalization index gained 1.79% this week.

- The Hold Seng Composite gained 6.12% this week; whereas Taiwan was up 1.67% and the KOSPI rose 2.41%.

- The ten-year Treasury bond yield fell 30 foundation factors to three.566%.

Airways and Transport

Strengths

- The perfect performing airline inventory for the week was Mesa Air, up 42.2%. Mesa Airways surged forward of, and following its, fourth quarter 2022 earnings launch, together with the firming of revised agreements with United collectors that gives ample liquidity till earnings can recuperate. Nevertheless, this isn’t inconsistent with the prior view that thought of chapter as decrease danger regardless of the submitting delay and announcement of plans to wind down the American Airways relationship.

- MSC has delayed a few of its ultra-large container vessels with the primary of its new vessels (MSC Tessa) anticipated to solely enter service in February 2023. As supply dates are mutable and liners sometimes benefit from the higher hand versus shipyards, supply slippages may outpace general capability development, catering to present market dynamics. Price noting, Drewry is forecasting that solely 60% of capability scheduled to be delivered in 2023 will finally happen in the course of the 12 months.

- Ryanair upgraded its fiscal 12 months 2023 steerage primarily based on stronger-than-anticipated revenue after tax. The brand new steerage is 13% above consensus internet earnings of €1.22bn for fiscal 12 months 2023. The corporate assumes the fourth quarter to be loss-making and notes a current softening in U.Okay. and Eire site visitors and pricing.

Weaknesses

- The worst performing airline inventory for the week was Cathay Pacific, down 2.8%. GOL Linhas Aereas reported December site visitors figures, with complete ASK (out there seats per kilometer) up 21% year-over-year, down 11.5% versus 2019, whereas RPK (income passenger kilometers) was up 15% year-over-year, down 15.9% versus 2019, yielding a load issue of 77.9%.

- The Evercore ISI Transport Corporations Survey moved down from 76.8 to 71.3, as moderation in spot tanker charges weighed on the index, transferring it off its highest degree since 2005.

- In December, airline shares declined 12.3% and underperformed the S&P 500 by 6.4%. In 2022, airways underperformed the S&P 500 in seven out of the 12 months and the Dow Jones U.S. Airways Index (DJUSAR) declined 21.8% on the 12 months in comparison with the S&P 500 down 19.4%.

Alternatives

- U.S. airways’ trailing seven-day web site visits stepped up this week by 43% year-over-year. All airways noticed visitation enhance on an absolute and year-over-year foundation which is probably going a results of the widespread cancellations across the holidays. Southwest Airways took the largest step as much as +99% year-over-year, with the trailing seven-day absolute visitation rising over 60% from the prior week.

- MSC took over the place because the world’s largest container liner, and the service has been manifesting the main spot ever since. MSC’s fleet grew by 321,500 teu in 2022, equal to roughly 7.5%, writes Alphaliner, in an summary of field service fleet development final 12 months. Nevertheless, MSC solely introduced in 83,600 teu from newbuilds, with the remainder coming from second-hand vessels acquired all year long.

- Chinese language home air journey rebounded to 47% of regular ranges in second half of December with yields 16% above regular. There could also be scope for an extra restoration into the Chinese language holidays with authorities restrictions successfully lifted on home journey. The Australian site visitors restoration has stalled as airways prioritize yields and operational efficiency, whereas Hong Kong and Taiwan site visitors is rebounding on border opening.

Threats

- There’s probably draw back danger to Southwest’s aggressive 15% year-over-year 2023 ASM plan, which is back-half weighted. A lot of this capability development is expounded to restoring the community, with the improved market depth probably supporting higher irregular operations recoverability.

- Analysts are bearish on marine transportation from a top-down perspective resulting from declines in cargo quantity. This is because of, 1) container transport provide/demand circumstances normalizing and the decline in transportation charges halting resulting from discount and lack of companies all through the containership trade, and a pair of) new medium-term plans and strengthening of shareholder returns at Nippon Yusen and Mitsui O.S.Okay. Traces. Nevertheless, the outlook just isn’t good for the slack season throughout February–March.

- Raymond James’ issues about Mesa stays the shrinking of the regional airline alternative within the U.S. on account of the doubling of regional pilot wages and, thus, uncertainty in regards to the normalized earnings potential. The group is assuming a halving of the pre-pandemic earnings energy because the pilot provide scenario normalizes, with upside if United decides to reallocate flying to Mesa from different companions (given the ten% stake and draw back danger if the attrition reprieve is short-lived), as ULCCs begin elevating pilot wages.

Rising Markets

Strengths

- The perfect performing nation in rising Europe for the week was Poland, gaining 4.0%. The perfect performing nation in Asia this week was Hong Kong, gaining 6.0%.

- The Russian ruble was the very best performing forex in rising Europe this week, gaining 1.9%. The Thailand baht was the very best performing forex in Asia this week, gaining 2.7%.

- Know-how shares buying and selling on the Hong Kong Trade outperformed this week. China allowed Alibaba’s finance affiliate, Ant Group, to lift $1.5 billion for its client finance unit two years after the federal government referred to as off a deliberate IPO and ordered the agency to restructure. As well as, China continues to reopen its market regardless of Covid infections rising.

Weaknesses

- The worst performing nation in rising Europe for the week was Turkey, dropping 3.0%. The worst performing nation in Asia this week was Indonesia, dropping 2.3%.

- The Polish zloty was the worst performing forex in rising Europe this week, dropping 1.3%. The Indonesia rupee was the worst performing forex in Asia this week, dropping 0.2%.

- China’s Manufacturing and Service PMIs declined additional in December. The manufacturing index dropped to 47.0 from 48.0 in November. The service index recorded a fair sharper correction, dropping to 41.6 from 46.7 within the prior month.

Alternatives

- Hong Kong will open its border with mainland China on Sunday. As much as 60,000 vacationers from Hong Kong will probably be allowed to cross into mainland China day by day, Chief Govt John Lee introduced on Thursday. A unfavorable take a look at outcome inside 48 hours earlier than departure is required with on-line registration required. It’s estimated that as many as 50,000 individuals may journey by the land border and one other 10,000 by ferry or air.

- China’s new International Minister, Qin Gang, stated that he needs to enhance bilateral ties with the USA. He was appointed on December 30 as International Minister in alternative of Wang Yi, who had held the place since 2013 and was moved to the Political Bureau of the Communist Social gathering.

- The Eurozone reported decrease inflation this week. The patron value index (CPI) dropped to 9.2% in December from 10.1% in November, under the anticipated studying of 9.5%. The largest nation in central rising Europe, Poland, reported a drop in inflation as nicely. CPI declined to 16.6% in December from 17.5% in November. Whereas the price of dwelling remains to be excessive, the slowdown is an indication that the worst is perhaps over.

Threats

- Political tensions are rising in Turkey earlier than scheduled presidential elections in June. Turkey’s prime courtroom froze funding for a number one pro-Kurdish celebration and is contemplating a ban of the celebration, which is presently the third largest within the parliament, aiming to problem President Recep Tayyip Erdogan within the upcoming election. The Individuals’s Democratic Social gathering (HDP) grew to become a big political opponent in 2015, when the celebration received 80 seats within the parliament, briefly stopping Erdogan’s AK Social gathering from securing majority. Buying and selling on the Istanbul Inventory Trade was halted twice on Thursday as equites dipped.

- Russia is tying its relationship with Iran. Russian and Iranian house companies have signed memorandums on provisions of launch companies. In December, the Iranian Minister of Info and Communications Know-how Issa Zarepour stated that the nation would put into orbit not less than two domestically produced satellites, Nahid-1 and Nahid-2, by the spring of 2023. Nahid-2 is taken into account an necessary development in Iran’s orbital spacecraft manufacturing. Till the Ukraine struggle, Iran was essentially the most sanctioned nation on this planet, in keeping with Castellum.Ai, which tracks sanctions. Russia now holds that document.

- Orthodox Christians will have fun Christmas on January 7, and Russian President Putin ordered a 36-hour cease-fire. Hopefully, either side will respect the few hours of peace, however shortly after the Christmas celebrations are over, Russia will probably proceed its aggression. Ukraine and Russia for years have been celebrating Christmas on the identical day, January 7, however not this 12 months. Ukraine declared Christmas to be celebrated December 25 to disassociate itself from Russia and Patriarch Kirill.

Power and Pure Assets

Strengths

- The perfect performing commodity for the week was uranium, up 5.16%, as proxied by the Sprott Bodily Uranium Belief. CoverDyn, the advertising arm of conversion companies from Honeywell Worldwide’s Metropolis Works plant in Illinois, was awarded $14 million from the U.S. Division of Power (DOE). This comes from its $75 million program to create a home uranium reserve to spice up power safety. 5 home uranium suppliers have introduced provide contracts for over 800,000 kilos of U3O8 to the DOE.

- The U.S. tied Qatar because the world’s prime exporter of liquefied pure fuel final 12 months, writes Bloomberg, a milestone for the meteoric rise of America as a significant provider of the gas. Each international locations exported 81.2 million tons in 2022, in keeping with ship-tracking information compiled by Bloomberg. Whereas that’s a modest enhance for Qatar, it marks an enormous leap for the U.S., which solely started exporting LNG from the lower-48 states in 2016 and has seemingly in a single day grow to be a dominant pressure within the trade.

- The offshore restoration is progressing and the setup into fiscal 12 months 2023 stays supportive of continued contracting time period power. Day-rate power has been most notable for benign floating rigs, however demand has been broad primarily based; cumulative rig years added so far in 2022 for each jackup and floating rigs have been the best within the final seven years.

Weaknesses

- The worst performing commodity for the week was pure fuel, dropping 16.51%. With pure fuel costs down 40% during the last three weeks, U.S. shale executives stay involved in regards to the outlook for rising prices going into 2023, writes Bloomberg, as they proceed to wrestle with hiring and retaining staff, in keeping with the Federal Reserve Financial institution of Dallas. Most respondents polled within the financial institution’s newest quarterly power survey, which was launched Thursday, stated they anticipate to extend capital spending barely or considerably subsequent 12 months in contrast with 2022 ranges.

- In accordance with UBS, European aluminum cuts have amounted to 1,200 tons, whereas one other 800-900 tons are in danger at a $3,000 per ton price base. However China’s manufacturing run-rate has risen from 38 million tons to 41 million tons, offsetting disruptions in Europe. Importantly, regardless of third celebration estimates suggesting 30-50% of Chinese language smelters are dropping cash, their on-the-ground channel-checks counsel output will probably be stickier than anticipated.

- With the current weak point in pure fuel costs, the decrease 48 fuel manufacturing was down 10.4% this previous week to only 88.8 Bcf/day versus 99.2 Bcf/day final week. Freeport’s LNG export terminal is now prone to be down for a number of extra months, additional constraining entry to worldwide costs for home producers of pure fuel.

Alternatives

- Iron ore costs have lifted to $118 per ton, supported by China’s fast re-opening and the weaker U.S. greenback. Demand indicators usually stay weak, with China’s pig iron manufacturing once more falling week-over-week in mid-December and China rebar costs/ spreads nonetheless depressed; iron ore port inventories have fallen 4 million tons because the finish of November with mills restocking, whereas metal inventories at mills stay excessive.

- Norway’s Blastr Inexperienced Metal is planning a $4.3 billion funding to assemble a low-carbon metal manufacturing unit in Finland. This may very well be one of many largest industrial tasks to be inbuilt Norway, as reported by Bloomberg. Steelmaking is very air pollution intensive with blast furnaces heating iron ore and coking coal. Blastr’s plant can have a totally built-in hydrogen manufacturing facility powered by plentiful wind provides within the Nordic area. Sweden’s SSAB AB and Finland’s Outokumpu Oyj are additionally exploring inexperienced metal, nevertheless it’s not produced on an industrial scale but.

- Bloomberg reported three main Chinese language solar-panel makers are ramping up manufacturing in a boon to wash power. Photo voltaic demand has been rising however manufacturing was hamstrung in 2021 and 2022 resulting from a spike up in polysilicon costs in the course of the pandemic. Polysilicon costs have collapsed 50% from final 12 months’s excessive which ought to increase their margins, giving producers an incentive to spice up income now. Silver demand may decide up with elevated photo voltaic panel manufacturing.

Threats

- Lithium’s going to get cheaper in 2023, in keeping with a Chinese language provider of the battery steel, doubtlessly providing some aid to electric-vehicle makers squeezed by hovering prices, writes the Monetary Submit. Costs have already softened after a spectacular two-year rally labeled “insane” by Elon Musk and “unreasonable” by China’s BYD Co. The cool-off is poised to proceed as extra provide emerges to trim abnormally excessive margins for lithium producers, Wang Pingwei, chairman of Sinomine Useful resource Group Co., stated in an interview.

- Oil costs began the 12 months with greater than an 8% slide displaying that future demand uncertainty is important because the maker ponders a recession for 2023. The December studying for the index of companies launched by the Institute for Provide Administration (ISM) confirmed its largest drop because the speedy aftermath of the pandemic. ISM’s gauge of producing confirmed a second consecutive month-to-month drop in December too, additional miserable the outlook.

- UBS maintains a impartial and cautious view on America’s aluminum producers, because it assesses uncooked supplies price lags will proceed to strain margins by the primary half of the 12 months. Specifically greater caustic soda and carbon costs, which generally circulation by inventories with a one to five-month lag. Particularly, the uschemicals staff estimates U.S. caustic soda costs will stay elevated by the primary quarter, as caustic soda provide (a by-product of PVC) stays below strain on account of the U.S. residential building slowdown.

Luxurious Items

Strengths

- Hermes, well-known for its luxurious purses and different leather-based items, regardless of already having costs above the trade common, was in a position to elevate costs throughout the board (all product classes) globally in the course of the holidays. The corporate raised costs in China throughout Christmas and in Europe and the UK on the primary of the brand new 12 months.

- MGM China Holdings, a Macau on line casino and lodge operator, was the very best performing S&P World Luxurious inventory for the week, gaining 18.3%. Macau shares proceed to surge as China reopens its financial system after virtually three years of Covid restrictions.

Weaknesses

- Retail gross sales in Hong Kong dropped 4.2% year-over-year in November. Most Bloomberg economists have been predicting a rise of 4.8%. Strict Covid restrictions have weighed on Hong Kong’s financial system since early 2020.

- Gross sales of luxurious houses in China fell 40% year-over-year in 2022, Yicai World reported on Thursday. Round 422 new upmarket homes, price greater than 150,000 yuan per sq. meter, have been offered (representing a 19% drop). Pre-owned luxurious houses costing over 150,000 yuan per sq. meter slipped 52%, with the gross sales of these at above 10 million yuan falling to 2017 ranges.

- Tesla was the worst performing S&P World Luxurious inventory for the week, dropping 8.1%. Shares continued to unload this week after the corporate introduced weaker-than-expected gross sales within the fourth quarter and lower automotive costs in China.

Alternatives

- Morgan Stanley’s analysis groups estimate that Korean nationals are actually the world’s greatest spenders per capita on private luxurious items. General, in 2022, the full private luxurious items spending by South Koreans ought to have grown by 24%, reaching $16.8 billion, making the Korean market one of many quickest rising because the begin of the pandemic. Morgan Stanley sees Richemont and Louis Vuitton as key beneficiaries from sturdy demand in Asia.

- Barclays believes that the posh sector ought to expertise some slowing, however not a pointy drop in demand, forecasting income development of 9% this 12 months. The dealer has a constructive view on the European luxurious items market and factors out Cartier-owner Richemont as a most well-liked title inside the luxurious house. Richemont’s publicity to watches and the jewellery section gives an asset class that holds worth during times of rising inflation.

- This Saturday, Hong Kong will begin permitting guests to journey to China’s mainland. Solely 60,000 guests will probably be allowed to cross the border for now, however Bloomberg estimates that this 12 months’s border reopening will permit Hong Kong retail gross sales to rise 18% year-over-year in 2023, probably hitting 95% of pre-pandemic ranges, as 27 million guests from mainland China journey to town within the subsequent 12 months. As a result of Covid restrictions, previously two years, the variety of Chinese language vacationers visiting Hong Kong have dropped under 500,000.

Threats

- Tesla’s Chinese language competitor, BYD, unveiled two new electrical car (EV) automobiles throughout a press convention on Thursday. The U8 sport utility automotive could be on the “million yuan” degree, making it one of the vital costly EVs on the street in China, in keeping with Bloomberg. Tesla’s mannequin Y SUV has a a lot decrease base value. As well as, BYD introduced a luxurious electrical sport sedan, the U9. BYD shares gained 5% this week after dropping 28% in 2022.

- Tesla lower automotive costs in China once more, deepening the cuts from October of final 12 months. The beginning value for Tesla’s regionally constructed Mannequin Y sport utility automotive dropped to a brand new low of 259,000 yuan ($37,875), in keeping with the corporate’s Chinese language web site, which is 43% lower than the bottom mannequin out there in the USA. Tesla additionally lowered the value of the Mannequin 3 by 14% to 229,900 yuan, about 30% cheaper than within the U.S.

- The Financial institution of America analysis staff says the patron restoration in China will probably be bumpy, because the inhabitants of 1.4 billion individuals is dealing with a surge in Covid circumstances. They predict client spending to worsen in early 2023. The second half of the 12 months ought to be stronger, supported by the federal government’s initiatives to spur consumption.

Blockchain and Digital Currencies

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the very best performer for the week was Lido DAO, rising 51.77%.

- BlackRock has given bankrupt bitcoin miner Core Scientific a brand new $17 million mortgage. BlackRock, which already was Core’s largest shareholder, beforehand held $37.9 million of the miner’s secured convertible notes. The newest $17 million is a part of the brand new $75 million convertible notes, that are a part of Core’s pre-arranged chapter course of, writes CoinDesk.

- An funding agency tied to 2 of Singapore’s most well-known households is taking steps to guess on the way forward for digital property, writes Bloomberg, regardless of the chilliness within the trade. Whampoa Group, a multi-family workplace anchored by principals from the Lee household that based Oversea-Chinese language Banking Corp and Amy Lee (the niece of the city-state’s founding prime minister), goals to deploy about $100 million in Web3 start-ups, by a brand new enterprise funding arm, the article continues.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performing for the week was Huobi Token, down 9.97%.

- The U.S. SEC is pushing again on Binance.US’s plan to purchase bankrupt crypto lender Voyager Digital in a deal valued at about $1 billion, in keeping with a chapter courtroom submitting. The SEC has communicated the issues to Voyager’s attorneys and has been suggested that revised paperwork will probably be filed, in keeping with the objection. The company added that it reserves the correct to amend its objection later, writes Bloomberg.

- Silvergate Capital slumped in early buying and selling after the financial institution stated it offered property at a steep loss and fired 40% of its workers. Prospects withdrew about $8.1 billion of digital asset deposits from the financial institution in the course of the fourth quarter, which compelled it to promote property at a lack of $718 million, writes Bloomberg.

Alternatives

- Animoca Manufacturers is trying to elevate about $1 billion this quarter for its new Web3 metaverse funding fund, sharply scaling again its ambitions in the course of the present crypto trade meltdown. Animoca Capital is in talks with potential traders and would use the cash to help blockchain and metaverse startups, writes Bloomberg.

- Singapore’s important crypto foyer group has pushed again on the central financial institution’s proposals to bar crypto corporations from lending out retail clients’ digital tokens, saying such a measure is overly restrictive. The Blockchain affiliation of Singapore stated such a blanket ban may as a substitute push individuals to hunt out unregulated offshore corporations to lend their tokens to writes Bloomberg.

- Throughout their first digital assembly of the 12 months, Ethereum builders stated they’re pushing forward with a key software program improve that will let individuals withdraw Ether tokens used to function the blockchain community, writes Bloomberg.

Threats

- DeFi customers fell sufferer to a phishing assault and misplaced $3.4 million in gmx, the native token of decentralized buying and selling protocol GMX, studies Bloomberg. The tokens have been then offered on the open market. On-chain information exhibits that the attacker began taking out funds from the sufferer’s pockets at 7 pm UTC on January 3. The attacker despatched out gmx price about $3.4 million to a different handle and swapped them for ether, safety analysts PeckShield estimated.

- The highest U.S. financial institution regulators issued a recent warning to lenders in regards to the dangers related to delving into crypto. The Fed, FDIC, and Workplace of the Comptroller of the Forex on Tuesday detailed issues with the risky asset class. Officers stated in a press release that it was necessary that dangers that may’t be managed aren’t allowed emigrate to the banking system, writes Bloomberg.

- Coinbase shares slumped as a lot as 6.8% in premarket buying and selling Thursday after the cryptocurrency trade was downgraded to market carry out from outperform at Cowen. This says that retail buying and selling volumes have but to indicate indicators of stabilizing, in keeping with an article revealed by Bloomberg.

Gold Market

This week gold futures closed at $1,871.80, up $45.60 per ounce, or 2.50%. Gold shares, as measured by the NYSE Arca Gold Miners Index, ended the week greater by 9.36%. The S&P/TSX Enterprise Index got here in up 2.04%. The U.S. Commerce-Weighted Greenback rose 0.37%.

| Date | Occasion | Survey | Precise– | Prior |

|---|---|---|---|---|

| Jan-2 | China Caixin China PMI Mfg | 49.1 | 49.0 | 49.4 |

| Jan-3 | Germany CPI YoY | 9.0% | 8.6% | 10.0% |

| Jan-4 | ISM Manufacturing | 48.5 | 48.4 | 49.0 |

| Jan-5 | ADP Employment Change | 150k | 235k | 182k |

| Jan-5 | Preliminary Jobless Claims | 225k | 204k | 223k |

| Jan-6 | Eurozone CPI Core YoY | 5.1% | 5.2% | 5.0% |

| Jan-6 | Change in Nonfarm Payrolls | 203k | 223k | 256k |

| Jan-6 | Sturdy Items Orders | -2.1% | -2.1% | -2.1% |

| Jan-12 | CPI YoY | 6.6% | — | 7.1% |

| Jan-12 | Preliminary Jobless Claims | 214k | — | 204k |

Strengths

- The perfect performing valuable steel for the week was gold, up 2.50%. Osisko Gold has amended the CSA stream settlement, successfully lowering the upfront cost for the silver stream to $75 million (beforehand $90 million). The corporate has additionally entered right into a backstop financing settlement with Metals Acquisition Corp., offering as much as $75 million in financing as an replace to the beforehand introduced copper stream possibility.

- Artemis Gold up to date the market on the timing of the BC Mines Act permits, indicating it expects to obtain the permits this quarter. The BC Mines Act permits are the ultimate allowing milestone for the undertaking. Main building remains to be deliberate for the top of the primary quarter, and substantial pre-construction work is underway or already accomplished.

- Skeena Assets Ltd. introduced that it has closed a royalty sale with Franco-Nevada Company pursuant to which Skeena granted a 0.5% internet smelter returns royalty on the Eskay Creek gold-silver Mission to Franco-Nevada in trade for a closing money consideration of C$27 million and contingent money consideration of C$1.5 million. As highlighted within the Firm’s September 26, 2022, information launch, Skeena repurchased this 0.5% NSR from Barrick Gold Company after it was initially granted in reference to the acquisition of Eskay Creek.

Weaknesses

- The worst performing valuable steel for the week was silver, down 0.21%. Regardless of constructive information on the finish of the week, Bloomberg reported three main Chinese language solar-panel makers are ramping up manufacturing in a boon to wash power. Photo voltaic demand has been rising however manufacturing was hamstrung in 2021 and 2022 resulting from a spike up in polysilicon costs in the course of the pandemic. Polysilicon costs have collapsed 50% from final 12 months’s excessive which ought to increase their margins, giving producers an incentive to spice up income now. which ought to result in elevated silver demand.

- Trade-traded funds (ETFs) lower 38,791 troy ounces of gold from their holdings within the final buying and selling session, bringing this 12 months’s internet gross sales to three.77 million ounces, in keeping with information compiled by Bloomberg. The gross sales have been equal to $70.4 million on the earlier spot value.

- Fortuna Silver Mines was down after the corporate on Thursday referred to as a choice by Mexico’s Secretary of Surroundings and Pure Assets to re-assess a 12-year extension of the environmental impression authorization for its San Jose mine within the nation “incomprehensible,” because it plans to problem the ruling.

Alternatives

- MAG Silver studies that it has acquired affirmation from Fresnillo, the operator of the Juanicipio Mission, that closing testing of the downstream energy distribution and management methods on the undertaking is now full. The whole system has now been energized and commissioning of the undertaking has formally begun. Fresnillo’s goal is to succeed in full nameplate capability within the second quarter of this 12 months. As soon as commissioning is concluded, greater grade mineralized materials will probably be processed on the Juanicipio plant and will additionally proceed to be processed on the close by Saucito and Fresnillo operations if required.

- Buying and selling in name contracts of VanEck Gold Miners ETF thus far this 12 months is essentially the most lively since March, studies Bloomberg, underscoring expectations the dear steel will proceed to outpace useful resource property. The fund, which has invested about $13 billion in a portfolio together with Newmont Corp., Barrick Gold Corp. and Franco-Nevada Corp., has jumped 7% in 2023 bringing to 40% its acquire since a low on September 26, the article continues.

- New Discovered Gold Corp. stated that it plans to increase its diamond

drill marketing campaign on the Queensway undertaking in Newfoundland and Labrador to

500,000 meters from 400,000 meters. The corporate stated its expanded drill program is absolutely funded out of its present money and marketable securities stability of $90 million.

Threats

- The feasibility research replace for Osisko has lowered the NAV estimate to C$88 million (from C$161 million beforehand). The decrease NAV is because of decrease grade (following the feasibility research grade 3.78g/t), and a 2024 startup, which is later than consensus.

- Gold eased from a six-month excessive this week as Treasury yields rebounded following Federal Reserve minutes that indicated rates of interest could keep excessive for a very long time. In an unusually blunt warning to traders, central financial institution officers cautioned in opposition to underestimating their will to maintain rates of interest excessive. Yields on benchmark 10-year authorities bonds rose Thursday, following a run of declines that drove bullion to the best since June this week.

- The gold value ticked down from recent six-month highs because the headline manufacturing index from the Institute for Provide Administration upset expectations in December, contracting barely greater than anticipated. The ISM manufacturing index was at 48.4% final month versus the consensus forecast of 48.5%. The month-to-month determine additionally marked a 0.9 percentage-point enhance from November’s studying of 49%.

U.S. World Traders, Inc. is an funding adviser registered with the Securities and Trade Fee (“SEC”). This doesn’t imply that we’re sponsored, beneficial, or accredited by the SEC, or that our talents or {qualifications} the least bit have been handed upon by the SEC or any officer of the SEC.

This commentary shouldn’t be thought of a solicitation or providing of any funding product. Sure supplies on this commentary could comprise dated info. The knowledge supplied was present on the time of publication. Some hyperlinks above could also be directed to third-party web sites. U.S. World Traders doesn’t endorse all info provided by these web sites and isn’t chargeable for their content material. All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions is probably not applicable to each investor.

Holdings could change day by day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Traders as of (12/30/22):

Skeena Assets

Franco-Nevada

Barrick Gold Corp

Fortuna Silver Mines

Osisko Gold Royalties

Alibaba Group Holding

American Airways

United Airways

Ryanair Holdings

Southwest Airways

Burberry

Hermes

Richemont

Louis Vuitton

Cartier

Tesla

Air China Ltd.

*The above-mentioned indices usually are not complete returns. These returns replicate easy appreciation solely and don’t replicate dividend reinvestment.

The Dow Jones Industrial Common is a price-weighted common of 30 blue chip shares which can be usually leaders of their trade. The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 frequent inventory costs in U.S. firms. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq Nationwide Market and SmallCap shares. The Russell 2000 Index® is a U.S. fairness index measuring the efficiency of the two,000 smallest firms within the Russell 3000®, a well known small-cap index.

The Hold Seng Composite Index is a market capitalization-weighted index that includes the highest 200 firms listed on Inventory Trade of Hong Kong, primarily based on common market cap for the 12 months. The Taiwan Inventory Trade Index is a capitalization-weighted index of all listed frequent shares traded on the Taiwan Inventory Trade. The Korea Inventory Value Index is a capitalization-weighted index of all frequent shares and most well-liked shares on the Korean Inventory Exchanges.

The Philadelphia Inventory Trade Gold and Silver Index (XAU) is a capitalization-weighted index that features the main firms concerned within the mining of gold and silver. The U.S. Commerce Weighted Greenback Index gives a basic indication of the worldwide worth of the U.S. greenback. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose fairness weights are capped 25 % and index constituents are derived from a subset inventory pool of S&P/TSX Composite Index shares. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded firms concerned primarily within the mining for gold and silver. The S&P/TSX Enterprise Composite Index is a broad market indicator for the Canadian enterprise capital market. The index is market capitalization weighted and, at its inception, included 531 firms. A quarterly revision course of is used to take away firms that comprise lower than 0.05% of the load of the index, and add firms whose weight, when included, will probably be higher than 0.05% of the index.

The S&P 500 Power Index is a capitalization-weighted index that tracks the businesses within the power sector as a subset of the S&P 500. The S&P 500 Supplies Index is a capitalization-weighted index that tracks the businesses within the materials sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base degree of 10 for the 1941-43 base interval. The S&P 500 Industrials Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the industrial sector as a subset of the S&P 500. The S&P 500 Client Discretionary Index is a capitalization-weighted index that tracks the businesses within the client discretionary sector as a subset of the S&P 500. The S&P 500 Info Know-how Index is a capitalization-weighted index that tracks the businesses within the info expertise sector as a subset of the S&P 500. The S&P 500 Client Staples Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the client staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the businesses within the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the businesses within the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the telecom sector as a subset of the S&P 500.

The Client Value Index (CPI) is among the most well known value measures for monitoring the value of a market basket of products and companies bought by people. The weights of elements are primarily based on client spending patterns. The Buying Supervisor’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index is predicated on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment surroundings. Gross home product (GDP) is the financial worth of all of the completed items and companies produced inside a rustic’s borders in a selected time interval, although GDP is often calculated on an annual foundation. It contains all personal and public consumption, authorities outlays, investments and exports much less imports that happen inside an outlined territory.

The S&P World Luxurious Index is comprised of 80 of the biggest publicly traded firms engaged within the manufacturing or distribution of luxurious items or the availability of luxurious companies that meet particular investibility necessities.

The Bloomberg U.S. Mixture Index is a broad-based flagship benchmark that measures the funding grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index contains Treasuries, government-related and company securities, MBS (company fixed-rate pass-throughs), ABS and CMBS (company and non-agency).

The Bloomberg Barclays World Mixture Detrimental Yielding Debt Market Worth Index measures the inventory of debt with yields under zero issued by governments, firms and mortgage suppliers all over the world that are members of the Bloomberg Barclays World Mixture Bond Index.

The S&P 500 Dividend Aristocrats index is designed to measure the efficiency of S&P 500 index constituents which have adopted a coverage of constantly rising dividends yearly for not less than 25 consecutive years.

The annual equal charge (AER) is the rate of interest for a financial savings account or funding product that has a couple of compounding interval.

[ad_2]

Source_link