[ad_1]

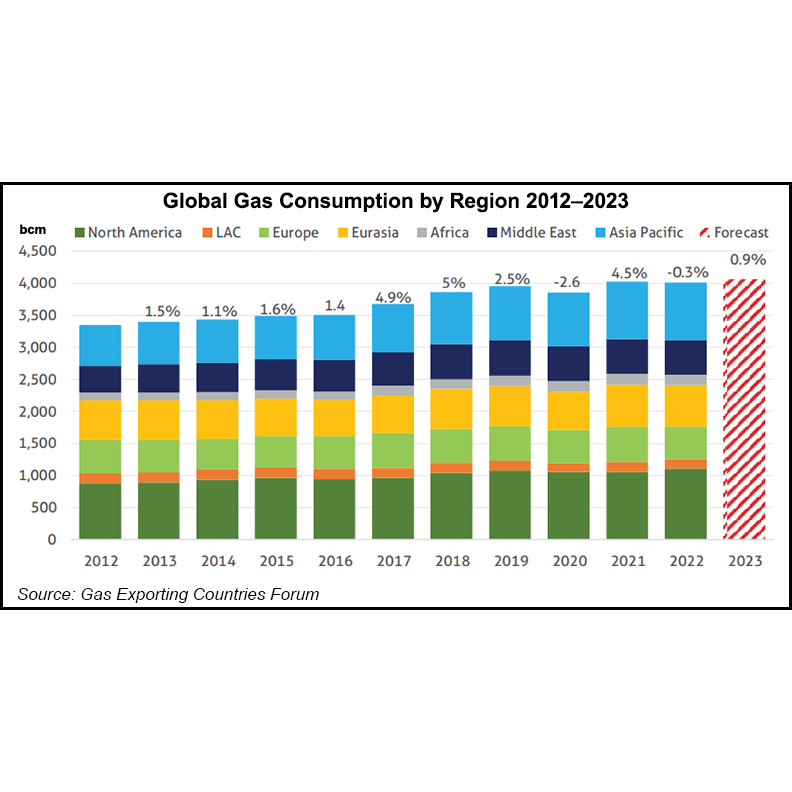

International pure fuel consumption is predicted to rebound this yr as easing worth volatility and rising financial exercise boosts LNG imports from China and South Asia and North America’s energy market continues to chop coal-fired capability, in line with the Fuel Exporting Nations Discussion board (GECF).

Researchers with the group headquartered in Qatar within the annual report stated fuel consumption might develop to an all time excessive by way of 2024. Fuel consumption had been trending upward after collapsing through the Covid-19 pandemic, however demand reversed once more in 2022.

A mix of delicate climate, excessive liquefied pure fuel costs and the invasion of Ukraine final yr led to a 0.4% decline, decreasing fuel consumption to 4.03 trillion cubic meters (Tcm). This yr, insurance policies to chop emissions from the North American energy sector and a surge of LNG demand in Asia is predicted to spice up consumption by 1%.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

Asia is anticipated to have a 4-4.5% yr/yr enhance in LNG imports in 2023, with world imports rising by 16-18 million tons (Mt) to round 416 Mt.

“China and international locations within the Indian subcontinent and Southeast Asia are forecasted to account for the majority of incremental improve in LNG imports with an extra 13-15 Mt of LNG imports,” researchers wrote.

In the US, the rising worth of coal and the continued retirement of coal era capability final yr helped gas a 5.4% rise in fuel consumption to 905 Bcm. Canada’s fuel consumption additionally rose with a 4% leap to 139 Bcm.

In 2023, GECF estimated North American fuel consumption would largely keep the identical or barely decline yr/yr as renewable era will increase. Reducing coal costs might additionally eat into fuel’s good points within the energy sector from final yr, researchers wrote.

Fuel consumption in Latin America and the Caribbean can be anticipated to proceed a decline this yr after dropping 2.7% final yr to 150 Bcm.

“In 2023, regional fuel demand is forecasted to say no by 1%, pushed primarily by the restoration in hydro and renewables output and decrease LNG imports because of excessive costs,” researcher wrote of Latin America.

Europe’s abrupt rush to exchange Russian pipeline fuel led to a 6%, or 21 Mt, leap in world LNG imports final yr, regardless of an general decline in fuel consumption. Whereas Europe is positioned to exit winter with pure fuel storage properly above the five-year common, GCEF estimated the area’s consumption might drop one other 3% yr/yr.

China and India led the decline in fuel consumption for Asia throughout 2020. China, which holds a big assortment of long-term LNG contracts, relied on home manufacturing and storage for a lot of the yr whereas Covid-19 restrictions tamped down consumption by 1.3% yr/yr. India noticed a 4.3% decline in fuel consumption whereas heighted costs drove gas-to-coal switching in its energy era sector.

Whereas coal noticed a resurgence in each Asia and Europe final yr, researchers wrote report tightness within the coal market and local weather targets will imply “energy era will seemingly stay the most important driver of worldwide fuel consumption, as extra international locations transition away from coal-fired energy crops.”

Three new international locations –Estonia, the Philippines and Vietnam– have been anticipated to turn out to be LNG importers this yr. Finland and Estonia partnered on a floating storage and regasification unit on the Port of Inkoo that obtained its first commissioning cargo final month. Germany and El Salvador joined the brand new importer membership final yr.

Vietnam is predicted to obtain a commissioning cargo through the summer time to launch distribution from the Thi Vai LNG import facility. India additionally launched its seventh LNG import terminal and its first on the jap seaboard earlier within the month. Dhamra LNG, a three way partnership between TotalEnergies and Adani Group, obtained an inaugural cargo from Qatar Fuel on April 3.

Regardless of a quiet begin to the yr for LNG markets, GECF expects spot costs to stay risky through the yr. Excessive exports ranges, particularly from the US, and the chance of worldwide recession “might exert downward stress.” Nonetheless, there’s additionally the expectation that better demand from Asia and industrial sectors might spike costs.

Moreover, any additional provide disruptions or excessive climate circumstances through the yr may additionally enhance costs,” researchers wrote.

[ad_2]

Source_link