[ad_1]

The large unfold between European pipeline gasoline futures and LNG delivered to the continent has narrowed to a median vary as international gasoline costs proceed to slip, however analysts warn the chance of volatility nonetheless looms giant.

European regulators and pure gasoline consumers have been cautiously eyeing the differential between Northwest European liquefied pure gasoline delivered to regasification amenities (NWE DES LNG) and the Dutch Title Switch Facility (TTF) contract for pipeline gasoline because the disruption of Russian pipeline imports final yr despatched shockwaves by means of the market.

The differential progressively ballooned final yr, when NWE DES LNG reached a file $22.47/MMBtu low cost to TTF futures in October, in response to information from Spark Commodities. The low cost for NWE DES LNG is at present round $1.45.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

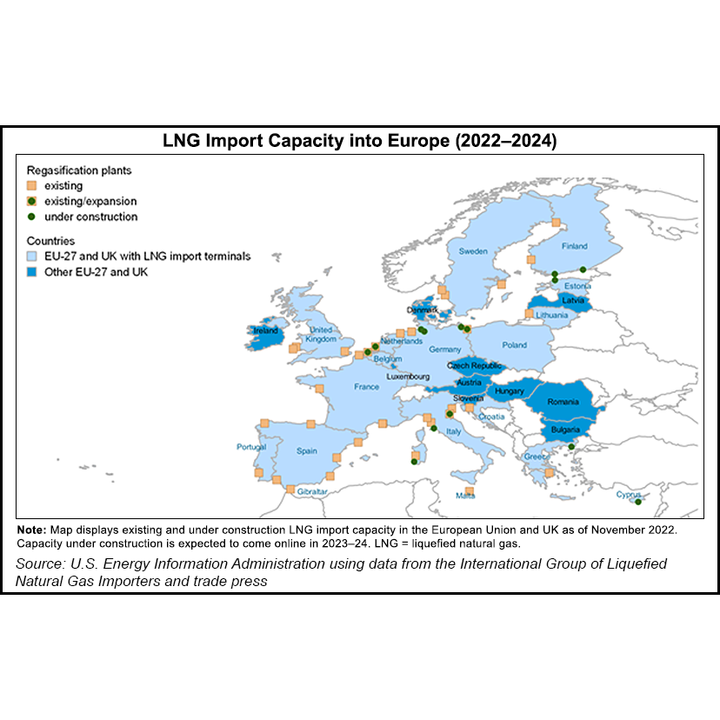

Spark Commodities’ Henry Bennett, head of pricing, instructed NGI the divergence of costs might largely be attributed to “elevated LNG inflows into Europe mixed with limitations on European import capability.” That added additional hurdles because the area’s markets realigned from the lack of Russian provide.

As provides dried up and TTF costs soared final yr, demand was excessive for LNG supply slots. Corporations that had import – or regasification capability – have been capable of safe reductions for LNG from corporations with out it, driving the value unfold between TTF and LNG wider in each Northwest and Southwest Europe.

As TTF costs have fallen, import capability has progressively elevated throughout Northwest Europe from terminal tasks, Bennett stated, “which has eased the import bottlenecks.” Europe has continued to import giant volumes of LNG, taking in 9.23 million tons (Mt) in January, in response to information from Kpler Nonetheless, the volumes of LNG idling in ships offshore have dropped after peaking at 3.37 Mt in November.

Whether or not the gulf between costs grows once more, “will rely closely on whether or not or not we see a reintensification of the power disaster,” Bennett stated. Nonetheless, the differential revealed by Spark is slender over the following 12 months, with LNG solely holding a max low cost of $2.74/MMBtu for the February 2024 contract.

Engie EnergyScan analysts not too long ago wrote that European costs “have discovered an equilibrium round their present ranges,” opening up the likelihood for elevated gasoline use to turn into economically viable. “Any sturdy drop under these ranges might set off a rebound in demand from energy era and business.”

Goldman Sachs Commodities Analysis additionally not too long ago adjusted its assumption for summer season TTF costs to a median of $32 on expectations European producers might improve gasoline demand.

EnergyAspects’ James Waddell, head of European Fuel and World LNG, instructed NGI it was vital to notice any steadiness in present international pure gasoline costs is coloured by demand discount throughout Europe and extended tightness within the LNG market.

Earlier this month, Germany’s gasoline community regulator reported gasoline demand was round 8% decrease in the beginning of February than the four-year common. Nonetheless, it warned consumption has been steadily rising because the starting of the yr.

“It’s unlikely that there might be a gasoline deficit state of affairs this winter,” employees with Germany’s Federal Ministry for Financial Affairs and Local weather Motion wrote. “On the identical time, making ready for the 2023-2024 winter is a key problem. It’s subsequently nonetheless vital to avoid wasting gasoline”

Whereas Northwest Europe’s elevated import capability will cut back competitors for slots at terminals, Waddell stated congestion was anticipated to say no this yr as a result of much less LNG may very well be out there for Europe in contrast with final yr.

In the meantime, the chance of unstable international LNG costs by means of the summer season and into the winter refilling season nonetheless exists, particularly if power demand from China rebounds after the top of strict Covid-19 insurance policies.

EnergyAspects shouldn’t be assuming a situation the place Asian consumers should out compete Europe for U.S. cargoes, Waddell stated. Nonetheless, there may very well be “extra demand relative to Pacific Basin provide this yr in comparison with final yr.”

[ad_2]

Source_link