[ad_1]

Following back-to-back weekly declines to begin the brand new 12 months, pure fuel futures on Tuesday rebounded amid forecasts for contemporary bouts of chilly later this month. The February Nymex fuel futures contract gained 16.7 cents day/day and settled at $3.586/MMBtu. March rose 5.7 cents to $3.253.

At A Look:

- Climate outlook takes bullish flip

- Manufacturing hovers round 101 Bcf/d

- Analysts see weak EIA storage print

NGI’s Spot Fuel Nationwide Avg. on Tuesday jumped 90.5 cents to $6.115.

The immediate month had shed 27.6 cents on Friday forward of the Martin Luther King Jr. Day vacation weekend and after a number of days of unseasonably heat climate to begin 2023. Manufacturing additionally proved robust and held round 101 Bcf/d, close to file ranges of about 102 Bcf/d, based on Bloomberg’s estimate Tuesday.

Nonetheless, colder forecast developments over the lengthy weekend despatched the outlook for the Jan. 25-31 interval “solidly to the bullish facet,” NatGasWeather mentioned Tuesday.

“Frosty Canadian air will pour into the western and central U.S. this weekend…for a bump in nationwide demand,” the agency mentioned. “Chilly air will lastly advance into the East subsequent week, leading to below-normal temperatures overlaying many of the U.S.,” bolstered by “a number of reinforcing chilly photographs into the northern U.S.

“Lows of 20s and 30s may also advance comparatively deep into Texas and South subsequent week to assist robust nationwide demand.”

EBW Analytics Group’s Eli Rubin, senior analyst, mentioned that whereas manufacturing is close to all-time highs, colder climate late this month and, doubtlessly, into early February might trigger wellhead freeze-offs throughout the Bakken, Rockies and MidContinent, leading to lighter provide.

Nonetheless, pure fuel costs are greater than 50% decrease than the place they have been only a month in the past. Rubin cautioned that for futures to maintain an upward trajectory, colder air might want to arrive quickly and forecasts for extra of it into February could also be wanted.

“After the 52 Bcf enhance in weather-driven fuel demand over the lengthy vacation weekend, the market could wrestle to generate any lasting upward momentum except temperatures proceed to shift markedly colder and dramatically tighten the February outlook,” Rubin mentioned.

“If chilly continues to construct into early to mid-February, swelling area heating demand alongside lurking freeze-off fears might spur a burst of upward strain,” he added.

Storage Snapshot

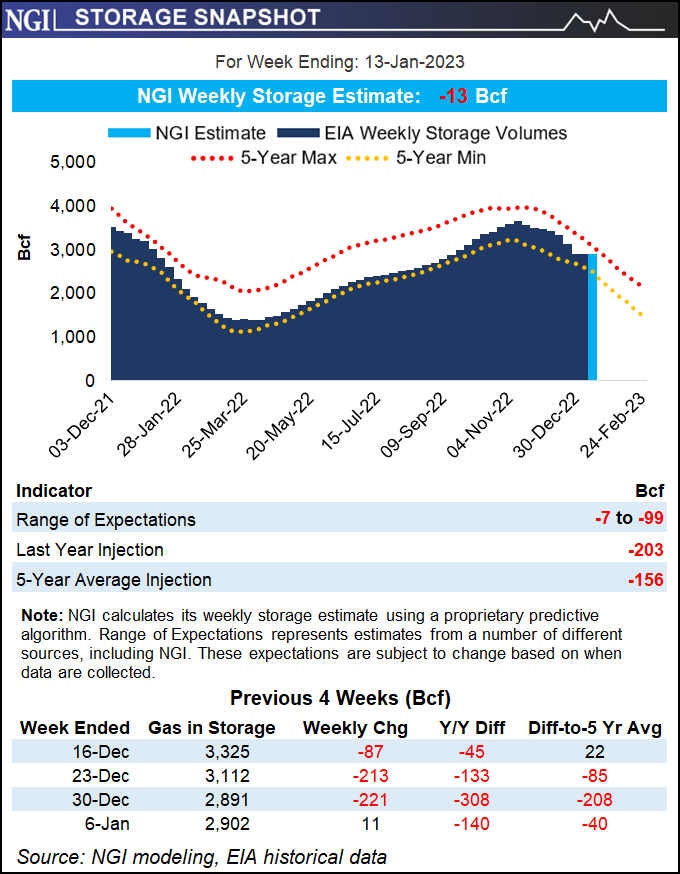

Within the meantime, following a uncommon winter storage injection printed by the U.S. Power Info Administration (EIA) final week – 11 Bcf for the interval ended Jan. 6 – analysts predict weak outcomes once more this week and subsequent, reflecting benign climate by way of the primary half of January.

The construct for the Jan. 6 interval in contrast with a five-year common pull of greater than 150 Bcf. The injection boosted inventories to 2,902 Bcf, leaving shares barely beneath the five-year common of two,942 Bcf and the year-earlier stage of three,042 Bcf.

With this Thursday’s EIA print, analysts are on the lookout for a draw — however a comparatively modest one.

Early estimates submitted to Reuters for the week ended Jan. 13, for instance, landed at a median pull of 74 Bcf. NGI modeled a withdrawal of 13 Bcf. That compares with a five-year common of 156 Bcf.

“Total pure gas-fired area heating demand remained abnormally low” final week, “so this Thursday’s EIA replace will likely be abnormally low,” analysts at The Schork Report mentioned Tuesday.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

So far as new catalysts, the Schork workforce added, “All eyes will likely be on Freeport LNG to see if the corporate sticks to its restart date for later this month.”

The Freeport export plant in Texas was compelled offline in June after a fireplace. Following reopening delays late in 2022, administration of the liquefied pure fuel facility mentioned final week they anticipated to finish repairs and relaunch by the tip of this month.

The corporate hopes to ramp as much as 2 Bcf/d of manufacturing capability inside a couple of weeks, drawing from home provides to satisfy export demand from Europe and Asia. This might create bullish strain on provide/demand balances, offering contemporary value help.

Spot Costs Spike

Subsequent-day money costs powered forward on Tuesday, bolstered by positive aspects within the West and Texas.

Harsh rains continued to wreak havoc in California over the vacation weekend, leaving chilly air and strain on demand of their wake Tuesday, whereas Texas braced for a looming cooldown and recovered from a droop final week.

SoCal Citygate surged $2.420 from Friday to common $23.120, and SoCal Border Avg. gained $4.495 on Tuesday to $22.005. Costs additionally spiked within the Rockies.

In West Texas, the place takeaway constraints have weighed on costs, El Paso Permian rebounded $4.420 to $1.730 and Waha $4.275 to $1.755. Each hubs had posted steep losses on Friday.

Elsewhere, costs ranged from modest positive aspects to notable losses. Chicago Citygate gained 7.0 cents to $3.115 as costs within the Midwest have been flattish.

Costs fell within the Northeast, in the meantime, amid near-term heat. Algonquin Citygate close to Boston, for one, shed $2.960 to $4.190.

The delicate climate that permeated a lot of the Decrease 48 to this point this 12 months is anticipated to proceed by way of the present buying and selling week, NatGasWeather mentioned.

“Very gentle nationwide demand will proceed the subsequent 4 days as many of the southern and japanese halves of the U.S. stay 10-30 levels above regular, together with very good highs of 70s to decrease 80s from southern Texas to Florida and with highs of 60s to 70s up the Mid-Atlantic Coast,” the agency mentioned. “The one comparatively chilly air throughout the work week will likely be over the northern Plains, with highs of 10s-20s.”

A little bit farther out, nonetheless, NatGasWeather anticipates a notable winter resurgence. Freezing air is anticipated to descend from Canada and usher in chilly situations throughout the western, central and northern United States within the ultimate week of January, the agency mentioned. By the ultimate days of the month, the chilly air is projected to unfold to the East, too.

Maxar’s Climate Desk additionally highlighted colder developments in its forecast overlaying Jan. 27-31.

“The ridge over the japanese Pacific within the six- to 10-day interval establishes a colder air circulate that encompasses a big a part of the U.S. and Canada within the 11- to 15-day interval,” Maxar mentioned Tuesday. “Under- and far below-normal temperatures span from the West to the Inside East, whereas aboves are restricted to elements of the Southeast, and temperatures are close to regular elsewhere alongside the East Coast.”

[ad_2]

Source_link