[ad_1]

CHUNYIP WONG

Introduction

I’ve lined power big Cheniere Vitality (NYSE:LNG) a number of occasions in energy-focused articles. Nevertheless, I’ve by no means solely centered on Cheniere Vitality, which I’ll do on this article. I discovered at the very least three good causes to put in writing this text.

- Cheniere Vitality shares have dipped for the primary time since early 2022.

- The decline is attributable to pricing and demand headwinds from Europe.

- Lengthy-term fundamentals stay terrific.

Whereas a few of that is bearish, the larger image stays extremely bullish. Therefore, I am beginning this text by explaining why I count on pure gasoline and LNG costs to rebound once more. After that, I’ll let you know why Cheniere is among the finest no-nonsense investments for long-term (dividend?) buyers.

So, let’s get to it!

Facet word: I often use tickers to seek advice from corporations. I will not do this on this article. At the least not when it involves Cheniere. In spite of everything, its ticker is LNG, which is the abbreviation of Liquid Pure Gasoline, which we’ll talk about on this article, as effectively.

The LNG Bull Case Is Paused, Not Lifeless

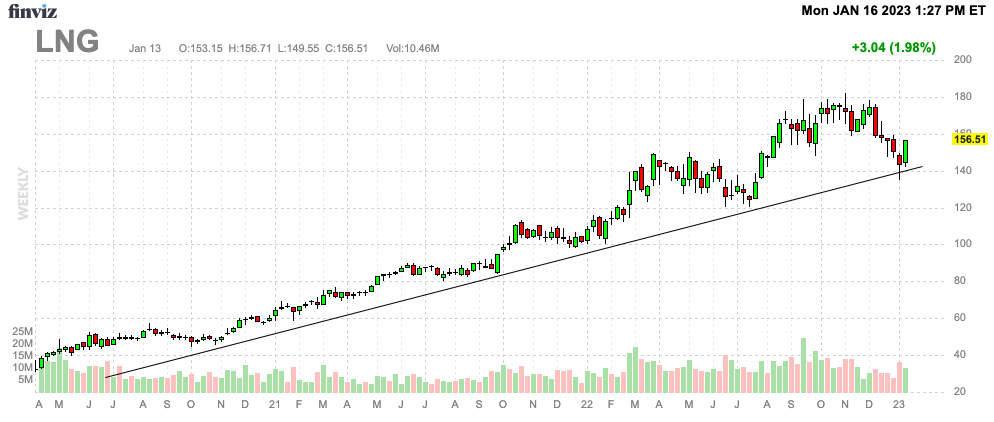

Cheniere Vitality has entered a correction. The Houston-based LNG big is at the moment 14% beneath its 52-week excessive. But, the inventory stays in an ideal uptrend that began in early 2020. In different phrases, as quickly as world power demand reached all-time low.

FINVIZ

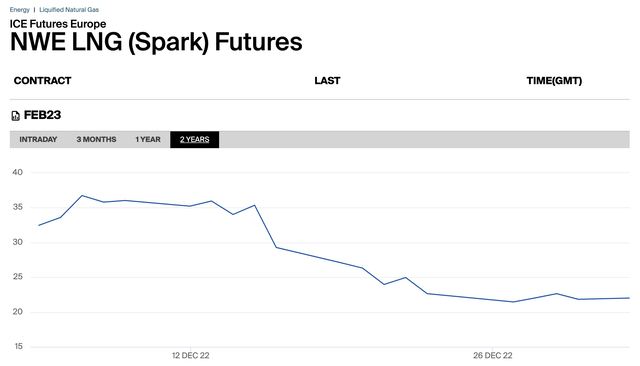

The explanation why Cheniere and associated shares have weakened is that the bull case has taken a breather. The chart beneath reveals the value of Northwest European Liquid Pure Gasoline Costs. It is the primary main LNG futures contract, which implies its historical past would not return very far. Nevertheless, it goes again far sufficient to indicate that costs have been hit – laborious. In early December, NWE LNG was buying and selling at $36 per MMBtu. Since then, costs have come right down to $20, which is a decline of 44%. That is a giant deal.

Intercontinental Alternate

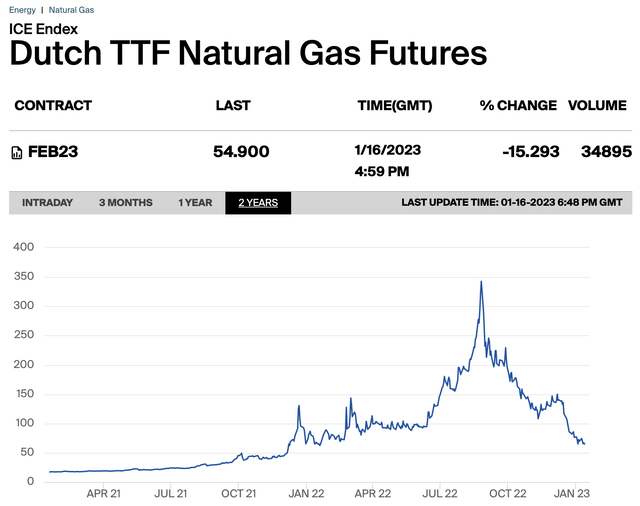

The identical goes for European TTF Pure Gasoline Futures, which have come down rather a lot since peaking at EUR 350 final 12 months.

Intercontinental Alternate

Sadly for Europeans like myself, that is short-term as an alternative of the tip of the bull market in pure gasoline and LNG.

A mixture of unexpected tailwinds has given Europe a break in its battle for long-term LNG provide after Russian pure gasoline exports have imploded since early 2022.

S&P International

European gasoline demand advantages from two issues:

- Financial-related demand destruction.

- Heat climate.

Financial-related demand destruction is a results of a lot decrease financial development expectations and measures to cut back pure gasoline demand forward of the winter months.

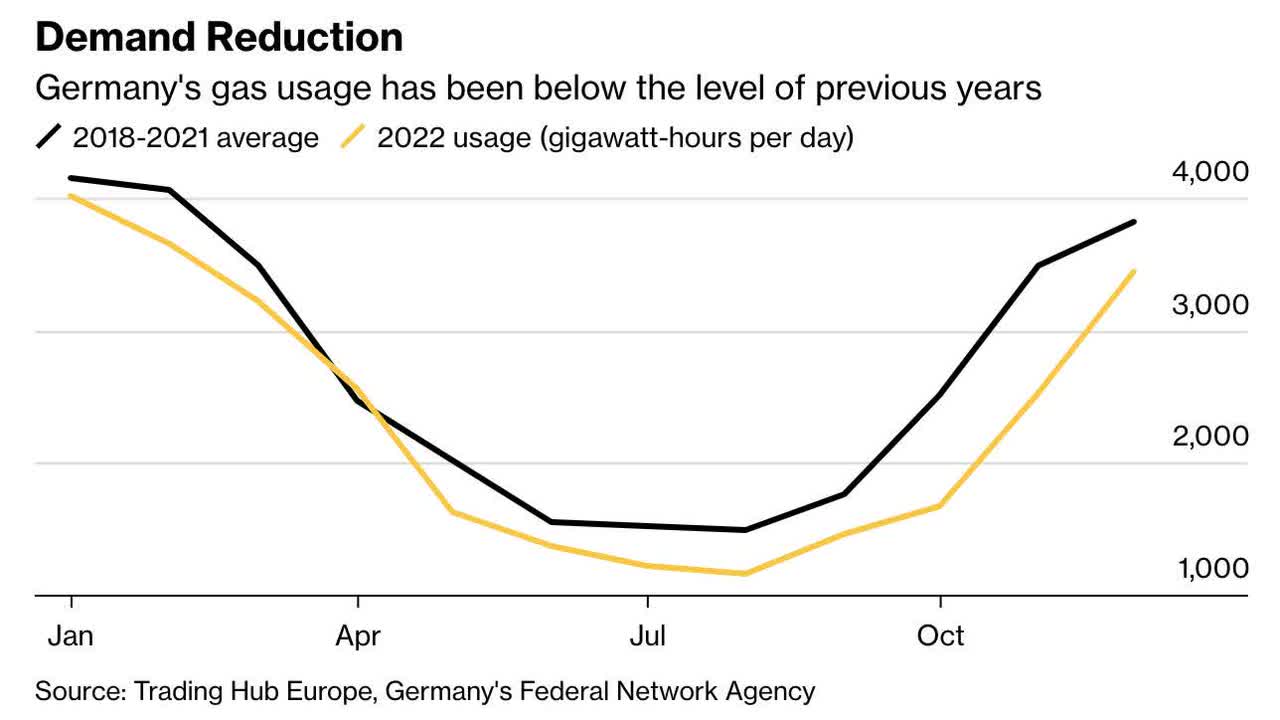

For instance, in Europe’s industrial coronary heart, Germany, 2022 demand was already a lot decrease within the Spring and Summer time months, because the graph beneath reveals.

Bloomberg

Going into the winter, tailwind quantity two began to affect demand. Temperatures in Europe have been above-average for weeks. Extra lately, temperatures have been as much as 5 levels above the long-term common.

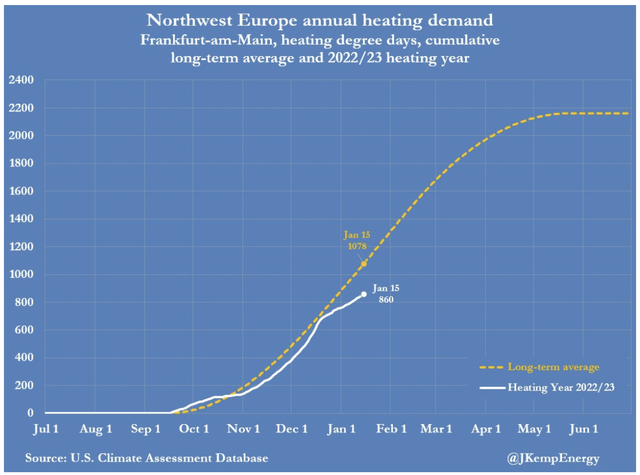

Vitality skilled John Kemp completely visualized what this did to cumulative long-term pure gasoline demand in Northwest Europe. We’re now well-below ranges one may count on to see underneath regular circumstances.

John Kemp (Uncooked Information: U.S. Local weather Evaluation Database)

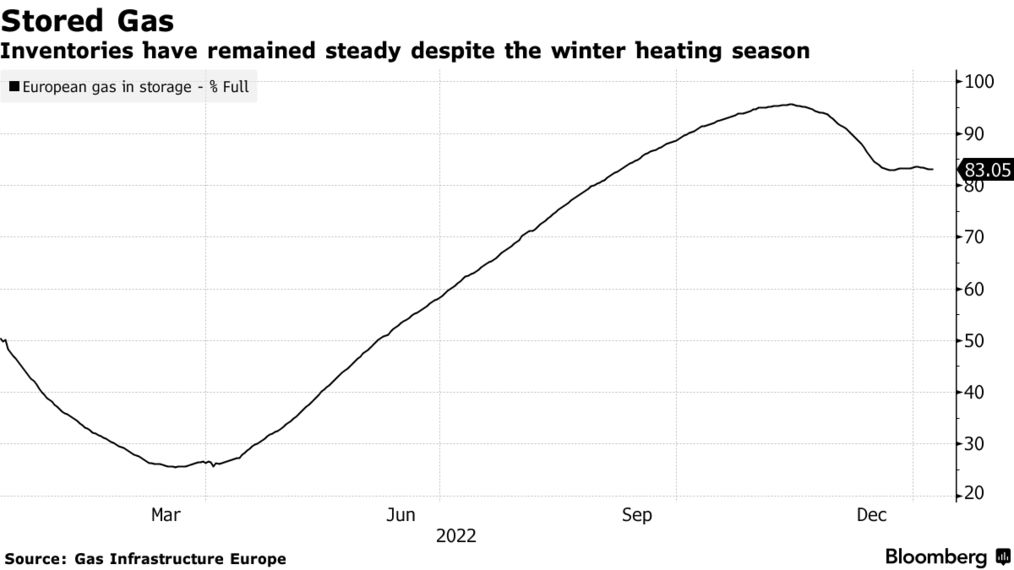

This allowed pure gasoline storage to stay unchanged in December and January. That is one thing that buys Europe loads of time.

Bloomberg

Furthermore, Europe continues to learn from loads of LNG from the US. Within the first week of this 12 months, 68% of LNG exported by the US was headed to Europe. Solely 27% went to Asia, regardless of fading worth premiums and the anticipated demand spike after the Chinese language authorities ended its Zero-COVID coverage.

With that mentioned, I am nonetheless extraordinarily anxious in terms of 2023 and past. Until a miracle occurs, Europe should rebuild its inventories subsequent 12 months with out Russian gasoline. In 2022, it nonetheless benefited from Russian gasoline flows till the second half of the 12 months. If Chinese language LNG imports return to 2021 ranges, we may see a pure gasoline scarcity of 27 billion cubic meters in 2023.

With provide tight, companies and shoppers have been requested to cut back utilization. The EU managed to curb gasoline demand by 50 billion cubic meters this 12 months, however the area nonetheless faces a possible hole of 27 billion cubic meters in 2023, in accordance with the Worldwide Vitality Company. That assumes Russian provides drop to zero and Chinese language LNG imports return to 2021 ranges.

Additionally, given the US’ means to export LNG (all of it is dependent upon infrastructure), it is unlikely that Europe will see a worth normalization earlier than 2026. Be aware that even after the value droop, costs are nonetheless nearly 3x as excessive as they have been earlier than the market began to cost in a Russian invasion in 2021.

So, as a lot as I benefit from the heat climate and the way a lot time this buys Europe, I am certain it will not final.

It is why I consider that the decline in Cheniere’s inventory worth is buyable.

Why Cheniere Is The Method To Go

Liquid Pure Gasoline is, because the identify already reveals, pure gasoline in a liquid state. It isn’t one thing we invented lately, because it dates again to 1820 when British scientist Michael Faraday efficiently chilled pure gasoline, turning it right into a liquid. Roughly 100 years later, the primary LNG plant was constructed in West Virginia.

Liquifying pure gasoline prices power. Therefore, the one purpose to do it’s to move it extra simply. The US can’t use pipelines to export pure gasoline to Asia and Europe. It wants to make use of ships crammed with LNG.

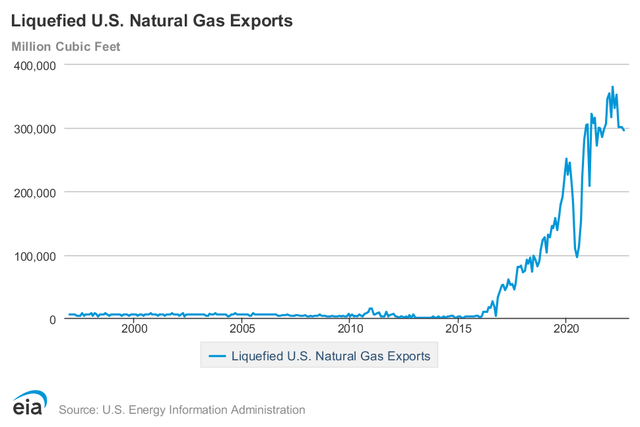

In 2016, the US exported nearly no LNG. Now, it exports roughly 300 thousand million cubic ft per thirty days.

Vitality Info Administration

Because the LNG increase is comparatively younger, there are loads of corporations that aren’t but mature and coping with excessive funding dangers and the whole lot associated to that. I select to disregard these corporations as a rule.

Cheniere Vitality is not a startup anymore. Based in 1996, Cheniere turned the primary US firm to export LNG in 2016. The corporate owns the Sabine Go LNG facility, which was the only driver of LNG export capability for greater than 4 years. Now, it is nonetheless the primary LNG export facility.

Vitality Info Administration

Cheniere additionally owns the Corpus Christi LNG facility, as its somewhat complicated holding construction beneath reveals. The corporate additionally owns 100% of the overall companion curiosity and 48.6% of the restricted companion curiosity in Cheniere Vitality Companions (CQP).

Cheniere Vitality

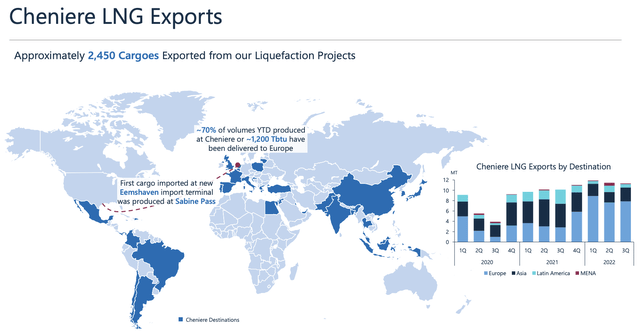

Cheniere’s huge footprint signifies that it’s a main pillar in terms of Europe’s power safety. Within the third quarter, the corporate produced and exported 156 cargoes of LNG from its services. 70% of that ended up in Europe. In 3Q21, that quantity was simply 30%.

Cheniere Vitality

Europe, which has boosted LNG imports by 87% in 2022, closely depends on this Texas-based firm. In line with the corporate:

[…] Cheniere alone was accountable for roughly 1/4 of Europe’s LNG imports this 12 months. As the highest center chart illustrates, U.S. LNG volumes surged over 200% year-on-year within the third quarter as Nord Stream flows got here to a halt by the tip of the quarter.

Furthermore, exports may have been increased if it weren’t for Europe’s lacking infrastructure. As Europe did not count on to be pressured to shift to LNG so shortly, it didn’t put money into enough infrastructure to show LNG into pure gasoline once more. In spite of everything, no person predicted the Ukraine battle just a few years in the past. And even when some did, good luck utilizing these theories to get funding for multi-billion greenback LNG tasks.

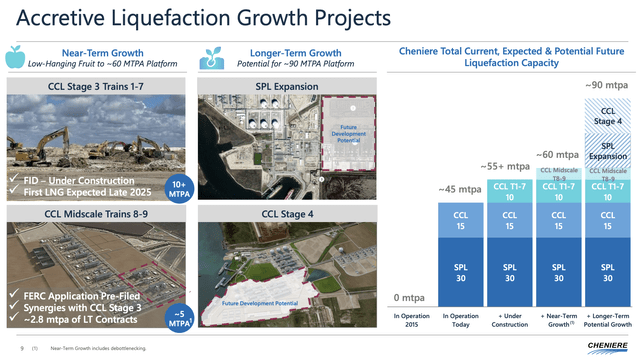

Anyway, Cheniere, which accounts for greater than 10% of world liquefaction capability (turning pure gasoline into LNG), is additional increasing. The corporate at the moment has 45 million tons per 12 months of liquefaction capability. 15 of those 45 million tons are in Corpus Christi. The opposite 30 are in Sabine Go. For now, the corporate has one other 10 million tons underneath development. That is an enlargement in Corpus Christi, anticipated to be accomplished in late 2025. After that, it has room so as to add extra “trains” (a part of the liquefaction course of) with a 2.8 million tons per 12 months capability. On a longer-term foundation, Cheniere may double its present capability to 90 million tons per 12 months.

Cheniere Vitality

As I discussed earlier, these capability expansions are costly, and so they take time. Nevertheless, the corporate is mature. It has environment friendly operations and excessive free money stream. Therefore, the corporate is not sucking in money however actively distributing money, sustaining a wholesome steadiness sheet, and investing in future development.

Positive, this probably signifies that Cheniere shares have much less potential upside than small startups that will make it within the business. Nevertheless, the dangers are additionally a lot decrease, making Cheniere an acceptable inventory for long-term buyers.

Steadiness Sheet, Free Money Stream & Valuation

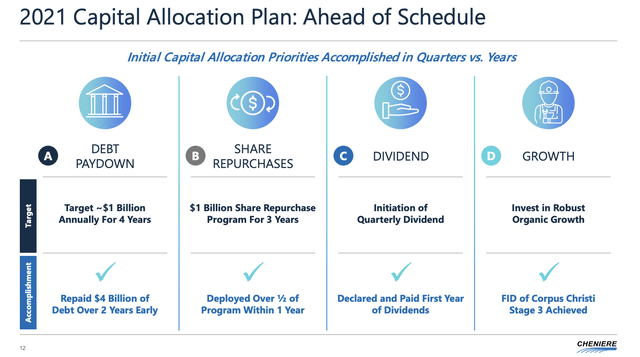

Due to conservative administration and the huge LNG tailwinds of 2022, the corporate is in a great place. It has achieved all of its capital allocation plans, established in 2021.

The corporate paid down $4 billion in debt as an alternative of $1 billion. It took the corporate simply two years as an alternative of 4. It purchased again $500 million price of shares in lower than one 12 months, declared a dividend for the primary time, and achieved a milestone in rising Corpus Christi’s capability.

Cheniere Vitality

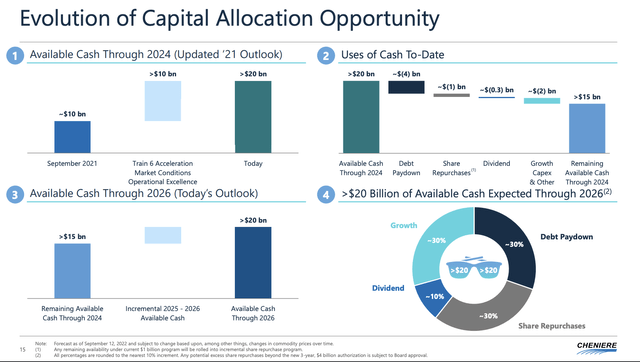

The visualization beneath is sort of fascinating, because it reveals that development is now simply 30% of the corporate’s accessible money spending by way of 2026. That is equal to debt reimbursement and share repurchases.

Cheniere Vitality

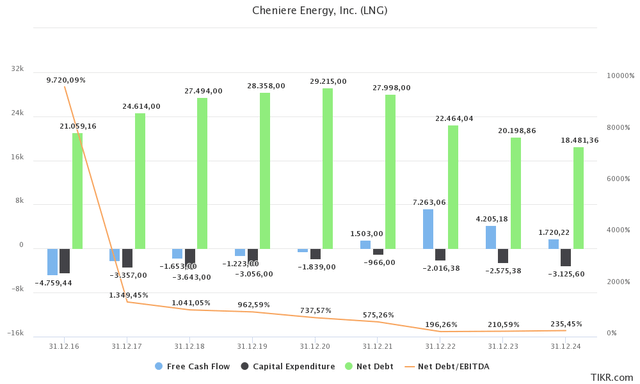

The chart beneath visualizes this as effectively. What we see is that internet debt began to say no in 2021. Internet debt is predicted to go from $29.2 billion in 2020 to $18.5 billion in 2024, leading to a sub-2.5x leverage ratio. Since 2021, the corporate will not be anticipated to function with an elevated leverage ratio anymore. The corporate has a BBB-rated steadiness sheet, which is only one step beneath the A variety, and a excessive rating for an organization that’s nonetheless investing billions in new infrastructure (which comes with extra dangers). I count on the corporate to be A-rated in some unspecified time in the future within the 2-4 years forward.

TIKR.com

That is solely doable because of bettering free money stream. Whereas capital expenditures are anticipated to rise once more because of the aforementioned tasks, free money stream will not be anticipated to go adverse once more.

Be aware that even in 2024, the corporate would generate $1.7 billion in free money stream, implying a 4.4% free money stream yield (based mostly on its $38.9 billion market cap). I even suppose that 2024 numbers will likely be manner increased than estimates, as sell-side analysts appear to include a fast normalization of LNG costs.

This additionally signifies that Cheniere stays attractively valued. The corporate is buying and selling at 6.3x 2023E EBITDA of $9.6 billion. That is based mostly on its $60.9 billion implied enterprise worth, consisting of its $38.9 billion market cap, $20.2 billion in anticipated internet debt, and $1.8 billion in minority curiosity.

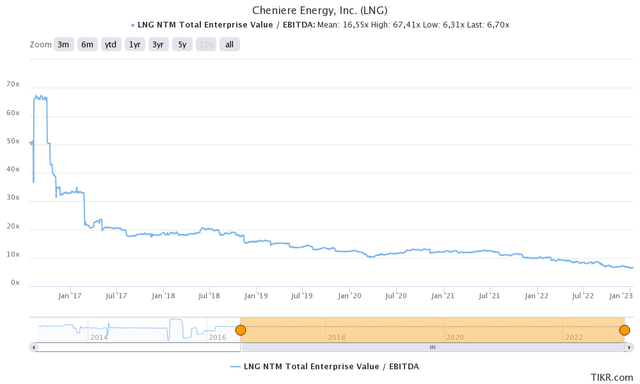

Utilizing historic valuations is tough as a result of the corporate has been unprofitable and reliant on exterior funding as a rule previously.

In 2017 and 2018, the corporate was buying and selling at 20x NTM EBITDA. Now, that quantity is constantly beneath 10x.

TIKR.com

If we incorporate considerably moderating EBITDA (because of decrease costs within the two years forward), I feel Cheniere ought to commerce at 10x EBITDA. This is able to suggest between 40% to 50% extra potential upside, giving the inventory a worth goal vary of $215 to $235. This makes me a bit extra bullish than the typical analyst. The corporate’s present common worth goal is $206. The latest purchase scores are:

- Citigroup $205

- Jefferies $210

Dangers

The corporate has turn out to be the epicenter of world geopolitics. In spite of everything, it ships and produces the commodity that fuels the European and Asian economies at a time when Russia has been remoted from doing enterprise with Western nations.

- Main dangers embody a speedy finish to the battle in Ukraine and new enterprise relationships with Russia. Do not get me mistaken, I am rooting for an finish to the battle, nevertheless it must be mentioned that this could shortly scale back pure gasoline costs if it have been to come back with new enterprise relationships with Russia.

- Cheniere’s means to fund its operations and enlargement. I consider this danger is contained because of 2021/2022 tailwinds and the truth that the corporate is now step by step increasing as an alternative of constructing a wholly new enterprise.

- Catastrophic climate occasions may affect the corporate’s means to provide and ship LNG. The identical goes for different occasions like those Freeport LNG skilled.

Takeaway

On this article, we mentioned Cheniere Vitality, which has was certainly one of my all-time favourite LNG performs. The corporate stays in a great place to stay the king of LNG exports, benefiting from excessive costs, sky-high (and additional rising) demand, and its means to make use of money for buybacks, dividends, and debt discount.

Because of short-term climate and demand tailwinds in Europe, I consider that Cheniere shares supply a buyable correction. Whereas cyclical dangers live on, I consider that Cheniere stays considerably undervalued.

(Dis)agree? Let me know within the feedback!

[ad_2]

Source_link