[ad_1]

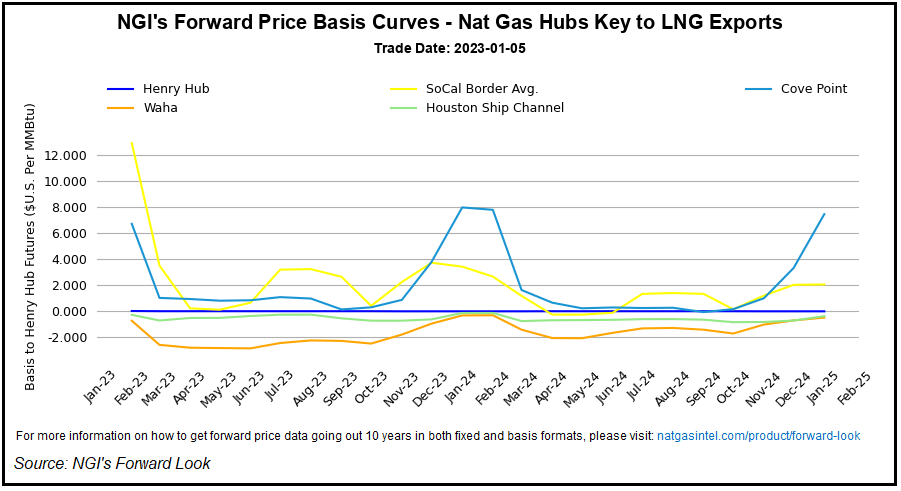

Pure gasoline ahead costs continued to plummet in the course of the buying and selling interval from Dec. 29-Jan. 4, this time taking West Coast markets alongside for the journey decrease, NGI’s Ahead Look confirmed.

After bucking the down pattern that started within the remaining week of 2022, West Coast markets led the worth declines throughout the Decrease 48 whilst a bomb cyclone pummeled the area.

February mounted costs tumbled a median of $1.070 throughout the nation, whereas March dropped 46.0 cents on common, in line with Ahead Look. Smaller losses had been seen for the summer season (April-October) and winter 2023-2024 (November-March) strips.

[Newly Updated: NGI’s 2023 Map of North American Natural Gas Pipelines, LNG Facilities, Shale Plays & Market Hubs includes 200+ pipelines, 160+ market hubs, 60 LNG terminals, 40+ storage facilities, and more. Get your map today.]

West Coast markets noticed costs fall a lot additional, nonetheless.

SoCal Citygate February foundation plunged $2.020 by the interval to complete at a $15.145 premium over benchmark Henry Hub, Ahead Look knowledge confirmed. With a extra reasonable outlook for March, foundation stood $4.835 above Henry Hub.

Additional out the ahead curve, mounted costs for the summer season on the SoCal Citygate averaged $6.460 as of Wednesday after sliding 10.0 cents decrease by the interval, whereas the winter 2023-2024 strip held regular at $8.392.

In Northern California, PG&E Citygate February foundation was down 71.0 cents by the interval to complete at plus $12.281, Ahead Look knowledge confirmed. March foundation moved 20.0 cents increased, although, ending at plus $3.941. Summer time costs fell 15.0 cents to common $6.290, whereas the winter strip slipped 7.0 cents to $7.404.

The final softening alongside the ahead curve occurred regardless of a continuation of brutal winter climate that has lent a hand within the unprecedented worth volatility that’s performed out all through the West this winter. What’s extra, the parade of storms confirmed no indicators of slowing.

AccuWeather mentioned no less than two folks died in a bomb cyclone that struck the West Coast by Thursday. It was the second huge storm to hit the area in lower than per week.

Fueled by an atmospheric river from the Pacific Ocean, the potent storm unleashed a fury of robust wind and rain throughout the West Coast. Gov. Gavin Newsom had declared a state of emergency forward of the storm, and evacuation orders and advisories had been issued in elements of Northern California.

Greater than 63,000 clients throughout California – primarily alongside the coastal counties of Northern California – had been with out electrical energy on Friday, in line with PowerOutage.US.

The prepare of storms was forecast to proceed monitoring throughout the Pacific Ocean and towards the West Coast, in line with the Nationwide Climate Service. The subsequent system in line is forecast to enter Northern California and Southwest Oregon Friday evening. By Sunday, extreme rainfall is forecast to shift barely south towards the central parts of the state. Further rainfall quantities of as much as six inches had been potential.

Notably, regardless of the continuing moist climate sample in place on the West Coast, costs in each the money and ahead markets have softened from latest highs. At the same time as some manufacturing remained offline due to freeze-offs within the Rockies, costs all through the area adopted the final pattern.

Northwest Sumas February mounted costs fell $2.310 by the interval to achieve $15.666, and March dropped 45.0 cents to $5.654, in line with Ahead Look. The summer season strip was down 21.0 cents to common $3.440, whereas the upcoming winter picked up a modest 4.0 cents to common $7.660.

Fuel provides, in the meantime, could also be leveling off after deteriorating sharply in latest weeks.

On Thursday, the Vitality Data Administration (EIA) reported that gasoline provides within the Pacific area went unchanged for the week ending Dec. 30. This left shares at 165 Bcf, which continues to be about 25% beneath year-earlier ranges and round 33% beneath the five-year common.

In discussing the EIA’s weekly stock report, Enelyst’s Het Shah, managing director of the net vitality chat, mentioned the vacations could have impacted demand in an in any other case frigid chilly interval.

The EIA reported a internet 221 Bcf withdrawal for the interval, lighter than the median of most main polls.

Previous to the report, projections submitted to Reuters ranged from withdrawals of 153 Bcf to 269 Bcf, with a median pull of 237 Bcf. A Bloomberg survey landed at a median pull of 240 Bcf. The Wall Road Journal’s ballot discovered draw estimates from 156 Bcf to 265 Bcf and a median of a 228 Bcf pull. NGI modeled a 237 Bcf lower.

EIA recorded a pull of 46 Bcf throughout the identical week a 12 months earlier and a five-year common of 98 Bcf.

The 221 Bcf draw “simply doesn’t add up,” Shah mentioned. It’s “positively an especially unfastened quantity.”

Mobius Danger Group’s Zane Curry, pure gasoline analyst, didn’t share that view.

As a substitute, he mentioned evaluating the most recent EIA determine in the course of the Dec. 30 reference week with an analogous week of chilly final 12 months paints a unique image. Adjusting for 12 fewer diploma days versus the storage week ending Jan. 27, 2022, when a 268 Bcf withdrawal was reported, and for an inexpensive vacation influence suggests the storage withdrawal of 221 Bcf was not bearish in any respect on a weather-adjusted foundation.

Damaged down by area, the South Central led with a lower of 96 Bcf, which included a 53 Bcf decline in salt services and a 43 Bcf draw from nonsalts, in line with EIA. The Midwest and East adopted with pulls of 60 Bcf and 56 Bcf, respectively. Mountain area inventories fell by 9 Bcf.

Curry famous that the hefty pull within the South Central opened up a 100 Bcf 12 months/12 months deficit on this area. “This marked the primary 12 months/12 months deficit for the South Central since late October.”

Whole working gasoline in storage fell to 2,891 Bcf, which is 308 Bcf beneath year-earlier ranges and 208 Bcf beneath the five-year common, EIA mentioned.

What’s Subsequent For Storage?

With delicate climate set to stay in place all through most of January primarily based on the most recent climate fashions, analysts are rightfully looking forward to the subsequent EIA report. Early estimates pointed to a lot lighter withdrawals between 10 Bcf and 20 Bcf, although there are rumblings of a modest injection as properly.

For the comparable week final 12 months, EIA posted a lower of 179 Bcf. The five-year common is 151 Bcf.

After distinctive chilly over the past week of the 12 months, and amidst the much more distinctive heat of the present storage week, Mobius mentioned the market is contemplating the chances of climbing to an end-of-March stock degree significantly above the 1.7 Tcf mark.

“If such a degree is reached, the summer season 2022 storage injection of roughly 2.2 Tcf turns into essential each from an absolute standpoint, and much more when weighing the potential for a bigger injection in the course of the summer season 2023 injection season,” Curry mentioned.

“Basic math reveals that 1.7 plus 2.2 equals 3.9 Tcf, or 100 Bcf lower than a degree which traditionally creates materials draw back threat and steep contango,” Curry defined. “The potential for monitoring towards a 4 Tcf end-of-October, or better, is the rationale market bears are pinning their expectations to.”

For Mobius, climate is essential for the steadiness of winter. If the present heatwave continues for one more couple of weeks, the chances of testing 4 Tcf will considerably improve, in line with the agency. Conversely, a shift again to a colder-than-normal steadiness of winter will put a wrench in market bears’ expectations, as this might push season ending stock again beneath 1.5 Tcf.

“Since even the climate forecasters have a tough time predicting the unpredictable, will probably be an attention-grabbing journey for the steadiness of January,” Curry mentioned.

On Friday, the longer-range climate fashions began to indicate indicators that chilly could lastly return in early February. Nevertheless, that did little to cease the bleeding within the gasoline market. After plunging 45.2 cents on Thursday, the February Nymex gasoline futures contract settled Friday at $3.710, off one other penny. March slipped 3.4 cents to $3.392.

[ad_2]

Source_link