[ad_1]

Pure fuel futures floundered once more Tuesday, as merchants appeared previous bitter chilly and blizzards this week and fixated on forecasts for unseasonably gentle situations to shut out 2022 and to start out the brand new yr.

At A Look:

- Nymex costs sink 52.5 cents

- Submit-Christmas temps to rise

- Manufacturing recovers

Coming off a 74.9-cent plunge within the earlier session, the January Nymex fuel futures contract shed one other 52.5 cents day/day and settled at $5.326/MMBtu on Tuesday. February misplaced 49.4 cents to $5.216. The hunch marked a 3rd consecutive day of steep declines.

NGI’s Spot Fuel Nationwide Avg. dropped $2.300 on Tuesday to $9.105.

Since Friday, climate fashions shifted notably hotter for late December and the start of 2023, with forecasts displaying gentle situations and a pointy drop in pure fuel demand. Moreover, manufacturing climbed about 1 Bcf to 99.5 Bcf/d Tuesday.

The 11- to 15-day interval (Dec. 30-Jan.3) once more trended hotter within the newest forecast from Maxar’s Climate Desk Tuesday.

This era “continues to function a widespread protection of above regular temperatures, with right this moment’s outlook trending even hotter when in comparison with the earlier,” the forecaster mentioned Tuesday. “A lot aboves now favor the Jap Half, whereas the West is regular to above regular all through the interval.”

What’s extra, Europe Union ministers this week agreed to cap the value of the continent’s month-ahead Title Switch Facility benchmark when it reaches 180 euros/MWh, or about $56/MMBtu, for 3 days. Costs would additionally should be roughly $11 above the typical worth of world LNG over the identical three days.

Analysts at Goldman Sachs Group seen the transfer as doubtlessly bearish for U.S. liquefied pure fuel costs and Europe’s provides. The continent is attempting to construct up new sources of fuel following current cuts in pipeline flows from Russia in the course of the Kremlin’s warfare in Ukraine.

“This in our view considerably will increase the probability the value cap is triggered” and, by extension, “the danger of a market disruption occasion,” the Goldman staff mentioned. “To be clear, as now we have argued beforehand, a worth cap with out an related cap to demand not solely doesn’t clear up the fuel deficit in Europe but in addition dangers making the continued deficit worse by incentivizing consumption.”

Close to-term Power

Spot costs additionally misplaced floor Tuesday, although this adopted a number of days of strong beneficial properties in December.

For all of the strain on costs Tuesday, money markets have been holding in lofty territory amid brutal chilly situations throughout giant swaths of the Decrease 48 and extra on the best way into the weekend.

Arctic air was delivering a “deep chill” and “threatening to erode stockpiles of heating gas,” analysts at Société Générale SA mentioned.

Surveys forward of Thursday’s U.S. Vitality Info Administration (EIA) storage report pointed to a withdrawal within the 80s Bcf.

Early outcomes of Bloomberg polling confirmed a median expectation for a pull of 86 Bcf, whereas a Reuters’ survey confirmed a median of 89 Bcf. NGI predicted a pull of 83 Bcf. The five-year common is a 124 Bcf withdrawal.

What’s extra, Rystad Vitality analyst Ryan Kronk mentioned that, pushed by early blasts of winter, U.S. energy costs surged increased by practically 50% on common final week, and this was anticipated to proceed by this week.

“Each noticed U.S. energy market is experiencing a worth hike associated to elevated pure fuel spot costs and colder climate,” Kronk mentioned. “The top is just not in sight,” and temporary breaks in climate apart, “we anticipate this pattern to proceed all through the winter, notably within the Northeast and the West.”

Costs “will proceed to surge,” he mentioned.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

Kronk famous that Texas spot fuel costs to this point this month proved modest amid benign climate, infrastructure constraints and comparatively robust wind era.

“Texas has by far the bottom costs in noticed U.S. markets,” he mentioned.

That might change, although, as quickly as this week.

Nationwide Climate Service (NWS) forecasts confirmed freezing temperatures within the West and northern Plains dropping into Texas. In a single day lows might dip into the kids in a number of main markets within the Lone Star State.

Dallas, for instance, is forecast to endure a low of 14 levels Thursday and 11 levels on Friday, with chilly lingering into the weekend, NWS knowledge present.

Money Worth Cascade

Spot fuel costs slid decrease throughout the Decrease 48 Tuesday, however hubs in a number of areas continued to command robust premiums relative to historic norms.

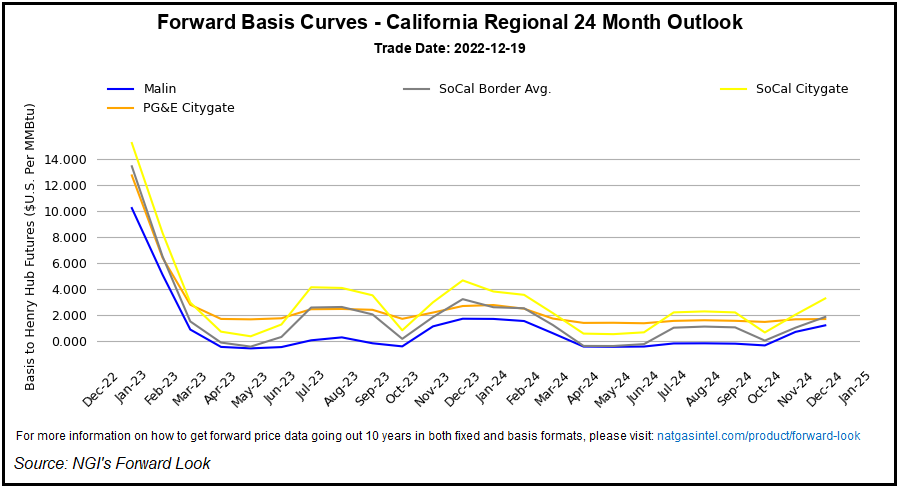

Out West, Malin dropped $6.880 day/day however nonetheless averaged $24.620, whereas SoCal Citygate misplaced $8.310 to $27.810.

Within the Rockies, Opal fell $7.735 to $24.655 and Questar shed $5.665 to $23.855.

Algonquin Citygate close to Boston, in the meantime, misplaced $3.030 however remained firmly in double-digit territory at $10.520.

Along with the anticipated arrival of frigid situations in Texas and elements of the South on Thursday, NWS forecasts confirmed freezing temperatures from the Northwest by the Rocky Mountains and Midwest, in addition to a lot of the East this week and to start out the subsequent. NWS mentioned wind chill warnings prolonged from Montana to Alabama.

Additionally, starting Wednesday, a “large” winter storm is anticipated to wreak havoc throughout a lot of the Midwest and Northeast, in line with AccuWeather.

Subzero lows, freezing rain and blizzard situations are all doable, the agency mentioned. A number of main cities, from Minneapolis to Detroit to New York, have been anticipated to grapple with extreme climate.

“And it’s not simply in the course of the storm when situations will likely be dangerous,” AccuWeather meteorologist Matt Benz mentioned. “Frigid air, ongoing gusty winds, blowing and drifting snow, and hard-packed snow and ice on the roads, will proceed to make for horrendous journey situations” over the Christmas vacation.

[ad_2]

Source_link