[ad_1]

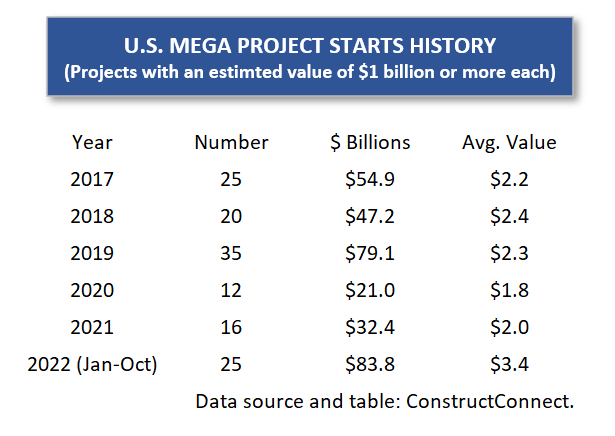

The present 12 months, 2022, is shaping as much as be the very best ever for mega undertaking initiations. ‘Megas’ are tasks carrying an estimated development worth of a billion {dollars} or extra every. For a lot of of those tasks, there’s additionally a equipment and tools part within the whole capital spending or funding determine that’s usually roughly equal to the development price.

In ConstructConnect’s ‘begins’ statistics, via October of this 12 months, there are 25 mega undertaking begins for a mixed greenback worth of $83.8 billion. 2019 was the earlier finest interval, when there have been 35 megas via the complete 12 months, including to $79.1 billion.

In ConstructConnect’s ‘begins’ statistics, via October of this 12 months, there are 25 mega undertaking begins for a mixed greenback worth of $83.8 billion. 2019 was the earlier finest interval, when there have been 35 megas via the complete 12 months, including to $79.1 billion.

A key issue inspiring homeowners to proceed with most of the nation’s largest development tasks is the chance for export gross sales. That is significantly true within the sphere of pure sources. To go a step additional, whereas these alternatives exist in another areas, akin to agriculture (with the constructing of immense soybean processing crops, as only one instance), they’ve particularly come to the fore within the area of vitality merchandise.

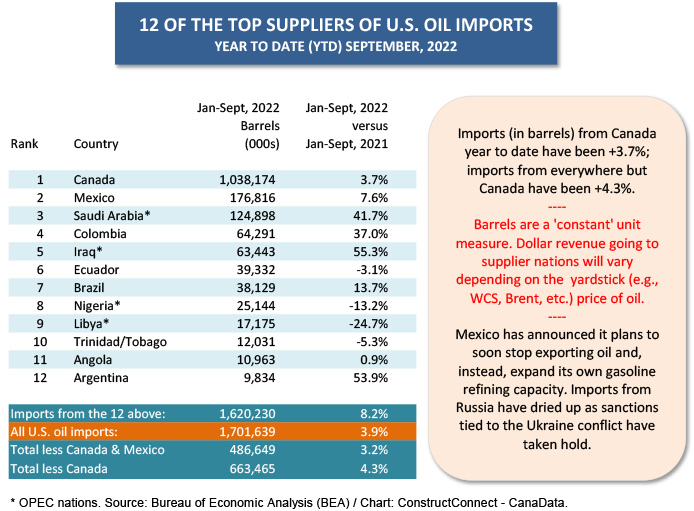

As a result of hydraulic fracturing, the U.S. is now not as depending on the remainder of the world for oil and pure fuel because it as soon as manner. In truth, the U.S. is again within the sport of exporting vitality merchandise.

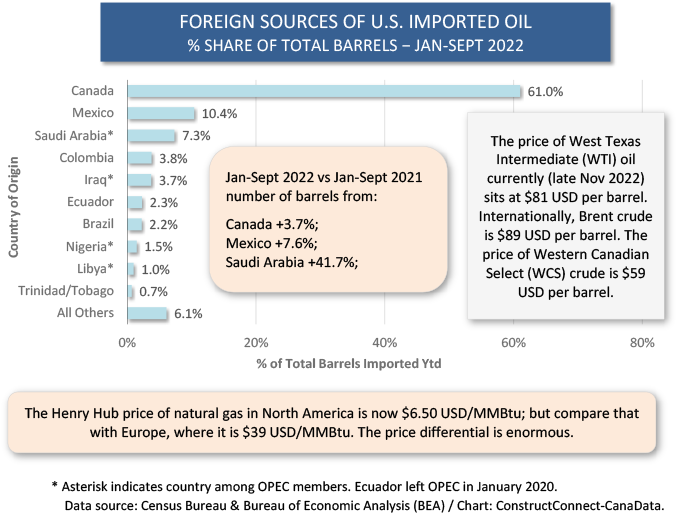

Disadvantaged of Russian vitality provides, as a fallout of the Ukraine battle, Europe is determined for oil and fuel from different suppliers. An enormous differential in value has opened between pure fuel extracted in North America, at round $6 USD per mcf (or MMBtu), and deliveries made to Europe, or Asia for that matter, starting at $30 USD/mcf and going skyward from there.

Inside the U.S.-Canada financial zone, oil and pure fuel are moved by pipeline or rail automobile. These aren’t choices for shipments to abroad markets. Probably the most handy method to transfer fuel throughout the vastness of oceans is in liquefied type. However meaning spending billions of {dollars} on liquefied pure fuel (LNG) exporting services. Seems, it’s now price it.

LNG terminals are already up and working in a number of U.S. coastal states. And there’s a lot extra such work deliberate for the likes of Texas and Louisiana.

Nor will the foreign-trade-driven main vitality tasks of the long run be restricted to grease and LNG deep-water exporting websites. Hydrogen and ammonia are two chemical compounds requiring main capital expenditures for extraction from fossil fuels or manufacturing by different means, akin to electrolysis. That is below the supposition that they’ll play necessary roles within the transformation of the world financial system to web zero carbon emissions by mid-century.

By the best way, ‘blue’ hydrogen derived from fossil fuels is just not thought-about a ‘clear’ supply; ‘inexperienced’ hydrogen from electrolysis, although, is considered by environmental displays as ‘pleasant’, supplied the electrical energy used alongside the best way is from renewable sources (e.g., hydro, wind, photo voltaic, geothermal).

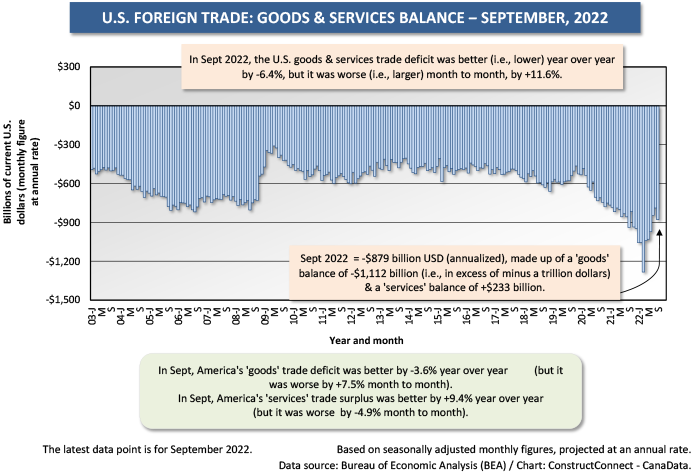

Due to the modifications occurring within the world vitality market, the U.S. overseas commerce deficit is shifting from a deeply damaging place to at least one that’s not fairly as alarming (Graph 2).

Texas is America’s Export Gross sales Chief

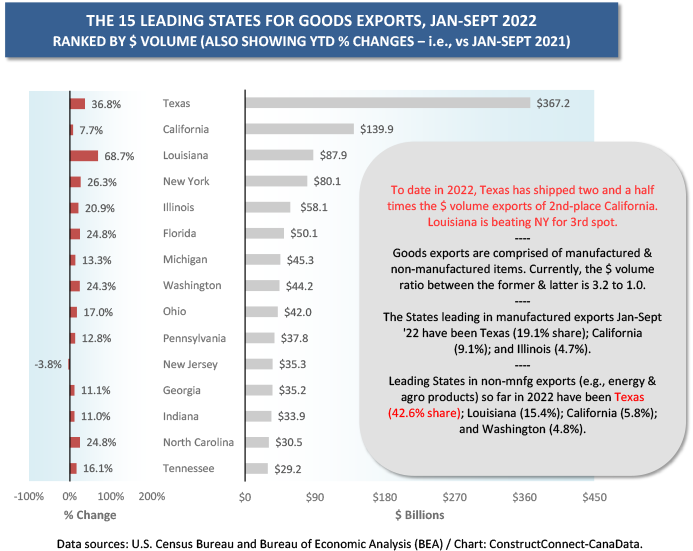

Amongst states, Texas as an vitality big is by far America’s export gross sales chief (Graph 4). Via the primary three quarters of this 12 months, the greenback quantity of exports leaving Texas has been two-and-a-half occasions larger than what has been shipped from the state in second spot, California.

In third place for export gross sales is one other Gulf-facing state, Louisiana. LA, which has spectacular prospects for the constructing of extra large energy-exporting services (primarily LNG-based) past these which might be already in place, is thrashing fourth-place New York for overseas shipments.

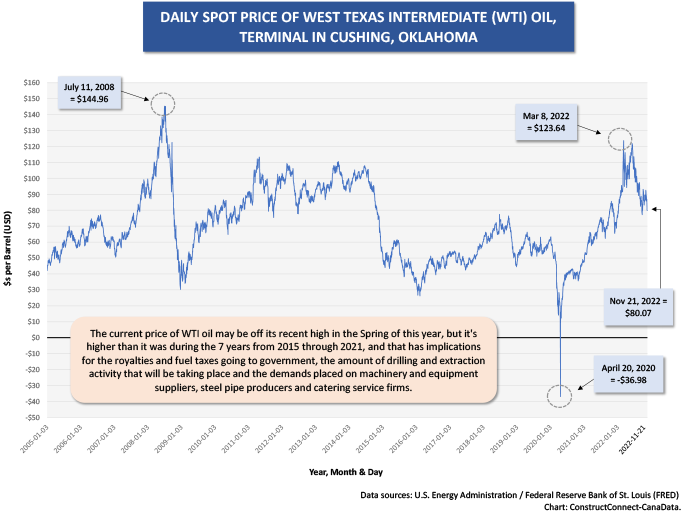

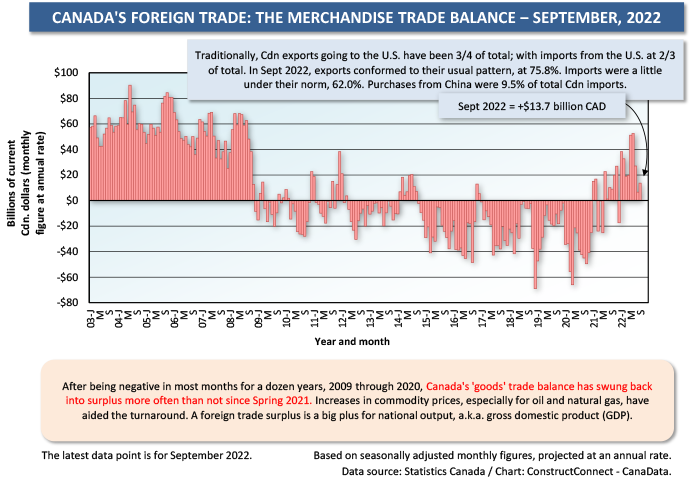

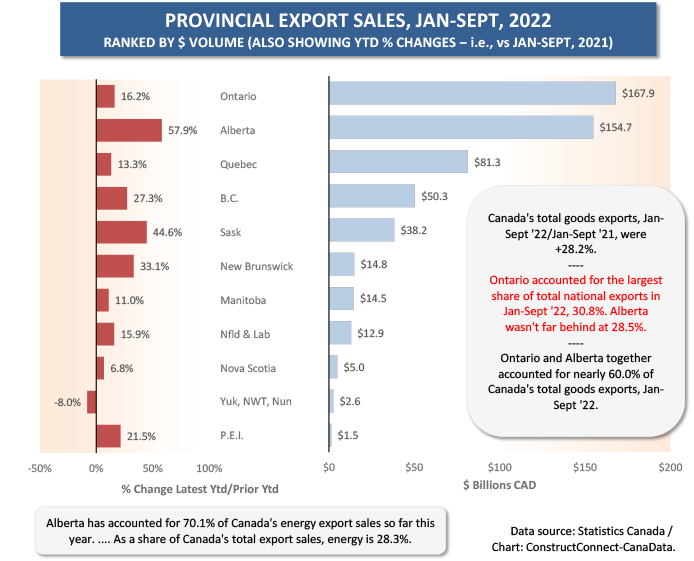

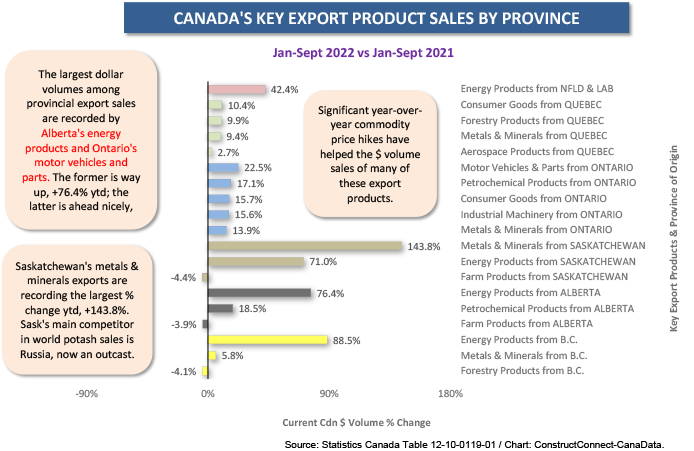

There’s an identical image for Canada. Graph 7 reveals the massive swing in Canada’s merchandise commerce place, from month-to-month deficits to surpluses, over the previous 12 months plus. The worldwide value of oil might have retreated from its latest peak within the spring of this 12 months, however it’s nonetheless manner up in contrast with the seven years from 2015 to 2021 (Graph 1).

Because of this, the energy-rich provincial financial system of Alberta is having fun with a full-blown revival. Alberta, with lower than a 3rd of the inhabitants, is barely a bit of behind first-place Ontario in year-over-year jobs creation. The identical goes for export gross sales (see Graph 7). Ontario and Alberta are operating neck and neck on the entrance of the provincial pack for greenback quantity of export shipments.

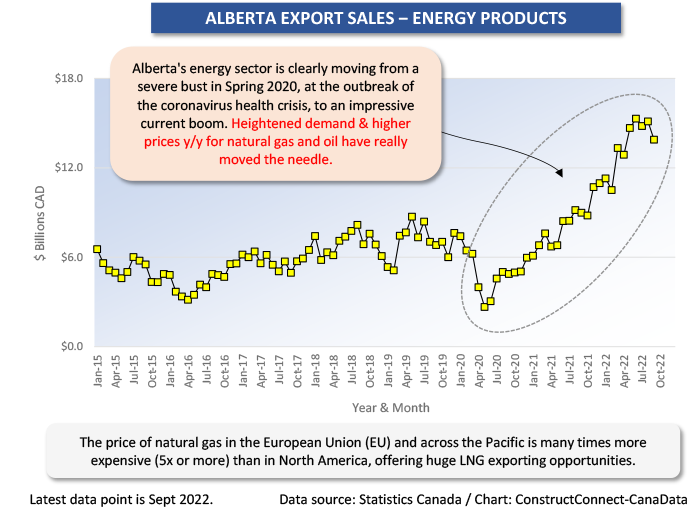

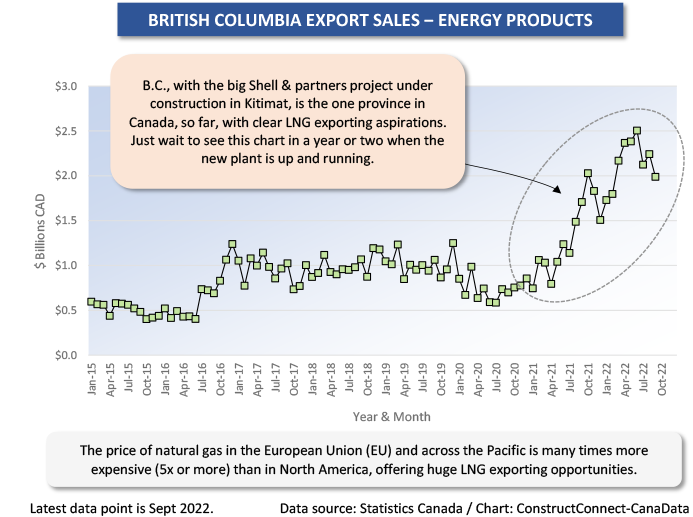

Graph 9 reveals the takeoff in Alberta exports of vitality merchandise. Graph 10 is simply as putting, however it’s for British Columbia’s vitality export gross sales, that are weighted in direction of pure fuel and hydroelectricity.

Moreover, B.C. has a particular motive to crow right now. It has been the one province within the nation, thus far, to embrace the probabilities offered by the Pacific Area’s thirst for LNG. The Canada LNG undertaking, backed by Shell and a bunch of worldwide companions, is being inbuilt Kitimat, with a fuel provide pipeline operating to it from the northeast nook of the province.

When Canada LNG comes onstream in a 12 months or two, it can propel B.C. into a much more outstanding function among the many provinces as an vitality powerhouse. There are extra such tasks on the drawing boards.

LNG Import Terminals in Germany

As a remaining be aware, there’s encouraging information regarding the skill of energy-strapped LNG importers to simply accept incoming product. Germany is quick monitoring development of terminals at which modified super-tankers will be capable to dock and covert cooled LNG again into gaseous type as its being offloaded. The primary of 5 such services has simply been accomplished in Wilhelmshaven on the fringe of the North Sea, west of Hamburg.

The Wilhelmshaven terminal has been inbuilt record-short time, lower than 200 days, below emergency measures that expedited approvals processes and largely ignored environmental issues. The latter turned a casualty when weighed towards the prospect of the citizenry shivering by candlelight in winter. Via this implies, Germany is hoping to exchange about half of the cut-off pure fuel that was beforehand arriving within the nation by pipeline from Russia.

Desk 1

Graph 1

Graph 2

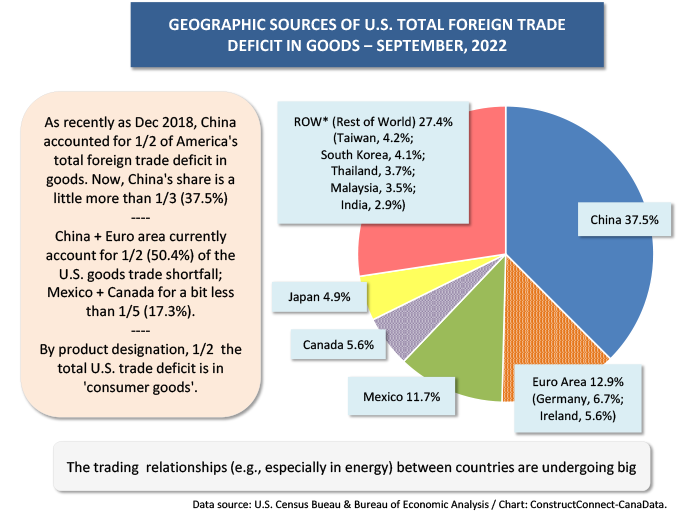

Graph 3

Graph 4

Desk 2

Graph 5

Graph 6

Graph 7

Graph 8

Graph 9

Graph 10

Graph 11

Alex Carrick is Chief Economist for ConstructConnect. He has delivered shows all through North America on the U.S., Canadian and world development outlooks. Mr. Carrick has been with the corporate since 1985. Hyperlinks to his quite a few articles are featured on Twitter @ConstructConnx, which has 50,000 followers.

[ad_2]

Source_link