[ad_1]

German onshore LNG import terminal builders are sustaining a constructive outlook and hoping to succeed in closing funding choices (FID), with some planning to take action earlier than year-end.

The three onshore initiatives aiming for FID are Hanseatic Power Hub’s (HEH) Stade terminal, German LNG’s (GLNG) Brunsbuttel terminal and Tree Power Options’ (TES) Wilhelmshaven terminal.

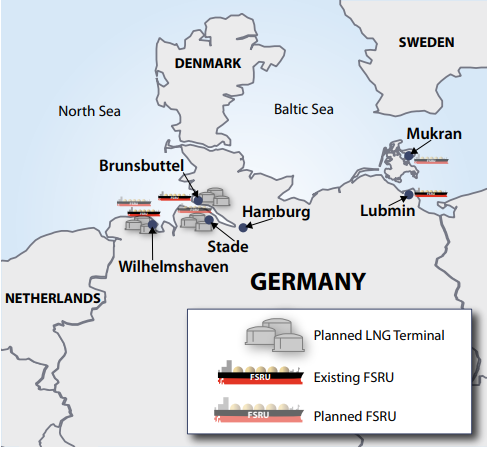

There are additionally floating storage and regasification items (FSRUs) which might be both energetic or deliberate at these websites (see Desk).

The terminal at Stade is anticipated to be the primary to take FID, doubtlessly earlier than the tip of the yr. The €1 billion terminal is anticipated to start operations by 2027 after Spanish vitality firm Enagas purchased 10% of the consortium that varieties HEH (see LNGWM, Sep ’23). Banks have been requested to supply funding for the terminal.

The 13.3-Bcm/y terminal has bought 12 Bcm/y of long-term capability for over 10 years. EnBW has booked 6 Bcm/y for 10-plus years, Securing Power for Europe (SEFE) has booked 4 Bcm/y for 20 years and Czech utility Cez just lately secured 2 Bcm/y on a long-term foundation.

Cez’s Stade capability will change its contract with the Eemshaven FSRU unit within the Netherlands, which expires in 2027. Cez’s Stade capability is for 15 years with an choice to increase for one more 10 years. Cez is reported to be searching for long run provide from the US.

Stade’s remaining 1.3 Bcm/y of capability shall be allotted on a short-term foundation through auctions, as requested by the German authorities. A FSRU is to reach on the terminal in December, which shall be managed by Deutsche Power Terminal (DET), not by HEH.

GLNG’s terminal in Brunsbuttel acquired €40 billion of assist from Germany, permitted by the European Fee in July. The ten-Bcm/y terminal plans to start operations by the tip of 2026, although it has but to safe FID, a choice which is anticipated to slide into early 2024.

The beneficiaries of assist embrace German vitality firm RWE and the Dutch vitality community operator Gasunie.

GLNG, which is constructing and working the terminal, is owned by the German authorities through German funding and improvement financial institution KfW with a 50% share, Gasunie with 40% and RWE with 10%. The terminal, which remains to be ready for building permits, will safe funding from KfW.

The UK’s Ineos, US main ConocoPhillips (COP) and RWE have booked capability on the terminal, though Shell’s unique curiosity in long-term capability on the terminal seems to have misplaced momentum.

COP is anticipated to provide 2 MMt/y of LNG to the terminal for 15 years beginning 2026 as a part of a take care of QatarEnergy. The provision will come from QatarEnergy’s North Discipline East and North Discipline South enlargement initiatives.

COP will obtain provide from its fairness offtake in Qatar’s North Discipline Enlargement initiatives.

TES is creating the import terminal on the Wilhelmshaven web site, which it calls Wilhelmshaven Inexperienced Power Hub, with Germany’s E.ON and France’s Engie.

The businesses, together with DET have chartered a FSRU to serve the venture which is to reach this winter. TES plans to take FID on the onshore terminal in 2024, though it must safe permits to have the ability to transfer forward.

Germany’s Deliberate LNG Infrastructure

The terminal is anticipated to have 15 Bcm/y of LNG capability, most of which has been allotted on a five-year foundation, regardless of the developer’s intention to have 20-year allocations. As much as 25 events had been reported to have proven curiosity throughout an open season in June 2022.

Capability was allotted to 5-10 corporations in heads of agreements and TES is working to transform these to binding commitments as quickly as potential. One firm opted out and the three.4 Bcm/y capability was made obtainable to the market in October on a primary dedicated, first served foundation.

There have been at the least two counterparties displaying sturdy curiosity on this capability, above charges initially agreed with the unique counterparty.

Pricing is flat whatever the measurement of capability secured by a shipper on a €/MWh foundation, though period will have an effect on the tariff. The TES reference is for a 20-year contract and better charges shall be paid for shorter contracts.

The German authorities has mandated that 10%, or 1.5 Bcm/y is reserved for brief time period allocations. The venture shall be funded by fairness from shareholders and loans offered in a venture finance construction.

TES’ Wilhelmshaven web site and HEH’s Stade web site are good places for LNG import terminals as they’re energetic ports that don’t require dredging. Stade is already an import terminal for chemical substances and an FSRU has been efficiently deployed to TES’ Wilhelmshaven web site.

The TES terminal shall be related to Open Grid Europe, considered one of Germany’s largest fuel networks. GLNG’s Brunsbuttel, nonetheless, has had start-up points regarding grid connectivity with its FSRU.

When the import terminals begin up, German legislation stipulates that the FSRUs working at these places should depart. Nevertheless, it’s unclear whether or not this may have an effect on the Esperanza which is on constitution to Uniper at Wilhelmshaven. This FSRU is unrelated to the TES deliberate onshore terminal at Wilhelmshaven and its related FSRU, the Excelsior, which is about to reach at the start of subsequent yr.

Inexperienced vitality ambitions

All three terminal operators have inexperienced ambitions that are in step with the German authorities’s internet zero plans. HEH and GLNG plan to ultimately present amenities for ammonia storage. As a part of Germany’s 2022 LNG Acceleration Act onshore terminals are obliged to supply companies for inexperienced fuels from 2043 however there may be political strain to do that earlier than 2040.

Nevertheless, many trade members suppose these targets shall be exhausting to attain and count on all three terminals to stay targeted on LNG in the long run.

HEH and GLNG’s terminals may have the same design which permits for storage of ammonia utilizing the same methodology of cladding in tanks, whereas plans name for TES’ Wilhelmshaven terminal to obtain e-methane produced from inexperienced hydrogen.

Its benefit is that the e-methane molecule (CH₄) is similar because the methane that comes from hydrocarbon extraction, so amenities and ships don’t want re-tooling.

TES and Australia’s Fortescue Future Industries (FFI) signed an settlement in 2022 that will permit for 300,000 tons of inexperienced hydrogen to be transformed to e-methane and shipped to the TES terminal.

FFI additionally agreed to make a €30 million funding in TES to grow to be a shareholder and supply €100 million for the development of the terminal. TES hopes to have the ability to supply extra favorable situations on pricing and tenure for importing e-methane versus LNG.

TES has one other settlement with Uniper and the Authorities of Decrease Saxony to develop a jetty at Wilhelmshaven for the import of inexperienced fuels.

The settlement is in partnership with Niedersachsen Ports (NPorts), the biggest operator of public seaports in Germany.

Usually, market members are calling for additional value readability on the inexperienced phases of those initiatives.

Supply: Poten & Companions

[ad_2]

Source_link