[ad_1]

When Russia slashed European fuel exports in 2022, Europe’s regas terminal infrastructure immediately grew to become a important focus for safety of provide.

Russian pipeline provides to Europe fell from round 30% of the European provide combine (pre Ukraine invasion) to round 5% in 2023.

This drove a pointy pivot in European provide in direction of LNG and a recognition that regas capability was insufficient, particularly in markets that had been most depending on Russian fuel (e.g. Germany & Italy).

The following vitality disaster noticed a bounce in regas utilisation, the emergence of serious bottlenecks (significantly accessing key continental NW European hubs) and a surge within the service provider worth of regas capability.

This shocked each coverage makers and trade gamers into pursuing a wave of funding in new regas capability (each FSRUs & fastened capability).

In at the moment’s article we use 4 charts to verify in on European LNG imports, regas capability utilisation and the way the wave of latest regas funding is impacting market value indicators.

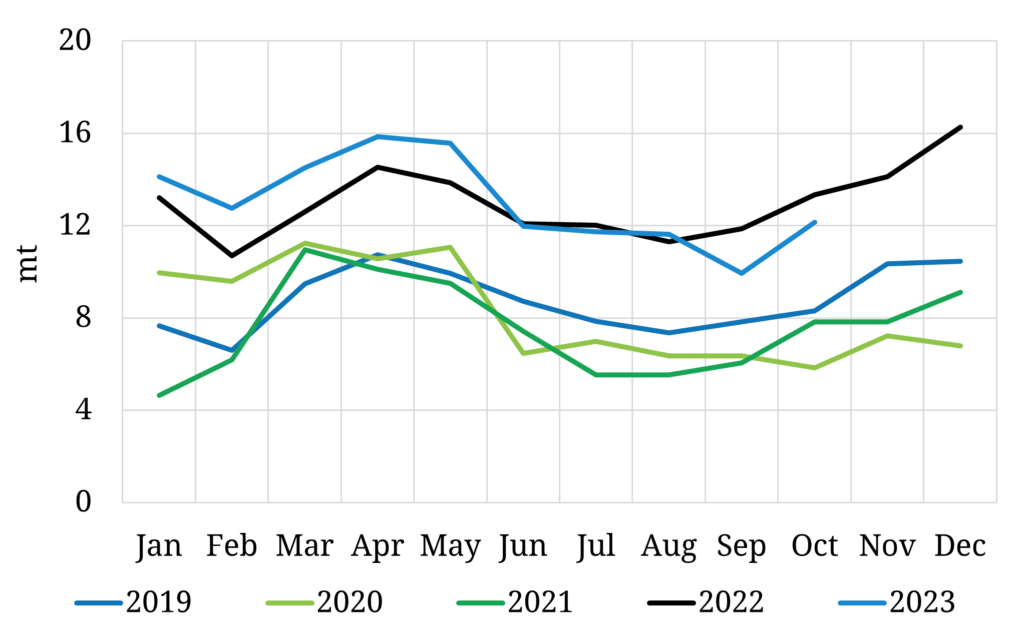

LNG imports at report ranges

There was a step change improve in European LNG imports from Q2 2022 because of Russian provide cuts. This may be clearly seen in Chart 1.

Chart 1: European LNG imports throughout final 5 years

Chart Supply: Timera Power, LNG Limitless

Learn the complete article by Timera Power

[ad_2]

Source_link