[ad_1]

With late spring chilly waning, however convincing indicators of early summer season warmth absent from the newest forecasts, regional pure fuel forwards misplaced floor in the course of the April 20-26 buying and selling week, NGI’s Ahead Look information present.

Henry Hub fastened costs for June supply gave up 9.0 cents for the interval to complete at $2.132/MMBtu. Fastened worth reductions of some pennies to a dime had been the norm for a lot of the Decrease 48.

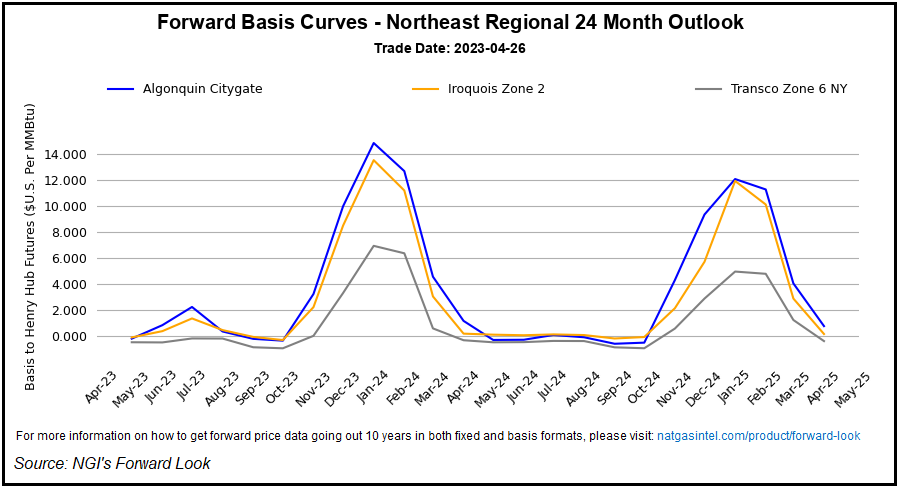

Extra unstable hubs in New England and alongside the West Coast, in the meantime, noticed heftier reductions as the dearth of intimidating weather-driven demand heading into Could appeared to take a few of the danger out of costs in these areas.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

June fastened costs at Algonquin Citygate plunged 58.7 cents for the interval to finish at $3.136. Within the West, SoCal Citygate gave up 27.5 cents to fall to $5.066.

Could Forecasts Combined

The up to date six- to 10-day forecast from Maxar’s Climate Desk Thursday confirmed unseasonably heat temperatures within the Inside West, with the southwestern Decrease 48 anticipated to see cooler circumstances.

The forecaster known as for below-normal temperatures in California, “the place a cut-off low hovers close to the coast. The low directs rounds of showers into the state, together with snow within the Sierras. Alternatively, above-normal temperatures are related to a ridge over the Inside West, with highs within the mid-70s in Denver.”

In the meantime, a spell of cooler temperatures anticipated to influence the Midwest, Ohio Valley and Inside Northeast after the upcoming weekend could possibly be the season’s final notable bout of heating demand, in keeping with NatGasWeather.

“This cool shot for early subsequent week could possibly be the final respectable late season system earlier than a fairly snug sample units up over many of the U.S. Could 4-15 with highs of 60s to 80s throughout the northern U.S. and 70s to 90s over the southern U.S. for gentle to very gentle nationwide demand,” the agency instructed purchasers Thursday.

Whereas the final vestiges of winter are quickly to fade, latest forecasts gave little indication of an early arrival for sturdy summer season cooling demand, in keeping with NatGasWeather.

“Going ahead, hotter-than-normal climate patterns and lighter manufacturing are going to be wanted if surpluses are to materially lower,” NatGasWeather mentioned. “However thus far, the climate information has but to supply when widespread warmth will arrive, whereas U.S. manufacturing stays sturdy at over 100 Bcf/d.

“Though, to our view, hotter developments will present up in time, and the again finish of Could might tease summer season warmth arriving early.”

A ‘Continental Divide’?

Regional variance in winter demand has arrange a “continental divide” between East and West by way of market and storage dynamics, in keeping with a latest analysis word from East Daley Analytics.

The agency cited Nationwide Climate Service information pointing to a 6% milder winter versus regular for america as an entire as of end-March by way of gas-weighted heating diploma days.

Coupled with sturdy home manufacturing, this has left the market with a Decrease 48 storage surplus to the five-year common far exceeding 300 Bcf as summer season approaches. As of April 21, the year-on-five-year-average surplus stood at 365 Bcf, or plus 22.2%, in keeping with EIA.

“Whereas internet bearish, the nationwide climate information fails to seize the nuance within the winter fuel story,” the East Daley analysts mentioned. “At a regional degree, the winter was unusually balmy throughout the japanese two-thirds of the U.S., together with file heat in components of the Mid-Atlantic and Southeast, whereas the West Coast and Rocky Mountains skilled a harsh winter.”

Cut up the numbers alongside the Nice Continental Divide, and the EIA storage information present the Pacific and Rockies areas at a big deficit to five-year norms, in stark distinction to hefty surpluses skilled in markets to the east, the East Daley analysts mentioned.

This divide has fueled premium pricing at demand hubs in California and within the Pacific Northwest, in addition to within the Rockies, in keeping with the agency.

“The divergence in storage ought to proceed to assist wider regional spreads,” the East Daley analysts mentioned. “Premium costs have been drawing fuel from as far-off because the Northeast by way of the Rockies Specific Pipeline, and western costs should keep elevated to draw volumes.

“Shippers on pipelines that immediately feed the West Coast, together with the Permian, Rockies and Western Canada, might see features in an in any other case robust macro fuel atmosphere.”

Could Expires On Down Observe

In the meantime, the April 20-26 buying and selling interval additionally introduced the expiration of the Could Nymex contract, which rolled off the board at $2.117 after a 19.0-cent swoon on Wednesday. On Thursday, June clawed again 5.0 cents in its first day as the brand new entrance month, settling at $2.355. June added one other 5.5 cents Friday to settle at $2.41.

ICAP Technical Evaluation analyst Brian LaRose posed two potential explanations to account for latest worth motion.

“Bullish case, pure fuel is slowly grinding out a backside,” LaRose mentioned. “This pullback from the latest $2.543 excessive within the June contract is nothing greater than a minor a-b-c correction. Bearish case, the June contract is heading for a take a look at of the $1.946/$1.944 spot lows.

“To keep away from visiting the lows, certainly one of two bands might want to present assist. The primary cuts at $2.257-2.229. The second cuts at $2.143-$2.117-$2.114-$2.101.”

[ad_2]

Source_link