[ad_1]

The prospect of late-month chills, significantly for western and northern parts of the Decrease 48, helped rally pure gasoline ahead costs at a number of regional hubs through the Feb. 9-15 buying and selling interval, NGI’s Ahead Look knowledge present.

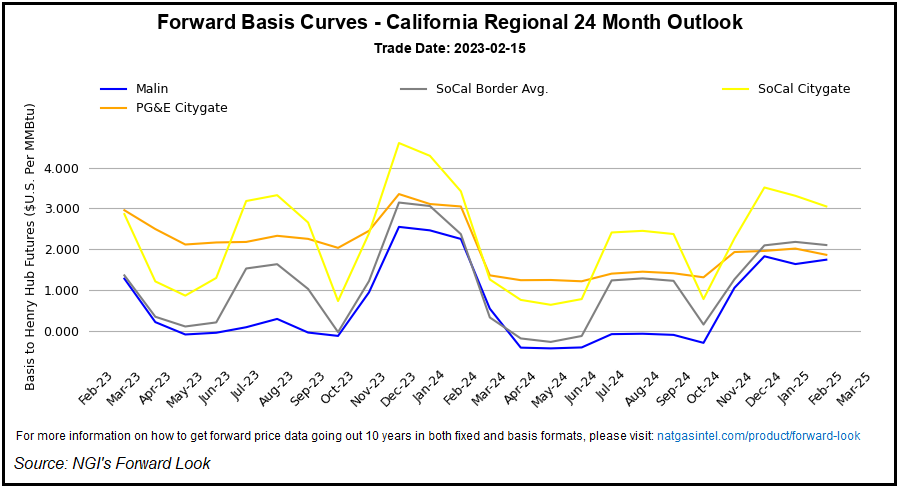

Within the West, the perennially constrained SoCal Citygate led the surge increased, with March fastened costs swelling $1.178 week/week to $5.332/MMBtu. Different western markets additionally noticed notable good points, together with Malin, the place March fastened costs jumped 66.6 cents to finish the interval at $3.755.

The most recent 11- to 15-day forecast from Maxar’s Climate Desk Thursday was colder-trending, with frigid temperatures centered within the western and central Decrease 48.

“The change comes from mannequin developments in constructing a stronger ridge from Europe towards Greenland,” Maxar mentioned. The “main sample” throughout this time-frame is one which “correlates chilly within the North and West this time of 12 months and heat within the South.

“The forecast displays this spatial regime, supporting a lot under regular temperatures within the West and early a lot aboves within the South.”

Loosening For SoCal?

Elevated costs have been an ongoing function of buying and selling out West this winter. Nonetheless, there could also be some aid in sight now {that a} long-running constraint on westbound flows into the Southern California market seems to have been resolved.

“After 19 months, El Paso Pure Gasoline (EPNG) has lastly terminated the power majeure on Line 2000, efficient the well timed cycle” for Wednesday’s gasoline day, Wooden Mackenzie analyst Quinn Schulz mentioned in a observe to shoppers. “In line with EPNG’s newest upkeep schedule, which means almost 0.59 Bcf/d in westbound capability by the CIMARRON constraint in Arizona can be returning.”

The diminished volumes on the EPNG Line 2000 helped drive a “dwindling of reserves” in Southern California through the 2021/22 winter and diminished receipts in the summertime of 2022, placing downward stress on inventories within the area, the analyst mentioned.

Stock ranges point out situations in Southern California have undergone some loosening just lately, in accordance with Schulz.

“Now with the return of Line 2000, extra of this loosening development has but to come back,” the analyst added.

The return of EPNG Line 2000 volumes additionally appeared to have knock-on results farther upstream within the Permian Basin, Ahead Look knowledge present.

Waha March fastened costs jumped 30.7 cents for the Feb. 9-15 buying and selling interval to finish at $1.595. That represented a 23.2-cent strengthening when it comes to Waha’s foundation differential to Henry Hub.

The nationwide benchmark, in the meantime, noticed a modest 7.5-cent fastened value achieve for the interval to climb to $2.479, setting the tempo for modest good points at most Decrease 48 hubs.

Swelling Storage Surplus

Regardless of some back-and-forth swings, front-month Nymex futures didn’t stray too removed from the $2.500 mark through the Feb. 9-15 interval. On Thursday, the March contract skidded 8.2 cents decrease to settle at $2.389, off a few nickel week/week. Costs prolonged the slide in Friday’s session, tumbling one other 11.4 cents to settle at $2.275.

The most recent Power Data Administration (EIA) storage report Thursday marked a fifth lighter-than-average weekly withdrawal out of six experiences up to now in 2023. EIA printed a 100 Bcf pull for the week ended Feb. 10, versus a five-year common withdrawal of 166 Bcf.

Inventories stood at 2,266 Bcf as of Feb. 10, an 8.8% surplus to the five-year common, in accordance with EIA.

Analysts at Tudor, Pickering, Holt & Co. estimated the market was 5 Bcf/d oversupplied on a weather-adjusted foundation primarily based on the latest EIA print.

“Excluding the previous couple of weeks, we estimate the market has averaged round 5 Bcf/d oversupplied on a weather-adjusted foundation year-to-date,” the analysts mentioned. This needs to be partially “offset within the coming weeks as Freeport ramps up towards full capability within the 2 Bcf/d vary.”

Nonetheless, the extent of oversupply year-to-date “highlights the market quandary forward of what we proceed to anticipate is rising provide as we development by 2023 and proceed to drag down the ahead curve to discourage dry gasoline provide progress,” the TPH analysts added.

A Freeport LNG request to FERC to renew operations in any respect three liquefaction trains marked a supportive growth for pure gasoline costs through the Feb. 9-15 interval, promising a rise in liquefied pure gasoline feed gasoline demand heading into the spring.

“Freeport LNG volumes elevated to almost 400 MMcf/d this week — the very best ranges reported because the outage” that started in June 2022, Rystad Power analyst Emily McClain mentioned in a current observe. “…We now anticipate Freeport LNG will obtain partial restart this month, however incremental LNG export volumes are anticipated to be minimal in February.

“We anticipate the plant will convey all three trains on-line in March, with a full ramp-up by early April.”

The Freeport progress, alongside a forecast that was “turning steadily much less bearish into late February,” helped drive an early week rally for pure gasoline, EBW Analytics Group analyst Eli Rubin noticed.

Nonetheless, the stock cushion is poised to proceed rising, limiting upside for costs, in accordance with the analyst.

“Storage surpluses are set to rocket increased in coming weeks to multi-year highs,” Rubin mentioned. “Whereas partially priced in, it could show troublesome for Nymex futures to submit a large rally within the face of continued oversupply situations.”

The outlook for bulls is probably not fully doom-and-gloom, nevertheless.

“Throughout the subsequent 30-45 days, it stays seemingly that Freeport’s return, extra supportive climate, decelerating provide, and steadying storage surpluses may assist Nymex futures set up a backside and migrate increased,” Rubin mentioned.

[ad_2]

Source_link