[ad_1]

Key implications:

- The launch of the grid-connected Hamina LNG regasification

terminal opens a second fuel import route to produce grid-connected

prospects in Finland, the place the market has relied solely upon the

bidirectional Balticconnector fuel pipeline since 21 Might 2022. - The Hamina LNG Terminal has a grid send-out capability of 4,800

MWh/d, making it small-scale, however it’s strategically positioned in

Finland’s largest port and will increase send-out capability in future

years. LNG provide capability in Finland can be additional bolstered by

the launch of the bigger Exemplar floating, storage, and

regasification unit (FSRU) in late 2022/early 2023. - Worries over provide, value, and local weather impacts should not

conducive to increasing Finland’s pure fuel consumption, which can

decline sharply in 2022. Long run, wind, nuclear capability

development, and biogas investments could more and more marginalize pure

fuel in Finland’s future power combine.

On 6 October 2022, it was introduced that the Hamina LNG

regasification terminal began business operations. The LNG

terminal is the primary in Finland to be related to the fuel

transmission community, with different working LNG terminals in Pori

and Tornio geared towards serving giant off-grid industrial

customers.

The launch of operations at Hamina is required to extend

Finland’s fuel provide. Finland has no home fuel manufacturing and no

underground fuel storage. Gasum’s provide from Gazprom Export was lower

on 21 Might 2022 as Gasum didn’t conform to Gazprom Export’s new

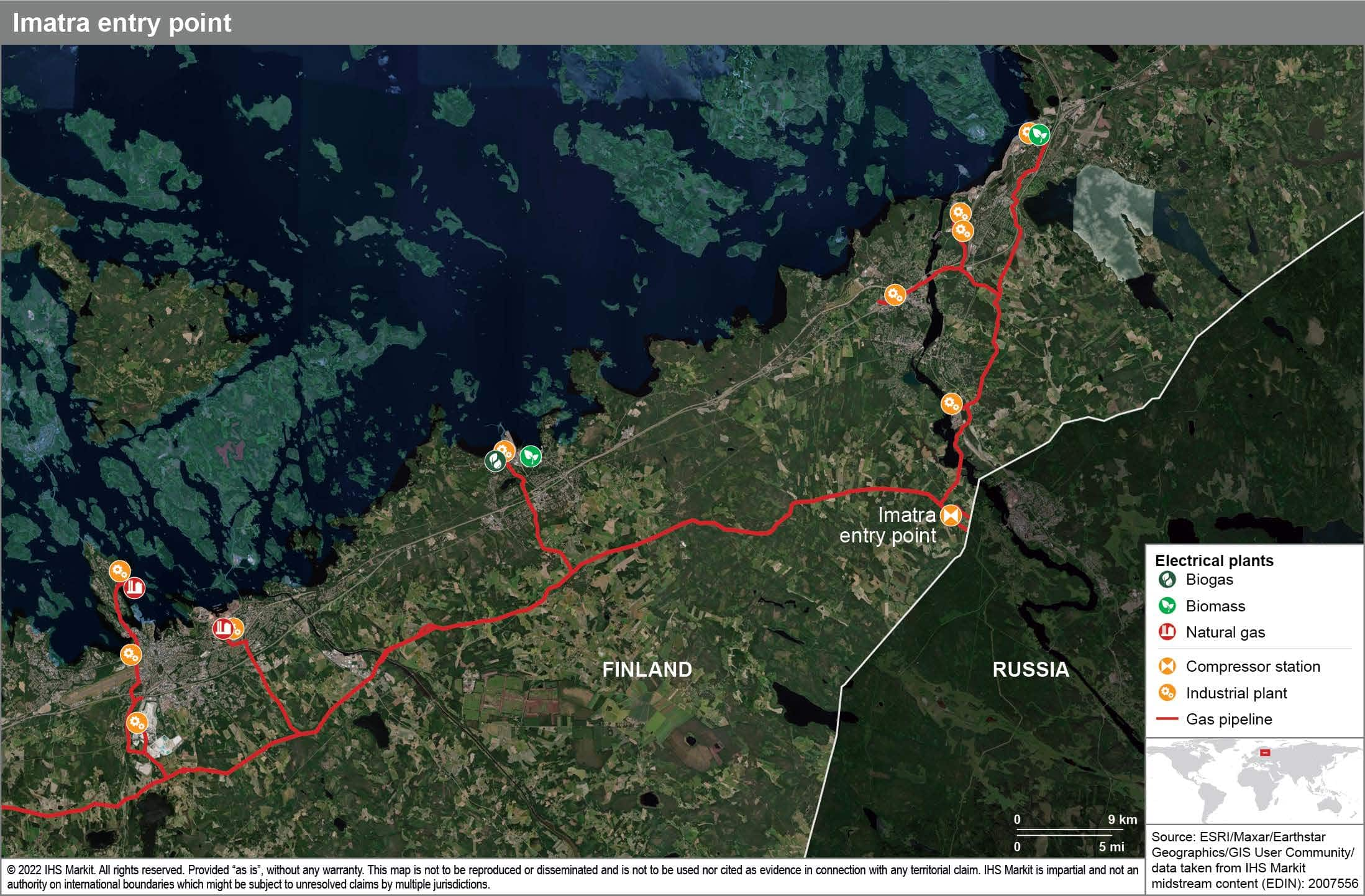

cost phrases. Gasoline pipeline imports from Russia through the Imatra

Entry Level in Japanese Finland have been then halted. Determine 1 reveals fuel

infrastructure across the Imatra Entry Level.

Since 21 Might 2022, grid-connected prospects have relied solely

on imports through Estonia from the Balticconnector fuel pipeline. The

halting of fuel provide between Gasum and Gazprom Export didn’t

impression availability in Finland or the functioning of the fuel

market. The Balticconnector’s capability of two.62 Bcm/y is barely

above Finland’s common 2016‒20 fuel consumption of two.38 Bcm/y.

Longer-term reliance upon a single bidirectional pipeline

undoubtedly would have left Finland’s fuel market susceptible to

provide disruption, as fuel through Balticconnector may not have been

enough to cowl peak winter demand necessities.

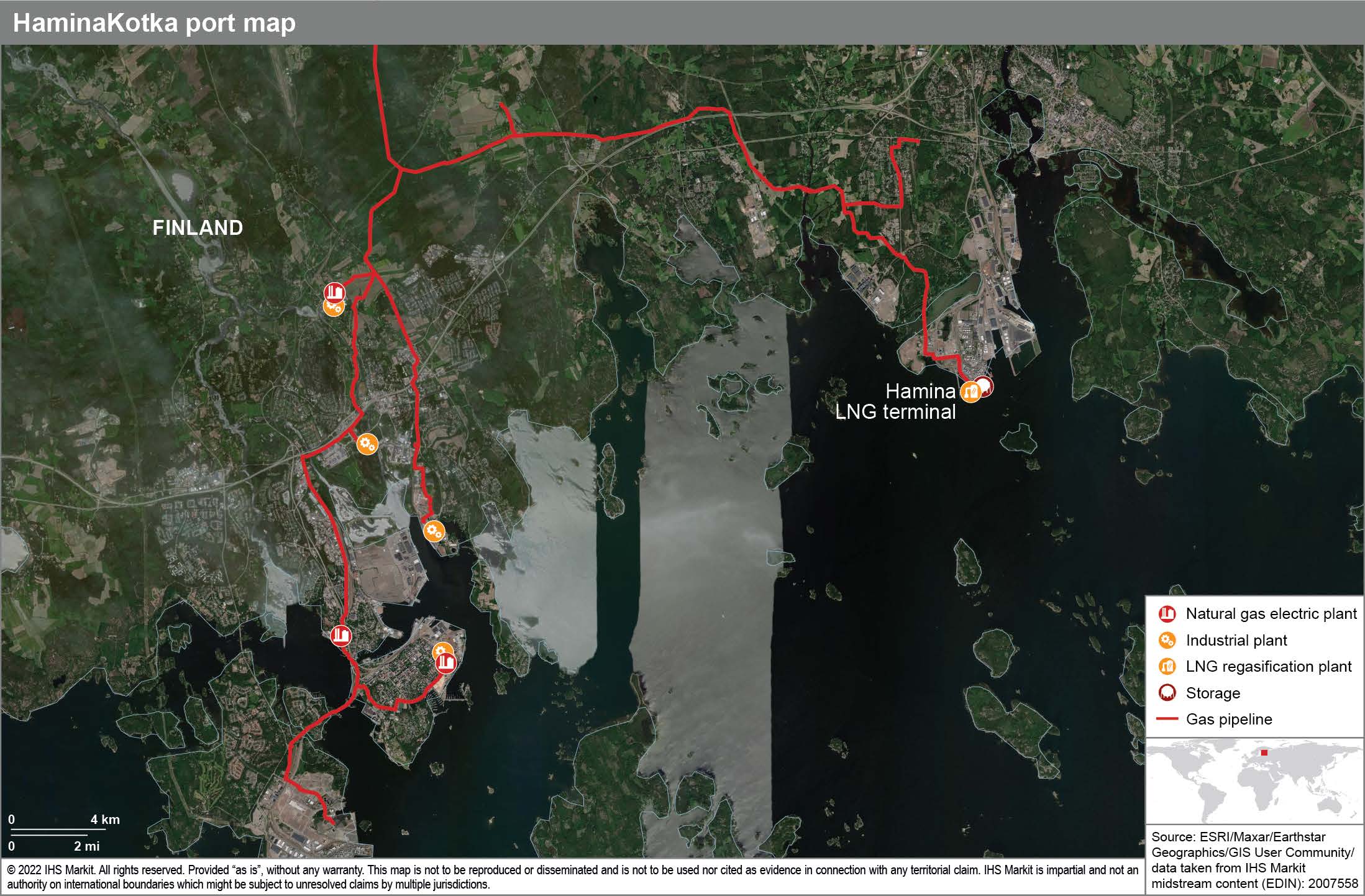

For Finland, the Hamina LNG Terminal launch is a welcome

various fuel provide supply, significantly as it’s operational

earlier than the onset of winter. Whereas the terminal is comparatively

small-scale—with a regasification capability into Finland’s fuel

transmission grid of 4,800 MWh/d—it’s strategically positioned in

Finland’s largest port of HaminaKotka, the place there are a selection of

industrial and energy sector customers. Determine 2 from the IHS Markit

Power Infrastructure and Markets Database (Midstream

Necessities)—which offers complete protection of oil and

fuel pipelines, terminals, and storage infrastructure—reveals

pipeline infrastructure and huge fuel customers within the port.

The Hamina Terminal additionally presents bunkering companies and has a

truck loading capability of three,600 cubic meters per day, so it’s

able to supplying off-grid customers within the industrial and

transportation sectors. The terminal was partially conceived to

promote LNG, each as a clear gasoline for the transport sector and to

provide off-grid inland prospects as distant as Kainuu area.

Nevertheless, extremely unstable European LNG costs—pushed by surging

European LNG demand and decrease Russian pipeline fuel imports—will

problem efforts to advertise LNG as a clear gasoline various for

off-grid industrial or transportation customers. Throughout winter

2022/23, Hamina could primarily be used as a peak provide supply for

grid-connected customers.

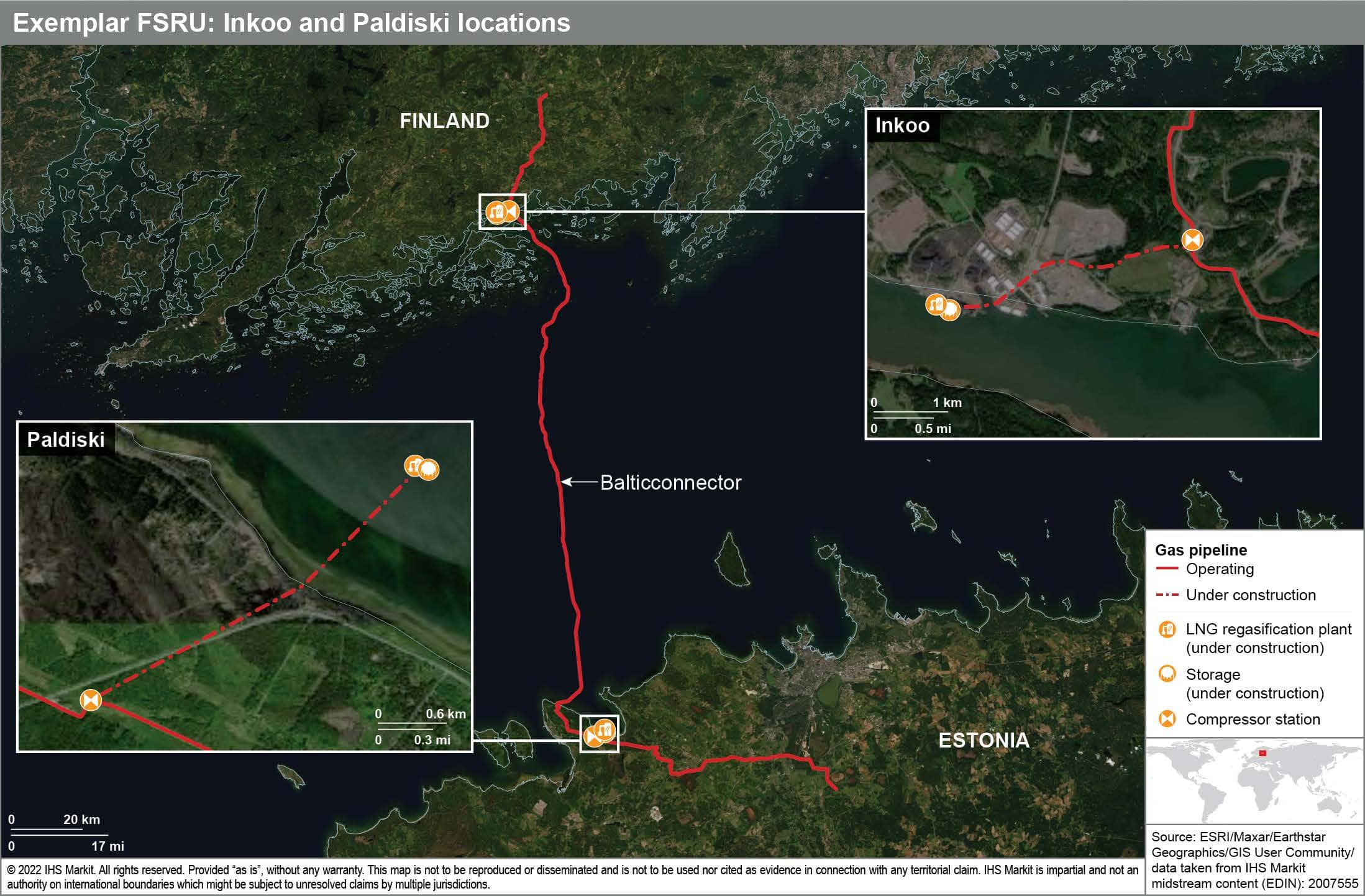

Finland’s fuel provide can be extra considerably bolstered by

the leasing of the Exemplar FSRU, a undertaking really useful by

Finland’s Ministerial Committee on Financial Coverage in April 2022

following Russia’s 31 March decree that funds for contracted fuel

from states deemed “unfriendly” ought to be made in rubles. Pushed by

pressing provide safety considerations, the Exemplar FSRU undertaking has been

quick tracked, demonstrated by the simultaneous growth of two

websites in Inkoo, Finland and close to Paldiski, Estonia. On 10 October

2022, Finland’s Ministry of Employment and the Financial system acknowledged that

the FSRU could be positioned at Inkoo. Inkoo was chosen because the

location for the vessel as it’s a deepwater port in a position to

accommodate the Exemplar FSRU and provider LNG tankers and is

located roughly 2 km from the Balticconnector fuel

pipeline—lowering the prices of linking into each the Finnish

and Estonian fuel grids. The Ministry of Employment and the Financial system

has acknowledged that siting the vessel in Inkoo would extra securely

assist gas-fired electrical energy manufacturing in Finland that might

serve the frequent electrical energy market. The siting resolution additionally

displays Finland’s provide safety pursuits and the main

funding function of Gasgrid Finland within the undertaking. Nonetheless,

infrastructure at Paldiski will proceed to be developed to scale back

undertaking dangers, permitting motion of the FSRU if obligatory. Determine 3

reveals the 2 places which can be being developed for the Exemplar

FSRU.

The Exemplar FSRU is much bigger than the Hamina Terminal with a

regasification capability of as much as 5 Bcm/y, which significantly

surpasses mixed fuel consumption in Finland and Estonia of two.8

Bcm/y in 2020. When commissioned, the Exemplar FSRU will present

sufficient capability to satisfy Finland’s fuel wants, though the present

value setting will imply excessive provide prices. File fuel costs

are possible eroding consumption in Finland, lowering the chance of

provide shortages. IHS Markit estimates 2022 consumption at solely

0.75 Bcm/y in contrast with a projected 2.3 Bcm/y in 2021.

The launch of the Hamina LNG Terminal is a milestone within the

recalibration of Finland’s fuel provide. It has been acknowledged that the

Hamina LNG Terminal’s send-out capability may theoretically be

doubled annually to succeed in 24 GWh/d, presumably by late 2026. The

growth of the Hamina LNG Terminal may intention to offer provide

safety to customers in jap Finland, who now not obtain

pipeline fuel from Gazprom Export.

Nonetheless, Finland’s pure fuel market shouldn’t be on a long-term

development trajectory. Gasoline consumption has been in long-term decline

over the previous decade, and whereas Finland plans to desert coal in

energy era by 2029, the gasoline is already marginal within the energy

combine; subsequently, advantages for fuel energy crops can be restricted.

Moreover, burgeoning wind capability and the launch of the

Olkiluoto 3 nuclear reactor—which reached its full internet

electrical energy capability of 1,600 MW throughout commissioning on the

finish of September 2022 may weigh on energy sector fuel consumption,

which has traditionally been increased than within the industrial or

residential sectors. Considerations over pure fuel provide could lead

Gasum to emphasise growth of its biogas enterprise as a

long-term various to pure fuel. Biogas depends extra on

home feedstock and is extra insulated from worldwide value

volatility whereas supporting authorities decarbonization coverage.

Worries over value, provide, and local weather impacts could imply that the

challenges confronted by Finland’s pure fuel sector in 2022 merely

speed up the long-term marginalization of pure fuel in

Finland’s power combine.

Study extra in regards to the Power Infrastructure and Markets

Database (Midstream Necessities) — which offers

complete protection of oil and fuel transportation, processing,

storage terminal, and first market infrastructure.

You might also contact one in all our specialists for a free

product demonstration.

Karl Lindstrom: karl.lindstrom@spglobal.com

Julien Zigliani: julien.zigliani@spglobal.com

Tom Grieder: thomas.grieder@spglobal.com

This text was printed by S&P World Commodity Insights and never by S&P World Rankings, which is a individually managed division of S&P World.

[ad_2]

Source_link