[ad_1]

Intercontinental Change Inc. (ICE) stated Friday it could launch a marketplace for buying and selling Title Switch Facility (TTF) contracts in London which can be topic to the European Union (EU) cap on the continent’s fuel benchmark that takes impact subsequent month.

“ICE’s goal is to create markets to permit our clients to handle their threat and now we have an obligation to our clients to supply options to the issues they face,” stated ICE’s Trabue Bland, senior vp of futures exchanges.

Bland stated TTF futures listed on the ICE Futures Europe market in London would supply an alternate venue offering the change’s clients with an “insurance coverage choice” if the EU’s worth management mechanism “prevents them from buying and selling and adequately managing their threat publicity.”

ICE Endex, based mostly within the Netherlands, which is the world’s most liquid marketplace for TTF futures and choices, additionally plans to vary its rulebook to make sure compliance with the EU’s regulation, which takes impact Feb. 15.

The TTF futures contracts listed in London would mirror these within the Netherlands, ICE stated. They’d nonetheless be physically-settled, with pure fuel delivered on the TTF buying and selling level if contracts are held till expiry. ICE plans to launch the rival market Feb. 20.

After the value cap takes place, adjustments to the ICE Endex rulebook within the Netherlands would stop market individuals from submitting orders to the change for TTF derivatives above the value cap, except they’re eligible for exemptions included within the rules.

ICE additionally stated it could not change its current methodology for figuring out and publishing end-of-day settlement costs.

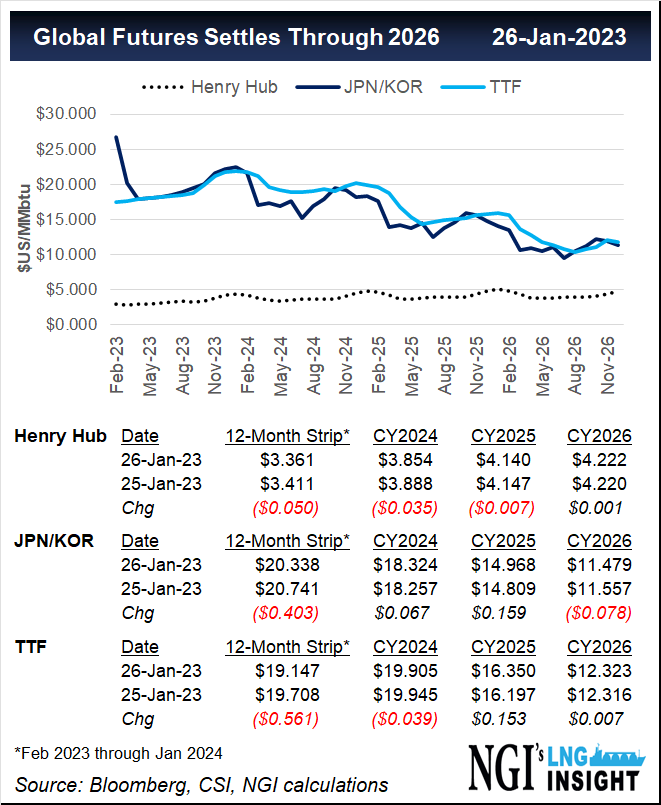

The EU adopted the value cap in December after a yr of volatility and sky-high TTF costs that reached ranges round $100/MMBtu. The worth spikes stretched the budgets of customers and governments throughout the bloc because the market rushed to safe LNG cargoes.

TTF is a digital pipeline hub and Europe’s main fuel benchmark, nevertheless it has diverged from seaborne imports of liquefied pure fuel, which have at instances traded above and beneath the contract.

To this point this yr, TTF hasn’t come near surpassing the 180 euros/MWh, or roughly $57/MMBtu, for 3 enterprise days that may set off the EU’s cap. It will even be triggered if the month-ahead TTF worth is 35 euros/MWh, or round $11/MMBtu, above a worldwide LNG reference worth for 3 enterprise days.

Heat climate and ample provides have stored pure fuel costs down this winter. TTF closed on Friday about 30 cents above LNG costs assessed by The EU Company for the Cooperation of Power Regulators.

Shortly earlier than the EU adopted the value cap, ICE warned that it might trigger havoc out there and stated it was contemplating shifting TTF buying and selling out of the Netherlands. EU regulators stated this month that buying and selling actions have but to be impacted, however they cautioned that future impacts had been nonetheless attainable.

[ad_2]

Source_link