[ad_1]

The potential for widespread frigid temperatures to start out February didn’t resuscitate pure gasoline costs for February baseload supply, with ample manufacturing, plentiful storage and languishing exports weighing down markets, based on NGI’s Bidweek Alert (BWA).

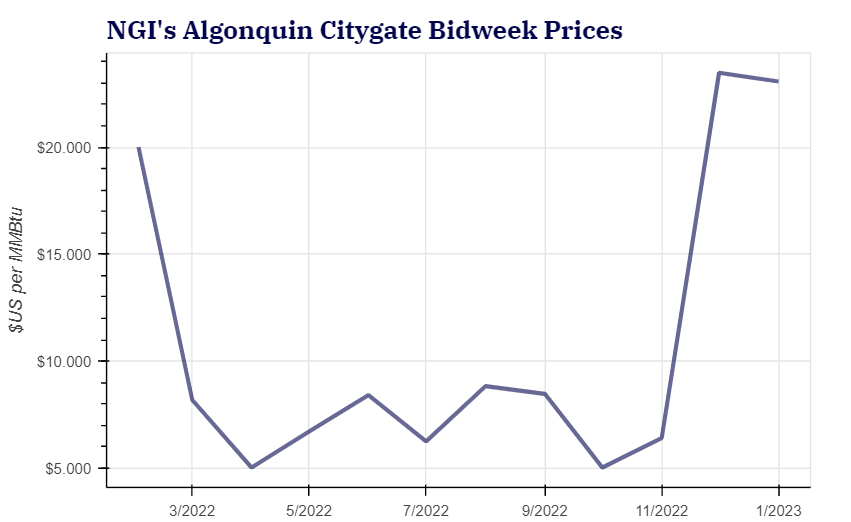

On the East Coast – the place a well-documented historical past of volatility has taken a again seat to the West Coast this winter – bodily foundation costs on the Algonquin Citygate averaged $8.800/MMBtu on day 1 of the February bidweek buying and selling interval that started Wednesday. This compares with foundation costs that ranged from $16.00-$19.00 for January baseload.

Transco Zone 6 non-NY foundation averaged round $2.470 for February supply, down from $6.75-$8.00 final month, BWA knowledge confirmed.

Upstream in Appalachia, the potential for one more spherical of freeze-offs within the subsequent couple of weeks could result in a modest restoration in costs. Japanese Fuel South foundation costs, for instance, averaged minus 71.25 cents for February baseload, up from a spread of minus $1.0275 to minus $1.210 final month.

[2023 Natural Gas Price Outlook: How will the energy industry continue to evolve in 2023? NGI’s special report “Reshuffling the Deck: High Stakes for Natural Gas & The World is All-In” offers trusted insight and data-backed forecasts on U.S. natural gas and the global LNG markets. Download now.]

After a principally gentle January, current climate knowledge exhibits bitter winter climate making one other look throughout the Decrease 48 within the coming days. What’s extra, the newest fashions trended colder for subsequent week, whereas additionally forecasting a frosty sample via the primary week of February.

Heavy rain and snow have already got blanketed massive swaths of the nation this week, stretching from the Ohio Valley and into the East. A chillier climate system was on its heels.

NatGasWeather mentioned the subsequent system would possible sweep throughout the Midwest Friday-Sunday, opening the door for a collection of frigid pictures over Canada to advance aggressively into the northern and central United States subsequent week. In a single day temperatures might plunge greater than 20 levels under zero, together with lows within the 10s to 20s throughout North Texas.

Though there’s potential for the subfreezing air to advance extra aggressively south and eastward, NatGasWeather mentioned climate fashions at present present the biting chilly moderating and slowly retreating towards the Canadian border by Feb. 7-9. After all, that longer-term outlook is topic to massive adjustments.

“It might be bearish if the Feb 8.-14 sample did in reality arrive hotter than regular,” the forecaster mentioned.

Even with temperatures plunging in components of the Lone Star State, merchants dismissed the specter of freeze-offs within the Permian Basin, BWA knowledge confirmed. Waha fastened costs averaged solely $2.435 on day 1 of February bidweek buying and selling, down from $4.785 final month.

The obvious disregard for the potential impacts a wintry combine might carry to the gasoline market will not be all that shocking. In spite of everything, December led to Winter Storm Elliott, the primary storm that got here wherever near rivaling Uri earlier than it in February 2021. Manufacturing dropped greater than 10% by some estimates, with the Permian, Rockies, Appalachia and the Bakken the toughest hit of the manufacturing areas. However output rapidly recovered and has trended not far off document highs above 100 Bcf/d all through a lot of January.

That mentioned, “paralyzing” winter manufacturing freeze-off dangers can now not be dismissed as one-off occasions, based on EBW Analytics Group LLC. The provision losses that plunged Texas into darkness throughout Uri didn’t repeat, however twin Arctic fronts in each February 2022 and December every posed greater than 10 Bcf/d of manufacturing losses.

“This now marks three tremendously disruptive manufacturing freeze-off occasions in below two years,” EBW senior vitality analyst Eli Rubin mentioned.

Alternatively, there’s little slowdown anticipated within the Permian. Related gasoline manufacturing is primarily pushed by oil costs, not pure gasoline costs, and subsequently would possible proceed to develop even with gasoline costs within the dumps, based on Rubin. The Appalachian Basin, in the meantime, is successfully pipeline constrained, with little readability on if and when the Mountain Valley Pipeline could start operations.

“In different phrases, the 2 largest engines of gasoline provide progress are each comparatively inelastic with respect to pure gasoline costs,” Rubin mentioned.

The analyst additionally identified that present pure gasoline costs – February Nymex futures settled Wednesday at $3.067 – stay larger than any full-year common from 2015-2020, when full yr Henry Hub costs averaged $2.11-$3.27. As such, “stray market requires producer shut-ins of flowing manufacturing within the close to time period are virtually definitely untimely,” based on Rubin.

In the meantime, storage inventories have benefited considerably from the principally gentle climate this month. After a uncommon January injection, subsequent withdrawals are anticipated to match frivolously with historic ranges and ultimately propel inventories to a greater than 150 Bcf surplus over the five-year common earlier than the late-January winter storm is taken under consideration. Even then, provides are anticipated to stay stout, with end-of-March stock estimates trending nearer to 2.0 Tcf.

After all, Freeport LNG’s return stays a wildcard. However at this stage within the winter, its inevitable return will not be prone to have the identical impression it will have had if it had returned in December, when it initially focused a comeback.

The liquefied pure gasoline export facility on Monday formally requested federal regulators to permit preliminary work to restart the two.38 Bcf/d terminal. Even nonetheless, the timeline for preparation work, ongoing monitoring and extra federal approvals means it nonetheless could possibly be a number of weeks earlier than the LNG facility is again in operation. The power has been offline since a June explosion.

“Collectively, the method seems prone to take at the least a minimal six weeks – indicating an early-March timeframe in a bullish case the place all goes easily – and sure longer as delays virtually invariably come up,” Rubin mentioned.

[ad_2]

Source_link