[ad_1]

With February solely days away, the pure gasoline market could also be closing the e book on winter – and disregarding information of Freeport LNG’s impending restart – as ahead costs continued to melt by means of the Jan. 19-25 interval, in response to NGI’s Ahead Look.

The previous week’s buying and selling patterns continued the traits which have performed out all through a lot of the season, with the West and East coasts main the step decrease as intimidating chilly has been missing from current forecasts.

NatGasWeather mentioned a powerful winter storm would exit the East on Thursday, whereas a colder system upstream was forecast to trace throughout the Midwest over the following few days. This technique is anticipated to open the door for reinforcing frigid photographs to advance aggressively into the northern and central United States, nevertheless, the newest information backed off this chance. It additionally didn’t present frigid air sticking round as lengthy, particularly within the World Forecast System (GFS) mannequin.

[2023 Natural Gas Price Outlook: How will the energy industry continue to evolve in 2023? NGI’s special report “Reshuffling the Deck: High Stakes for Natural Gas & The World is All-In” offers trusted insight and data-backed forecasts on U.S. natural gas and the global LNG markets. Download now.]

“The in a single day European Centre remains to be impressively chilly for Jan. 31-Feb. 4 for very sturdy nationwide demand, however then moderates temperatures over the southern and japanese U.S. quicker Feb. 5-8, just like the GFS,” NatGasWeather mentioned.

With storage inventories within the East monitoring close to seasonal ranges, ahead markets merchants had been content material to take costs down just a few extra notches.

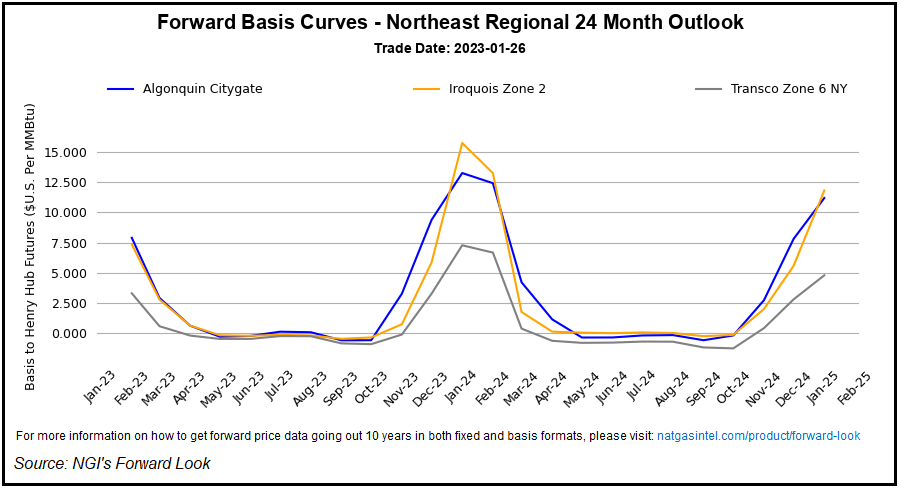

New England’s Algonquin Citygate tumbled $1.270 to $11.935 for February, Ahead Look information confirmed. The summer season strip (April-October) fell 12.0 cents to common $3.110, whereas the upcoming winter strip (November-March) managed to choose up a penny to common $13.077.

Related worth decreases had been seen alongside Transcontinental Gasoline Pipe Line Co. Transco Zone 6 non-NY’s February contract slid $1.060 to $6.681. The summer season strip misplaced a dime to achieve $2.730. Costs for subsequent winter had been down 52.0 cents to $7.791.

The sell-off was much more pronounced on the West Coast. Notably, nevertheless, costs stay at a pointy premium over the remainder of North America given the vastly completely different provide/demand image out West.

For instance, on the subject of storage, the Pacific area stands out as the one one the place inventories are lagging historic ranges – at greater than 30% beneath the five-year common, in response to authorities statistics.

On the similar time, AccuWeather mentioned the transition to spring from winter could also be gradual on the West Coast, with just a few extra waves of rain and mountain snow seemingly. The late winter and early spring storms in California will not be as frequent or as livid because the storms that kicked off 2023. Nonetheless, they need to proceed to alleviate the drought circumstances which have endured for the previous few years.

AccuWeather mentioned the onslaught of storms from late December by means of early January fully erased the intense and distinctive drought circumstances throughout the state. Extra rounds of precipitation late within the winter and early spring ought to proceed to minimize the severity of the continuing drought throughout the area. That is in stark distinction to 2022, when a dry finish to winter and begin to spring brought on the drought to worsen.

The wet season ought to bode properly for hydroelectric energy era this spring, with a restoration in output more likely to put a damper on energy burns. That mentioned, the provision of that gasoline provide may lastly make its means into storage, the place it’s wanted.

To that finish, gasoline flows additionally might enhance within the coming weeks.

Kinder Morgan Inc. on Wednesday requested federal regulators to elevate the stress restriction on Line 2000 of the El Paso Pure Gasoline Pipeline (EPNG) system to return the road to business service.

Work to restore the road was accomplished earlier this month following an August 2021 explosion close to Coolidge, AZ. Nonetheless, EPNG suggested shippers that the Pipeline and Hazardous Supplies Security Administration would want time to assessment the request.

“If we had been to imagine a two-week turnaround for approval, this might place the road again into service close to Feb. 7,” mentioned Wooden Mackenzie’s Quinn Schulz, pure gasoline analyst. “Whereas this submittal is sooner than what we anticipated, the actual fact stays that we nonetheless can’t be sure how lengthy this approval might take as a result of circumstances surrounding this occasion: the fatalities, the size of the repair, and many others.”

Bearish Macro Outlook

Worth declines had been a bit extra tempered throughout most different U.S. ahead curves, although the unsupportive market indicators continued to have a powerful affect available on the market.

Except for the more and more bearish near-term climate outlook, the newest authorities storage information additionally did little to encourage a rebound for costs.

The U.S. Power Data Administration (EIA) on Thursday mentioned inventories for the week ending Jan. 20 fell by 91 Bcf. Although the withdrawal was bigger than anticipated by most analysts, it nonetheless fell properly in need of regular pulls for this time of yr. A pull of 217 Bcf was recorded throughout the identical week final yr, whereas the five-year common draw is 185 Bcf.

The East led all areas with a pull of 40 Bcf, whereas the Midwest adopted with a draw of 36 Bcf. Mountain and Pacific area inventories every fell by 7 Bcf.

South Central shares, in the meantime, decreased by a web 2 Bcf. The outcome mirrored a 3 Bcf injection into salts that was greater than offset by a pull of 5 Bcf from nonsalt services, EIA mentioned.

Even with the larger-than-expected withdrawal, inventories as of Jan. 20 stood at 2,729 Bcf, which is 107 Bcf increased than a yr earlier and 128 Bcf above the five-year common.

One participant on Enelyst, a web-based vitality chat, mentioned tighter numbers might arrive within the weeks forward, particularly contemplating the anticipated chilly snap – temporary as it could be. That mentioned, it’s “too little too late within the large image.”

On the very least, although, the marginally larger-than-expected withdrawal “ought to give some pause to this falling knife,” in response to advisory agency Valor Analytics. “Nonetheless wants plenty of climate help. In any other case, the large guys are gunning for a $1 deal with quickly.”

Certainly, with exports nonetheless languishing amid the continued outage on the Freeport liquefied pure gasoline terminal, ample manufacturing and lackluster demand have taken a swift toll on costs. Costs may flip round quickly, although.

Freeport LNG on Thursday obtained FERC approval to start commissioning, together with cooldown, of Loop 1 switch piping and to reinstate service of the boil off gasoline administration system. It had requested the Federal Power Regulatory Fee for permission to start preliminary work to restart operations on Monday (Jan. 30).

NGI’s LNG Export Tracker confirmed modest quantities of feed gasoline being delivered to the two.38 Bcf/d terminal on Thursday. Freeport LNG has been shut since a June explosion.

The Freeport information largely unfazed bears, although. February Nymex futures settled Thursday at $2.944, off 12.3 cents from Wednesday’s shut. The contract reversed course Friday forward of expiry so as to add 16.5 cents and end at $3.109.

The February contract floundered most of Friday however bounced again within the ultimate hour, avoiding a fourth-consecutive loss beneath the stress of regular manufacturing and provide/demand imbalance.

[ad_2]

Source_link