[ad_1]

Russian pure fuel exports to overseas markets dropped practically 46% yr/yr in 2022, once they had been impacted by a steep decline in deliveries to Europe, in response to Gazprom PJSC.

Exports, together with these to China by way of the Energy of Siberia Pipeline, dropped to 100.9 billion cubic meters (Bcm) final yr, or about 3.6 Tcf. That’s in comparison with 185.1 Bcm, or roughly 6.5 Tcf, in 2021.

Gazprom had a “very, very tough” yr, Gazprom Chairman Alexey Miller reportedly mentioned at a convention late final month. Gazprom produced 412.6 Bcm of pure fuel final yr, a 20% decline from 2021 volumes, he mentioned.

“Gazprom won’t be able to seek out any substantial new export shops over the following decade,” mentioned Jonathan Stern, a senior analysis fellow on the Oxford Institute for Power Research. “Nothing will compensate for the lack of 140-150 Bcm of pipeline export volumes to European Union (EU) international locations any time quickly.”

Europe was Gazprom’s essential export outlet till Russia invaded Ukraine final February. The Kremlin continued curbing deliveries to EU nations all through 2022 in retaliation to Western sanctions towards the struggle. By September, Gazprom minimize flows to a trickle and explosions knocked out the Nord Stream (NS) fuel system operating from Russia to Germany.

Russian fuel deliveries into Europe are actually restricted to a cross-border pipeline by way of Ukraine and one other pipeline by way of Turkey.

“Though the present roughly 25 Bcm of exports is more likely to proceed until the battle interrupts Ukrainian flows, it’s doable this might marginally enhance if there’s a settlement, however at current that doesn’t look probably,” Stern instructed NGI.

Russia has managed to compensate for the loss in export volumes with the large will increase in European fuel costs and excessive oil costs. Stern expects costs “to rise additional as Putin retaliates towards the just lately imposed European cap, which might grow to be extra vital because the fuel, and doubtless oil provide and demand rebalance.”

Gazprom didn’t publish its monetary outcomes for 2022, leaving the corporate’s financial state of affairs unclear. Miller famous in Gazprom’s year-end letter that there was “a complete change in power markets” influenced by western sanctions.

Focus On LNG

Russia’s future export plans embrace rising LNG shipments within the West from PAO Novatek’s Yamal and Arctic liquefied pure fuel initiatives. It additionally plans to spice up exports within the east from the 2 Sakhalin initiatives that the nation took over by a decree from President Vladimir Putin in June.

Russian LNG exports elevated practically 10% yr/yr in 2022 to 32.87 million tons, in response to Kpler knowledge.

“Russian LNG exports will proceed even to Europe as a result of – United Kingdom apart – they haven’t been sanctioned and don’t look as if they are going to be,” Stern mentioned.

However rising LNG exports from new initiatives shall be tough.

Novatek’s Arctic Cascade liquefaction know-how seems to have failed, Stern mentioned, “so LNG exports will stall submit Arctic LNG Practice 1 due to sanctions, or till Russia or China develops their very own liquefaction applied sciences which isn’t not possible however at present not on the horizon.”

Hopes Pinned On China

Russia has an bold export technique centered eastward on China in a shift away from Europe. Gazprom goals to extend exports to China by including round 100 Bcm of supply capability by 2030.

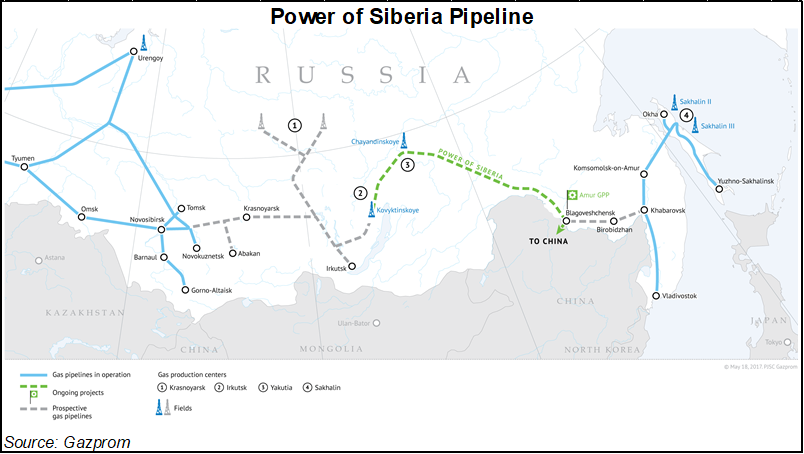

The Energy of Siberia 1 (POS) pipeline began deliveries to China in 2019. It provided about 10 Bcm of fuel in 2021. POS 1 is predicted to succeed in its full 38 Bcm capability by 2025.

The deliberate 50 Bcm/yr POS 2 would take the place of NS 2 to move fuel from the Yamal-Nenets area by way of Mongolia to China, Russian Power Minister Alexander Novak mentioned in September. However POS 2 shouldn’t be anticipated to return on-line till 2030 or later.

POS 3 is a ten Bcm/yr pipeline to ship Russian fuel from the Far East Island of Sakhalin throughout the Sea of Japan to northeast China by 2026.

Russia will want billions of {dollars} for these initiatives, and contract costs for Chinese language exports are considerably decrease in comparison with costs paid in European markets. “Chinese language costs aren’t more likely to considerably enhance,” Stern mentioned.

“China will construct up slowly over this decade, however POS 2 shouldn’t be but agreed and 100 bcm seems to be extremely bold previous to 2030, with 50-60 Bcm wanting extra probably.”

[ad_2]

Source_link