[ad_1]

Pure gasoline futures floundered Tuesday, opening common 2023 buying and selling very similar to they closed out final yr – falling on expectations for gentle January temperatures and lightweight heating demand.

At A Look:

- Demand forecast fades

- Manufacturing bounces again

- Blended outlook on storage

The February Nymex gasoline futures contract on Tuesday settled at $3.988/MMBtu, down 48.7 cents day/day. March shed 46.3 cents to $3.641. The immediate month had slipped 8.4 cents on Friday to complete 2022.

NGI’s Spot Gasoline Nationwide Avg., in distinction, jumped $1.545 to $6.305, led larger by hubs within the West amid flooding rains in California and punishing snow storms within the Rocky Mountains and northern Plains.

After bouts of winter climate this week, nevertheless, a lot of the Decrease 48 is anticipated to see warmer-than-normal temperatures subsequent week and thru no less than the center of January, based on Nationwide Climate Service information.

“Many of the southern half of the U.S. and up the Mid-Atlantic Coast will see highs within the 60s and 70s,” with “little or no protection of daytime highs beneath freezing over the northern U.S.” outdoors of the northern reaches of the Rockies and the Plains, NatGasWeather mentioned.

In the meantime, after widespread freeze-offs amid an Arctic storm final week, manufacturing had largely recovered by Tuesday, boosted by good points within the Northeast.

Output climbed above 99 Bcf/d on Tuesday, up from round 95 Bcf/d in late December, based on Bloomberg estimates.

Wooden Mackenzie analyst Laura Munder mentioned “impacts are nonetheless ongoing” in North Dakota and Montana, however manufacturing general is again close to the document ranges simply above 100 Bcf/d reached in 2022.

Forecasts additionally confirmed above-average temperatures for many of Europe within the first half of January, probably easing near-term demand for U.S. exports of LNG after a seasonally gentle December over components of the continent. European pure gasoline costs on Tuesday hit the bottom degree since November 2021.

Moreover, a key U.S. liquefied pure gasoline facility in Texas remained offline this week amid protracted restore efforts. Freeport LNG was pressured offline final summer season following a hearth. The corporate hopes to relaunch later this month.

“A document heat begin to 2023 for the U.S., near-record pure gasoline manufacturing, gentle LNG exports on account of Freeport nonetheless being offline, and really heat temperatures the previous few weeks over Europe have led to very large danger off commerce in U.S. and world pure gasoline markets,” NatGasWeather mentioned.

[Want today’s Henry Hub, Houston Ship Channel and Chicago Citygate prices? Check out NGI’s daily natural gas price snapshot now.]

EBW Analytics Group’s Eli Rubin, senior analyst, served up an identical evaluation Tuesday.

“The overwhelmingly gentle climate shifts that marked the tip of 2022 are persevering with unabated into 2023, with excessive heat throughout the japanese U.S. and Texas extending to mid-January. The gasoline market has now misplaced 235 Bcf of weather-driven demand since December 15, collapsing the February contract,” Rubin mentioned.

Basically, he added, “pure gasoline is weak with additional to fall on a seasonal foundation. The market is repricing eviscerated pure gasoline danger premiums from having assured winter provide adequacy to being oversupplied in 2023. Climate is fickle and a short-term bounce is feasible, however the outlook for pure gasoline is bearish for the brand new yr.”

Storage Snapshot

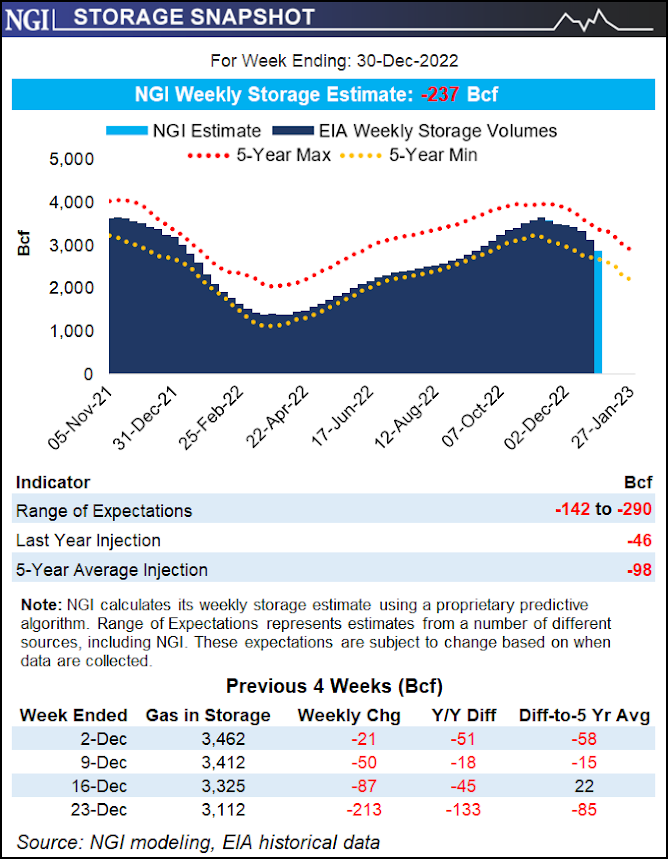

In bulls’ favor, analysts are on the lookout for an enormous withdrawal with this week’s U.S. Power Info Administration (EIA) report – following the blustery situations and hits to manufacturing late in December.

Early estimates for the week ended Dec. 30 submitted to Reuters ranged from withdrawals of 142 Bcf to 290 Bcf, with a median of 220 Bcf.

NGI estimated a pull of 237 Bcf.

That compares with a reported lower of 46 Bcf throughout the identical week a yr earlier and a five-year common of 98 Bcf.

EIA reported a larger-than-expected 213 Bcf withdrawal from storage for the week ended Dec. 23. Stockpiles ended that interval at 3,112 Bcf, or 85 Bcf (minus 2.7%) beneath the five-year common.

Analysts at The Schork Report anticipate that pull to be adopted by a “gargantuan” withdrawal with this week’s print. Along with climate elements, they famous sturdy residential electrical energy demand amid vacation gatherings.

EIA storage stories masking early January, nevertheless, might show “miniscule,” given climate forecasts and rebounding output, the Schork analysts mentioned.

Spot Costs Surge

Subsequent-day money costs spiked within the West on Tuesday amid a rash of winter climate. The storms weren’t anticipated to final lengthy, however within the rapid time period, they fueled sturdy demand from California via the Rocky Mountain area.

Within the Rockies, Northwest Sumas climbed $2.880 day/day to common $18.460, and Questar soared $4.080 to $21.500.

Farther west in California, SoCal Citygate surged $7.920 to $26.410, whereas SoCal Border Avg. superior $9.175 to $25.425.

AccuWeather meteorologists famous that heavy snow and blizzard situations wreaked havoc in components of the Rocky Mountains, northern Plains and Higher Midwest to start out the week. Greater than a foot of snow fell from Monday night time via Tuesday in components of the Dakotas, for instance, with stormy situations anticipated to proceed into Wednesday.

In some areas, freezing rain preceded snow on Tuesday.

The extreme climate menace might lengthen to the South and East, AccuWeather mentioned, within the type of thunderstorms and doable tornadoes.

The primary threats are highly effective wind gusts and flash flooding in areas of Kentucky and Tennessee in addition to components of Georgia and Florida, AccuWeather mentioned. Nevertheless, a number of of the strongest thunderstorms might produce tornadoes.

Within the Southeast on Tuesday, Florida Gasoline Zone 3 gained 10.0 cents to $3.685, and Transco Zone 4 gained 12.5 cents to $3.590.

Earlier within the week, messy storm programs first impacted California with flooding rains and mountain snow earlier than monitoring throughout the nation’s midsection, AccuWeather famous.

One other storm is anticipated to douse swaths of California on Wednesday and Thursday, possible inflicting flooding and, probably, mudslides.

“The slow-moving nature of the storm and its moisture will result in a number of hours of reasonable to heavy rain at low and intermediate elevations of California,” mentioned AccuWeather meteorologist Joe Lundberg.

[ad_2]

Source_link