[ad_1]

European Union (EU) members agreed Monday to create a worth management mechanism for pure fuel traded within the bloc after months of negotiation and debate on whether or not a coverage to guard towards market volatility may restrict a lot wanted LNG provide.

The vast majority of management from the 27-country EU agreed to institute what Czech Trade and Commerce Minister Jozef SÍkela referred to as a “dynamic” worth cap that might be triggered as quickly as Feb. 15. Adoption and clarifications for the coverage are anticipated to be finalized within the coming days, in accordance with the EU vitality ministry.

Beneath the agreed mechanism, a cap on fuel costs could be triggered by two occasions. The primary could be the month-ahead worth for the Dutch Title Switch Facility contract reaching above 180 euros/MWh, round $56/MMBtu, for 3 enterprise days. The second situation is triggered if the month-ahead worth is 35 euros/MWh, or round $11/MMBtu, above a reference worth for liquefied pure fuel on world markets for 3 enterprise days.

[Shale Daily: Including impactful news and transparent pricing for shale and unconventional plays across the U.S. and Canada, Shale Daily offers a clear snapshot of natural gas supplies for analysts, investors and global LNG buyers. Learn more.]

“At this level I want to underline that this proposal was by no means purely concerning the cap stage,” SÍkela stated at a Monday press convention. “It was additionally about ensuring the mechanism wouldn’t jeopardize the safety of provide or stability of economic markets.”

The coverage additionally contains emergency clauses to droop a worth cap if it negatively impacts Europe’s provide state of affairs, together with dropping the amount of traded contracts.

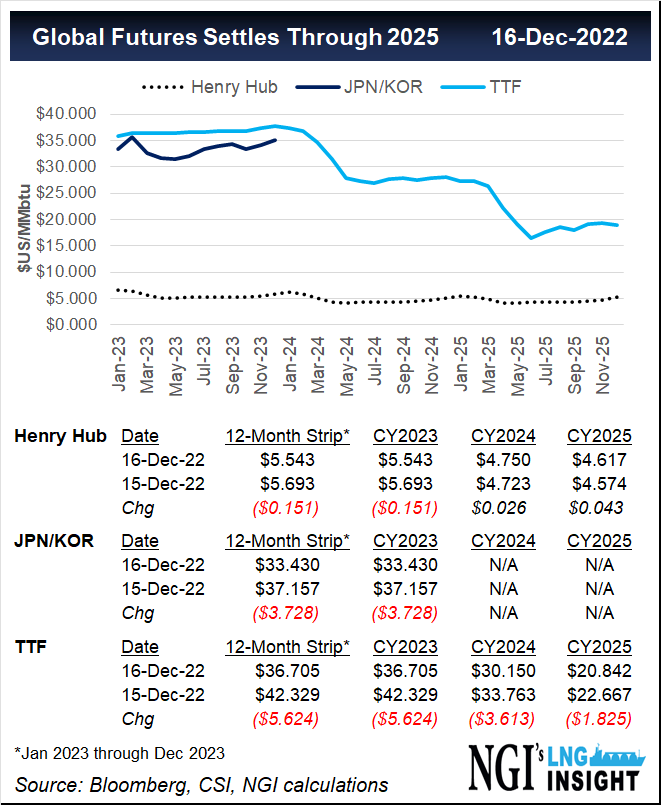

The TTF is Europe’s main fuel benchmark. The contract produces a each day settlement worth based mostly on transactions of consumers bodily shopping for and promoting pure fuel. It’s the world’s second most liquid pure fuel contract after the U.S.-based Henry Hub.

The immediate TTF closed at close to $34/MMBtu Monday, down roughly 6% from Friday’s shut because the assembly gave the market pause and a chilly snap eased. European fuel costs have been dropping because the starting of final week towards the bottom level in a month as merchants anticipate milder climate, in accordance with buying and selling agency EnergiDanmark.

The EU has been negotiating totally different iterations of proposals since late November as members weighed the advantages of stopping file excessive spikes for imported fuel with the chance of destabilizing fuel markets and threatening the bloc’s skill to maintain attracting LNG cargoes. Different members, reminiscent of Poland, have stated a mechanism is important to scale back Russia’s skill to stoke market volatility by withholding pipeline fuel to western European nations.

“On the latest conferences in Brussels, our majority coalition managed to interrupt the resistance – primarily from Germany,” Poland’s Prime Minister Mateusz Morawiecki wrote on Twitter. “This implies the tip of market manipulation by Russia and its firm Gazprom.”

Main worldwide fuel market companies and monetary establishments, together with Intercontinental Change Inc. (ICE), have warned potential market instability may pressure it to rethink the way forward for its substantial Netherlands market. ICE has grown to turn out to be a most popular bourse for the worldwide fuel commerce and the TTF is traded on the alternate.

In an announcement launched shortly after the EU resolution, representatives for ICE wrote that “TTF markets will proceed to be open for buying and selling as common” because it conducts a assessment of the brand new insurance policies.

“We now have persistently voiced our issues concerning the destabilizing influence a TTF worth cap may have available on the market and the dangers it presents to monetary stability,” ICE representatives wrote. “We’re reviewing the small print of the introduced market correction mechanism, its technical feasibility, the influence on monetary stability and whether or not ICE can proceed to function truthful and orderly markets for TTF from the Netherlands as per our European regulatory obligations.”

Supplemental critiques and evaluation of the coverage’s potential impacts are anticipated to be submitted to EU management by March. The European Fee can be anticipated to observe up with a whole assessment of the worth cap by November to find out if it was efficient or deserves renewal.

[ad_2]

Source_link