[ad_1]

Pure gasoline ahead positive factors had been widespread through the Dec. 8-14 interval as forecasts confirmed Arctic chills sweeping by the japanese two-thirds of the Decrease 48 heading into the again half of December. In the meantime, already-elevated western hubs noticed costs average, in accordance with NGI’s Ahead Look.

Because the market locked onto the approaching chilly blast and a looming spike in heating demand, Henry Hub mounted value forwards rallied 70.7 cents through the Dec. 8-14 interval to complete at $6.440/MMBtu. That set the tone for mounted value positive factors for many Decrease 48 hubs through the week.

The notable exceptions had been out West, the place mounted costs remained elevated however declined sharply week/week. Malin January mounted costs tumbled $5.622 to $13.287 through the interval.

Nymex futures, in the meantime, typically strengthened through the interval, buoyed by the prospect of a flip towards a lot chillier temperatures following underwhelming weather-driven demand to open December. The January Nymex contract rallied 54.0 cents Thursday to settle at $6.970.

Moderating forecast tendencies for temperatures through the remaining days of 2022, nevertheless, despatched the entrance month retreating Friday, with January in the end dropping 37 cents to settle at $6.600.

Western Foundation Moderates

When it comes to regional foundation shifts, the most important swings occurred within the western Decrease 48 through the Dec. 8-14 interval, Ahead Look knowledge confirmed. In California, PG&E Citygate January foundation shed $5.999 to finish at plus-$8.007. SoCal Citygate entrance month foundation dropped $5.037 to finish at a $10.259 premium to Henry Hub.

Elevated bodily pricing in California this month displays “a poorly-timed spike in demand, alongside upstream provide worries as we head into the thick of the winter season,” Wooden Mackenzie analyst Quinn Schulz advised purchasers in a current observe.

Latest attracts have left inventories on each the PG&E and Southern California Fuel programs lagging the prior five-year common, the analyst mentioned.

“Latest upstream constraints additionally assist to additional tighten the area,” Schulz mentioned. “The primary and most long-term constraint is a barrage of upkeep occasions” on the North Mainline of the El Paso Pure Fuel (EPNG) system. “These occasions have collectively lower westbound flows by 277 MMcf/d since Nov. 28 and can final till the top of December.

“…Given these circumstances, unanswered questions in regards to the return-to-service date for EPNG’s Line 2000 are additional dampening confidence in California’s winter provide.”

The Vitality Data Administration (EIA) Pacific area withdrew 14 Bcf from storage for the week ending Dec. 9, leaving stockpiles within the area at 203 Bcf. That’s a 26.4% deficit to the five-year common of 276 Bcf, EIA knowledge present.

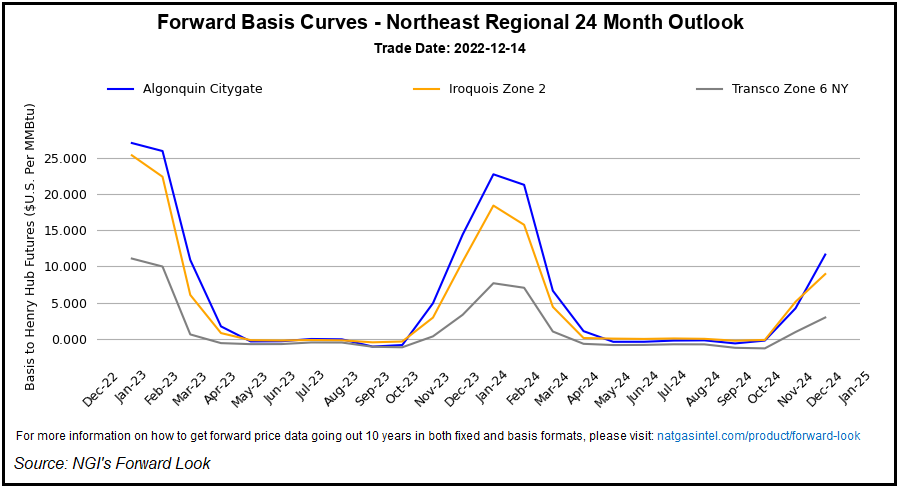

In the meantime, foundation strengthening was widespread alongside the East Coast through the Dec. 8-14 interval as merchants assessed the impacts of what’s shaping as much as be a frigid stretch for the japanese Decrease 48 heading into the Christmas vacation.

The newest six- to 10-day forecast (Tuesday by Dec. 24) from Maxar’s Climate Desk Thursday confirmed an “Arctic air mass settling” into the central Decrease 48 “through the early half earlier than increasing additional south and eastward from mid to late interval. Temperatures are strongly under regular in affiliation.”

The 11- to 15-day interval (Dec. 25-29) was anticipated to hold over “widespread a lot and powerful belows within the Japanese Half. Belows wane over the course of the interval as aboves increase within the West,” in accordance with the forecaster.

Transco Zone 5 January foundation surged $2.730 increased week/week, ending at a $11.121 premium to Henry Hub. Cove Level jumped $2.730 to plus-$11.178.

Farther north in New England, hubs maintained or added to already hefty January premiums. Tenn Zone 6 200L completed at plus-$27.018, a 79.3-cent acquire week/week, Ahead Look knowledge confirmed.

‘Somewhat Intimidating’ Chilly

The newest EIA report Thursday revealed a lighter-than-average web 50 Bcf withdrawal from U.S. pure gasoline storage for the week ending Dec. 9, although merchants are prone to be extra thinking about how inventories fare with late December chilly.

“The market has appeared reticent following current high-profile forecast busts,” EBW Analytics Group LLC analyst Eli Rubin advised purchasers. “If the chilly blast delivers, nevertheless, 225 Bcf-plus weekly storage attracts may ship January capturing increased.”

Nonetheless, within the larger image, a chilly blast to shut out 2022 is unlikely to usher in urgent storage adequacy considerations, in accordance with the analyst.

“On a seasonal foundation, the winter storage trajectory seems enough, and downward stress on Nymex futures may resume as quickly because the market can see by the upcoming chilly blast to hotter temperatures forward,” Rubin mentioned.

Noon climate knowledge from the American mannequin trended colder Thursday, together with by suggesting frigid temperatures can be “slower to erode or average” through the Dec. 27-30 time-frame, in accordance with NatGasWeather.

“Most significantly, the noon knowledge remained impressively chilly” beginning over the weekend and persevering with by the upcoming week “as a number of frigid pictures sweep throughout the U.S.,” the agency mentioned. “…The primary in a collection of frigid blasts will sweep throughout the U.S. this weekend” with lows starting from under zero to the 20s over the northern Decrease 48 and within the teenagers to 30s farther south, sufficient to drive “sturdy nationwide demand.”

Subsequent “reinforcing Arctic blasts” set to reach within the week forward appeared “quite intimidating” within the newest forecasts, NatGasWeather added. They’re anticipated to ship extraordinarily frigid circumstances for the Midwest and Plains earlier than the chilly would unfold farther south and to the east.

Not solely are rising diploma day totals supportive for pure gasoline demand, the chilly may additionally issue into the availability image, analysts at Tudor, Pickering, Holt & Co. (TPH) advised purchasers Friday.

“Outdated Man Winter seems on the verge of impacting the availability aspect of the equation as properly, with provide edging towards the 98 Bcf/d vary yesterday from flows above 100 Bcf/d earlier within the week,” the analysts mentioned.

In gentle of the extraordinary chilly within the outlook, which prompted the Texas Railroad Fee to ship out a winter climate advisory to operators, “we suspect volumes throughout numerous core basins might be on the decline within the coming days,” the TPH analysts mentioned.

Freeport Restarts When?

In the meantime, as residential/business demand is about to rise sharply into late December, the timing of the Freeport LNG terminal’s return to service stays a “essential basic piece of the demand equation,” in accordance with Rystad analyst Ade Allen.

Latest information of a prolonged request for info from federal regulators directed on the Freeport LNG terminal “has added to hypothesis that the timeline may doubtlessly shift once more,” the analyst added.

Even so, “the present short-term climate forecast is powerful sufficient to offset the dearth of exports and supply buoyancy to the general winter demand image,” in accordance with Allen.

[ad_2]

Source_link