[ad_1]

After 5 straight days in optimistic territory, pure gasoline bulls could wrestle to maintain momentum going amid continued climate mannequin volatility. Although they managed to eke out one other substantial value enhance on Tuesday, hotter developments within the climate fashions took a hatchet to early positive aspects. The Nymex January gasoline futures contract reached a $7.105 intraday excessive however finally settled at $6.935/MMBtu, up 34.8 cents on the day.

At A Look:

- Newest mannequin runs heat barely

- Freeport LNG chatter returns

- California utilities warn of upper costs

Spot gasoline costs additionally moved up sharply on Tuesday, with ongoing chilly climate and provide constraints fueling a surge to $75.00 in Northern California. NGI’s Spot Gasoline Nationwide Avg. jumped $2.365 to $14.000.

After pummeling the West Coast, a significant winter storm is anticipated to dump greater than two toes of snow in components of the central United States this week. The accompanying spike in heating demand has stored merchants on edge awaiting readability on extra chilly blasts anticipated to blanket the Decrease 48 starting subsequent week. Up to now, the fashions have been uneven, trending colder or hotter every day.

As of noon Tuesday, the World Forecast System mannequin remained the coldest, nevertheless it shed a handful of heating diploma days (HDD) to align higher with the European mannequin, in response to NatGasWeather. The forecaster mentioned the primary in a collection of frigid blasts is anticipated to brush throughout the US this weekend. In a single day lows may plunge greater than 10 levels under zero throughout the northern half of the nation and into the higher teenagers in Texas and the South.

Whereas this might seemingly end in sturdy nationwide demand, NatGasWeather identified that the information aren’t not fairly as chilly as they’d been. That mentioned, the fashions remained impressively chilly with an Arctic blast hitting the Decrease 48 subsequent Wednesday by way of Christmas Day (Dec. 21-25), that may ship in a single day temperatures within the Midwest and Plains greater than 20 levels under zero. The agency cautioned, although, that developments as soon as seen as bullish late within the 15-day outlook have had the tendency to heat as they roll into the entrance of the forecast.

As such, the system wants shut monitoring since there’s potential the Arctic entrance advances deep into the southern United States, notably Texas, NatGasWeather mentioned. The forecaster famous that grid stability within the Electrical Reliability Council of Texas (ERCOT) may very well be in play given the crippling chilly.

ERCOT mentioned final month it was ready to satisfy peak winter demand of almost 67.4 GW after “landmark reliability reforms” following Winter Storm Uri. It’s anticipated to have 87.3 GW of sources out there from December-February.

In the meantime, Mobius Threat Group mentioned HDDs are anticipated to be greater than 60 increased than the 30-year norm — to not point out greater than 140 increased than a yr in the past. As such, there’s a sturdy chance that 2022 will finish with lower than 3 Tcf in storage.

“This needs to be seen as a key threshold because it has solely occurred twice in trendy historical past,” Mobius senior analyst Zane Curry mentioned.

Notably, the present forecast for subsequent week carries the potential to ship a storage withdrawal of greater than 200 Bcf main as much as the Christmas/New 12 months vacation, in response to Mobius. This has not occurred since 2017. Solely 4 withdrawals of 200 Bcf or extra have been reported within the month of December up to now decade.

“This is able to even be one thing for the market to strongly take into account, notably if climate forecasts fail to surrender the supply of Arctic air earlier than yr finish,” Curry mentioned.

After all, the market additionally continues to search for clues as to when Freeport LNG could return. The liquefied pure gasoline exporter has focused late December for a restart of its terminal on the higher Texas coast.

On Tuesday, it caught to that timeline even after FERC despatched a 16-page letter asking it to deal with dozens of points earlier than operations can resume. The Federal Power Regulatory Fee despatched two separate paperwork requesting info on 64 questions, solely considered one of which was made out there to the general public due to safety causes.

The questions had been developed with the Pipeline and Hazardous Supplies Security Administration and the U.S. Coast Guard after a go to in late November. The questions additionally included follow-ups to info supplied by Freeport since a June explosion knocked it offline.

Chilly Lifts Money To New Highs

Spot gasoline costs had been on the transfer throughout the nation on Tuesday, with West Coast costs returning to the $50-plus ranges seen late final week and dwarfing what usually could be thought-about substantial value will increase on the East Coast.

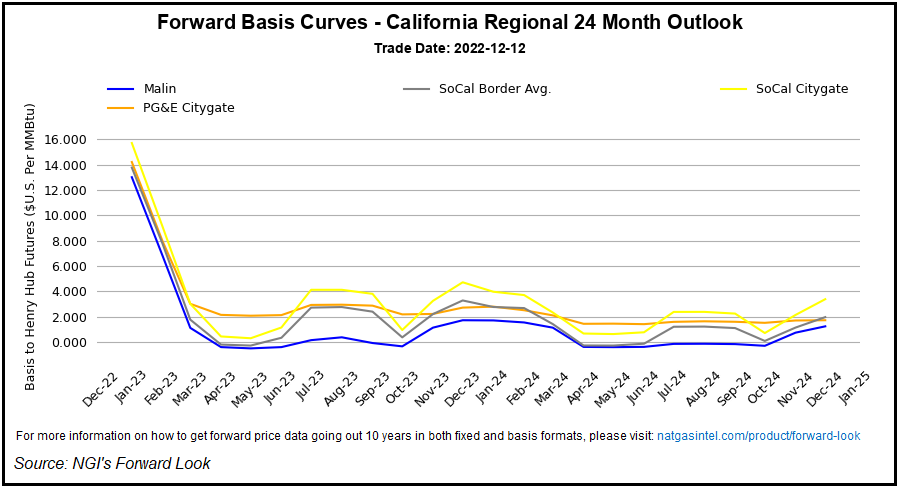

In opposition to a backdrop of low storage inventories, heightened demand and pipeline points, PG&E Citygate next-day gasoline traded at a $75.00 excessive for Wednesday’s gasoline day. The Northern California location finally averaged $48.170, up $9.580 on the day.

SoCal Citygate climbed $6.710 to common $49.67.

Comparable value spikes had been seen all through the West, with some notable exceptions that posted even stronger positive aspects. Kingsgate money was up $23.525 day/day to common $47.50, and Questar was up $7.070 to $30.795. It traded as excessive as $43.800.

The West is anticipated to see the frigid situations which have blanketed the area for weeks proceed for one more week and a half. Starting subsequent week, although, temperatures are forecast to thaw, providing some a lot wanted aid to the area. Costs ought to observe swimsuit.

That mentioned, San Diego Gasoline & Electrical (SDG&E) despatched direct emails to prospects this week maintaining them apprised of the varied points which have performed a job within the unprecedented value spikes. Referencing NGI’s story on the state of affairs, SDG&E mentioned between November and December, the residential pure gasoline fee jumped by 19% as a result of the commodity value for pure gasoline climbed considerably.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

Based mostly on the newest market dynamics, present forecasts point out that costs may go even increased into January when the climate within the area is usually the coldest and gasoline utilization is mostly the very best. This probably may put extra upward stress on prospects’ payments, in response to SDG&E.

“SDG&E stays dedicated to working with our prospects as costs for quite a lot of items and providers, together with pure gasoline, proceed to surge throughout the nation,” mentioned SDG&E’s Dana Golan, vp of buyer providers. “It’s essential that we assist prospects put together as a lot as potential for colder climate and better winter vitality payments and that we offer entry to monetary help.”

Elsewhere throughout the Decrease 48, large positive aspects had been seen on the East Coast because the storm system hitting the Midwest shifts east. AccuWeather mentioned the storm may hit close to southeastern Virginia on Thursday and observe off the New Jersey coast on Friday. From there, it’s anticipated to spin close to southeastern New England by Saturday.

The positioning of the storm would enable chilly air from Canada to be pulled south into the Northeast and assist produce a widespread snowfall for a big a part of the area, in response to AccuWeather meteorologist Mary Gilbert. At this early stage, “the best likelihood of six inches or extra of snow might be from close to and north of Interstate 80 in Pennsylvania, north by way of upstate New York and in central and northern New England,” she mentioned.

Not solely does the storm have the potential to supply heavy snow, however in some places from Pennsylvania to New England, snow may fall for greater than 24 hours, in response to AccuWeather. The storm’s gradual motion is seen rising the potential for a foot or extra of snow to fall from east-central New York to the ski nation of northern New England.

The approaching chilly blast despatched spot gasoline costs on the risky Algonquin Citygate climbing $2.610 to common $21.515 for Wednesday. Transco Zone 6 NY picked up $2.200 to common $11.690.

The very best value upstream in Appalachia was seen at Texas Japanese M-3, Supply, which rose $2.650 day/day to $11.555.

[ad_2]

Source_link