Fallout from Russia’s invasion of Ukraine is being felt throughout all transport markets, however none extra so than liquefied pure fuel (LNG) transport. Penalties to this transport phase have been quick, sweeping and probably everlasting.

Historically, about 30% of U.S. LNG exports has gone to Europe. The vacation spot combine has dramatically modified. Over the previous two months, round 70% of U.S. LNG goes to Europe, in response to Evercore ISI analyst Sean Morgan.

Ship-position information from MarineTraffic exhibits an armada of ships stuffed with U.S. LNG now en path to Europe. Solely a small minority of U.S. cargoes are destined for Asia.

“The not too long ago introduced EU vitality provide reconfiguration could possibly be the most important change in European vitality consumption because the finish of the Second World Struggle,” stated Morgan in a presentation to buyers final week.

The European plan — which assumes continued entry to Russian provide through the transition — requires 70% of pure fuel imports from Russia to get replaced and for the EU to extend its LNG imports by 4.8 billion cubic ft (Bcf) per day over the following 12 months. Morgan identified that that is the equal of over a 3rd of America’s complete export capability.

Extra vacation spot flexibility

U.S. LNG exports have far more vacation spot flexibility than exports from Qatar and Australia, making America one of the best supply of quick alternative provide for Europe. Even so, American volumes gained’t suffice if Europe loses entry to Russian pipeline provide. “There isn’t sufficient seaborne fuel accessible to exchange Russian volumes,” wrote Morgan.

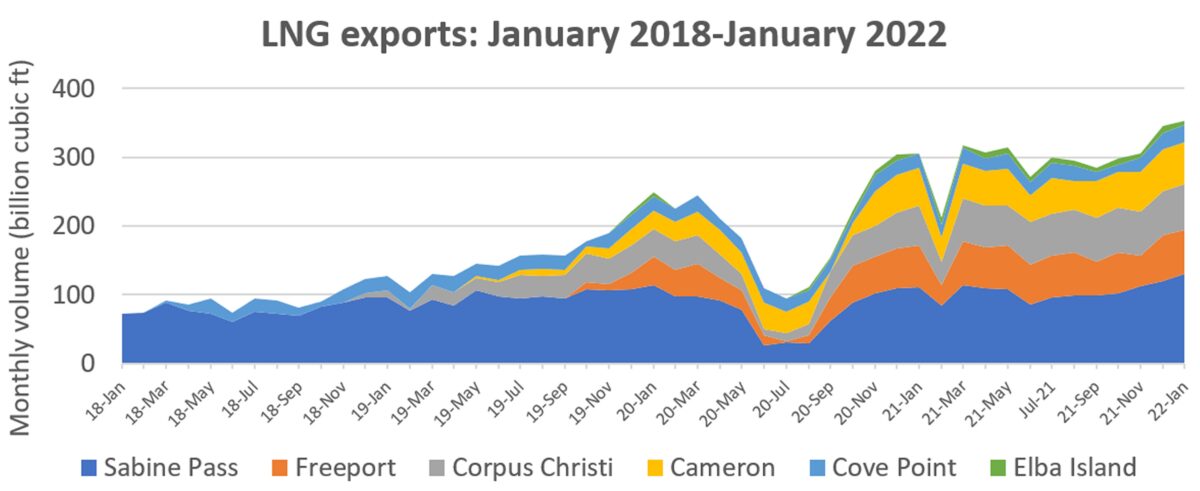

U.S. LNG exports are hitting new data every month, with terminals delivering volumes at or past their nameplate capacities. Exports reached 353.5 Bcf in January. RBN Power predicted that exports will submit one other report this month, given a brand new export practice at Cheniere’s Sabine Cross facility and the startup of the brand new Calcasieu Cross export plant.

Final week, the Biden administration gave Cheniere (NYSE: LNG) authorization to ship extra volumes from its Sabine Cross and Corpus Christi amenities to nations that don’t have free commerce agreements with the U.S., together with all of Europe. The U.S. Power Data Administration now predicts that U.S. LNG imports will improve by 16% in 2022 versus 2021.

Increased demand from Europe might spur extra ultimate funding selections on extra U.S. liquefaction capability. Morgan referred to as the Russian invasion of Ukraine a “huge alternative for U.S. LNG export growth plans.”

LNG transport charges

Regardless of the armada of ships stuffed with U.S. LNG headed to Europe, spot charges for LNG carriers should not unusually excessive.

In response to Clarksons Platou Securities, spot charges for tri-fuel, diesel engine (TFD) LNG carriers have been at $42,500 per day on Monday. That’s effectively above the mid-February low of $25,000 per day, however in step with the 2017-21 common for this time of 12 months.

LNG transport is primarily a long-term contract market, not a spot enterprise. “The spot market stays skinny,” stated Clarksons, which famous that “the time period constitution market continues to be energetic,” with fashionable TFDE carriers signing 12-month offers for $115,000 per day.

If the Russian invasion of Ukraine pushes extra U.S. LNG to Europe as an alternative of Asia on a sustained foundation, that’s not constructive for spot charges. Given the a lot shorter crusing distance, the U.S.-Europe commerce requires much less ship capability than the U.S.-Asia commerce.

Spot charges attain exceptionally excessive peaks at occasions when Asian LNG costs are considerably greater than European LNG costs. That pricing hole attracts extra U.S. LNG cargoes to Asia as an alternative of Europe, and compels merchants to re-export LNG from Europe to Asia. The extra Atlantic-to-Pacific cross-basin commerce, the upper the voyage distances, the transport demand and the spot charges. In distinction, the battle with Russia has saved European LNG costs excessive, curbing common voyage distance.

Click on for extra articles by Greg Miller

Associated articles:

[ad_2]

Source_link