[ad_1]

Ofgem dangers stifling innovation and stopping vitality corporations from making a revenue in its makes an attempt to scrub up the trade, warned the boss of Utilita Vitality.

Chief govt Invoice Bullen informed Metropolis A.M. the watchdog must “be part of the dots” between its varied insurance policies, slamming its choice to impose capital adequacy necessities whereas sustaining the restrictive vitality worth cap.

He argued Ofgem’s insurance policies danger benefitting the largest gamers within the trade forward of challengers with inventive propositions to supply to the market.

This might result in challenger suppliers being squeezed out of the trade.

Bullen stated: “This newest spherical of capital adequacy simply doesn’t chime with the value capping regime that they’ve put in place until after all you’re Centrica or EON or Scottish Energy or EDF. These are huge vitality corporations. They’re arising with a algorithm during which solely the large ones can survive.”

The vitality boss famous that the most recent market information recommend corporations had been making a lack of one per cent throughout their buyer bases, on common, despite the fact that the value cap was supposed to permit as much as 1.9 per cent of revenue inside its margins.

He defined: “I don’t see how what we’re doing now’s going to encourage innovation or allow it as a result of there’s no revenue margin to go for.”

The present massive six may have a 90 per cent maintain of the vitality market, if Octopus’ takeover of Bulb is greenlit, in line with current calculations from Cornwall Perception.

He believed the cap had restricted funds flowing into the trade since its introduction 5 years in the past, pre-dating the vitality disaster, and meant “none of us have gotten capital to enhance innovation and to enhance our effectivity.”

Bullen feared the scenario would now be exacerbated by Ofgem’s newest calls for for commitments to guard capital to shore up the solidity of suppliers.

He stated: “There may be completely no case for funding within the vitality provide market in the meanwhile as a result of clearly everyone’s shedding cash and clearly everyone seems to be massively in danger. So, what’s the funding case? You possibly can’t enhance your steadiness sheet by gaining extra funding. The one manner you possibly can do it could be by retaining income, if you happen to may make some, and constructing it up that manner.”

Utilita is residence to round 850,000 prospects – with the overwhelming majority signing as much as pre-paid and pay-as-you-go fashions.

The corporate’s emphasis, since its founding in 2005, has been on encouraging individuals to responsibly minimize vitality utilization to assist drive down payments and attain the UK’s local weather objectives.

He additionally criticised Ofgem’s newest report card on the efficiency of suppliers, which outlined that Utilita had “extreme weaknesses” in the way it dealt with susceptible prospects.

Bullen stated: “We predict that examine doesn’t in any manner mirror the place we’re as a enterprise. In the event you have a look at stuff that’s within the public area, for instance, the stuff that’s in our app in a digital area, it doesn’t mirror actually what Ofgem sees.”

When approached for remark, Ofgem argued permitting suppliers to make use of a few of their buyer credit score balances for innovation, working money and hedging however not for riskier spending liking funding unsustainable development, was the suitable steadiness.

A spokesperson stated: “Ofgem’s precedence is to guard customers and we proceed to carry suppliers to account to make sure they’re delivering the very best service for his or her prospects.

“We work intently with suppliers and we additionally perceive the pressures they’re dealing with on account of excessive vitality costs. We imagine our choices ship the suitable steadiness and each defend shopper pursuits whereas additionally being honest for suppliers.

Utilita unveils white paper to guard households

Bullen was talking to Metropolis A.M. forward of the launch of its white paper as we speak, outlining measures to keep away from extra deaths this winter from hovering vitality payments and chilly climate.

The white paper, submitted to each the Authorities and Ofgem, requires an pressing intervention to keep away from extra winter deaths related to vitality self-disconnection

Utilita warns that 2.25m pay-as-you-go (PAYG) households with out digital connectivity and good meters are liable to self-disconnecting in silence, with no assist from their suppliers.

The vitality agency has known as for 5 measures to alleviate the disaster this winter together with good installations in households and eradicating standing costs from PAYG prospects.

It desires the Authorities and the broader trade to clamp down on stopping misinformation, finish the stigma over PAYG to make sure prospects who want the service use it, and for suppliers to work extra intently with the Division for Work and Pensions and BEIS to assist scale back self-disconnecting.

The vitality boss famous that even with the heavy subsidies inside the Vitality Worth Assure, many households would wrestle to pay their vitality payments over the winter months.

He stated: “We’re at £2,500 per 12 months for the typical invoice which compares £1,000 earlier than this disaster began. We’re two and a half occasions dearer. That’s the issue. That’s what’s inflicting individuals issue.”

Bullen praised the Authorities’s current embrace of vitality effectivity measures – with Chancellor Jeremy Hunt concentrating on a 15 per cent minimize in vitality utilization.

The Authorities rolled out an extra £1bn to spice up insulation earlier this week, on high of £6bn pledged from 2025 to ramp up the vitality effectivity of British properties.

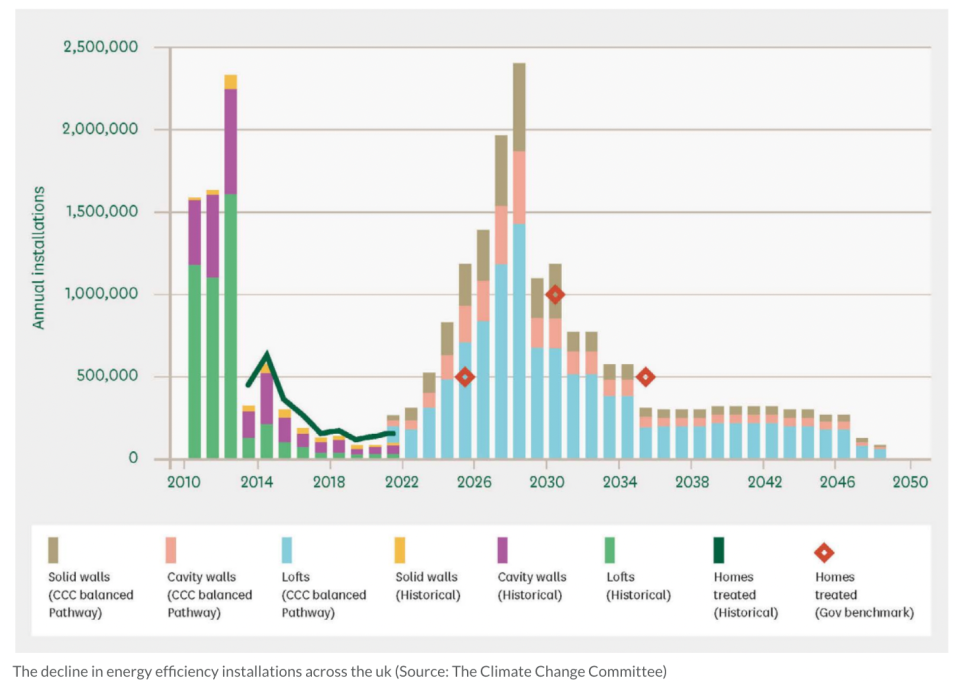

Set up charges throughout the UK have dropped sharply prior to now decade from over two million properties per 12 months to only tens of 1000’s after former Prime Minister David Cameron slashed earlier effectivity schemes within the mid-2010s – as revealed within the BEIS Choose Committee report on vitality pricing earlier this 12 months.

Presently only one third of UK properties have an vitality efficiency certificates score of C or above – the minimal requirements the Authorities has set for home households by 2035.

This implies an estimated 19m properties want retrofitting – with a examine from EDF and Sprift earlier thuys 12 months revealing the insulation age of UK properties to be at the very least 46 years previous.

The vitality big surveyed 2,000 UK householders, which indicated greater than than half (58 per cent) the nation’s households solely meet the insulation requirements of 1976 or earlier than.

Bullen argued that bettering the vitality effectivity of individuals’s properties alongside measures to cut back utilization would considerably decrease the UK’s reliance on imports of gasoline from Norway and LNG from the US at premium costs.

He stated: “Lastly the Chancellor of the Exchequer has labored out that truly saving vitality is a very good factor to do when it comes to defusing the entire hurt that Putin is perhaps making an attempt to do by proscribing gasoline provides to Western Europe. Nevertheless it’s additionally a great factor for individuals to do, due to the price of residing.”

[ad_2]

Source_link