[ad_1]

| A liquefied pure fuel tanker docks at an import terminal within the Netherlands. Supply: Mischa Keijser/Getty Inventive through Getty Photographs |

A wave of current contracting bulletins has kicked off the following cycle of constructing multibillion-dollar U.S. liquefied pure fuel export services. The surge reveals little signal of slowing within the second half, as two initiatives superior to development on the Gulf Coast.

The nation’s largest LNG exporter, Cheniere Vitality Inc., commercially sanctioned a midscale growth of its Corpus Christi LNG terminal in late June that may add roughly 10 million tonnes per yr of LNG manufacturing capability to the Texas facility.

Weeks earlier, Enterprise International LNG made a last funding resolution to construct its second U.S. LNG export facility — the 20-Mt/y Plaquemines LNG undertaking in Louisiana. These initiatives alone replicate a serious buildout of U.S. export capability, including as much as roughly a 3rd of the prevailing U.S. capability. However sector consultants extensively consider that these is not going to be the final U.S. LNG initiatives that advance to development over the following yr.

The query is who can be subsequent among the many backers of a dozen or so different initiatives making an attempt to construct enough business help to safe financing.

“You might be nonetheless in an setting the place you may get issues accomplished — it is constructive, nevertheless it’s aggressive,” mentioned Michael Webber, an impartial LNG analyst and managing companion of funding analysis agency Webber Analysis & Advisory. “A number of these should stick round for the following cycle.”

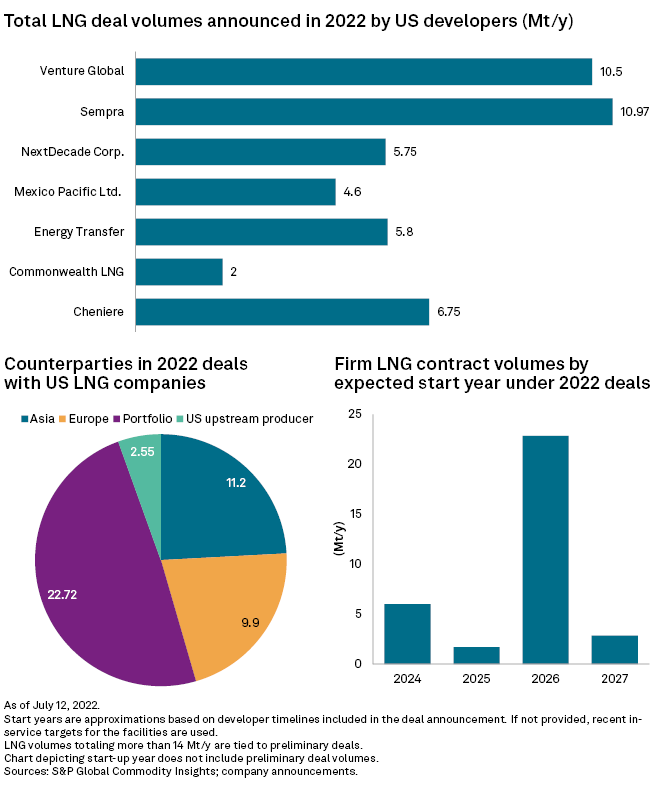

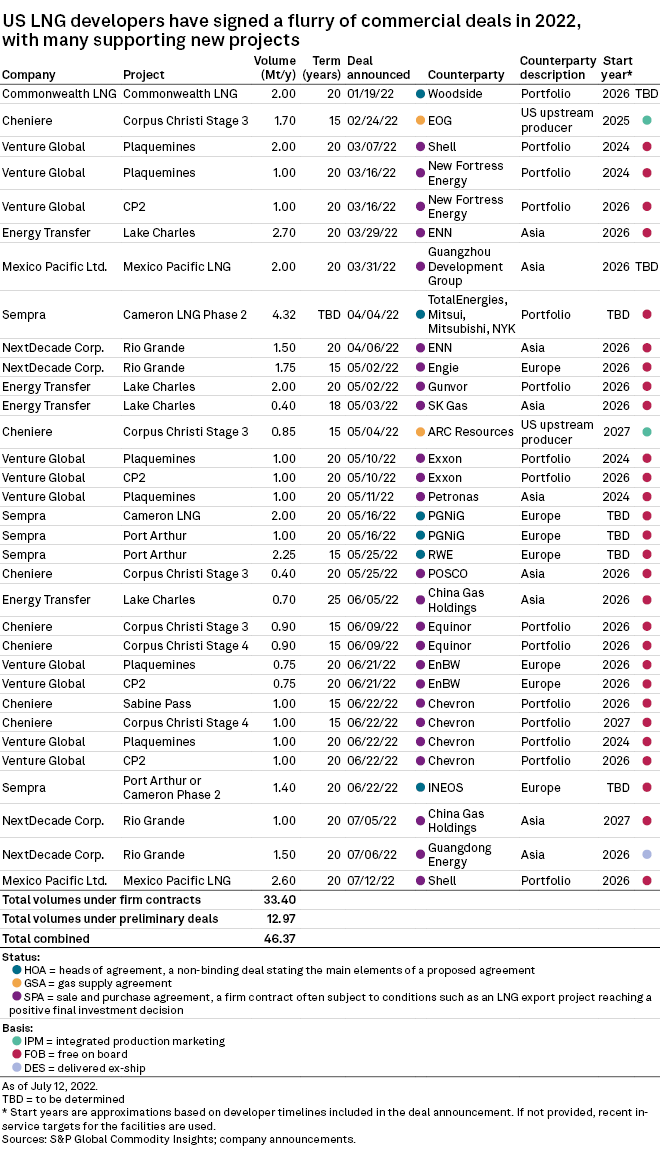

Cheniere and Enterprise International secured long-term contracts to advance to development as surging pure fuel costs overseas spurred rising purchaser demand for American fuel provides, particularly because the conflict in Ukraine raised fears of provide disruptions. A number of different U.S. LNG builders additionally benefited from the excessive quantity of business exercise in 2022. Greater than 33 Mt/y value of binding long-term agreements tied to U.S. LNG initiatives have been signed since Russia invaded Ukraine on Feb. 24. U.S. builders have secured about one other 13 Mt/y value of preliminary offers in 2022.

The invasion prompted a scramble by European patrons to shore up new LNG volumes. Excessive costs and safety provide issues additionally spurred different patrons to decide to new long-term provides in 2022, together with volumes from proposed U.S. initiatives that buyers had thought of useless only a yr earlier. Prospects in Asia and enormous portfolio merchants have accounted for many of the contracting exercise with U.S. builders year-to-date.

Webber’s analysis agency expects that two or three extra U.S. initiatives have likelihood of getting commercially sanctioned throughout this development cycle. However the agency has additionally cautioned about rising development dangers due to components akin to inflationary pressures on international provide chains and a possible contractor crunch.

S&P International Commodity Insights analysts lately predicted that U.S. LNG export capability will attain 21.7 Bcf/d by the top of 2027, an 84% improve from present ranges. How rapidly new initiatives can come on-line can be a key difficulty for a worldwide fuel market going through a provide shortfall headed into the mid-2020s.

An early June fireplace on the Freeport LNG Improvement LP export terminal in Texas highlighted the delicate state of world fuel provide and jolted market contributors. U.S. LNG exports had averaged about 12.5 Bcf/d earlier than the Freeport shutdown however will seemingly common nearer to 11 Bcf/d so long as the ability is offline.

The next is a compilation of updates to main U.S. LNG export initiatives in current months.

Cheniere eyes additional growth

Cheniere Vitality collected a sequence of long-term contracts to help the Corpus Christi growth. This consists of some offers with LNG tied to Cheniere commercially sanctioning a possible additional growth of the Texas facility past the seven trains that lately superior to development. Cheniere additionally operates the Sabine Go LNG terminal in Louisiana, the nation’s largest export facility.

Enterprise International pursues low-cost method

Enterprise International, which has been one of many main beneficiaries of the contracting wave, used modular trains at its flagship Calcasieu Go terminal in Louisiana to chop prices and start manufacturing months sooner than initially anticipated. The liquefaction trains have been in-built Italy, shipped to the location and put in.

Enterprise International has taken an identical method with its different LNG initiatives, together with the Plaquemines undertaking that it expects to start out transport LNG in 2024.

In addition to Calcasieu Go and Plaquemines, Enterprise International has purposes pending at FERC for 2 extra Louisiana export terminals: the as much as 28-Mt/y CP2 LNG undertaking and the as much as 24-Mt/y Delta LNG undertaking.

New Fortress pitches ‘quick’ floating LNG items

New Fortress Vitality Inc. filed allow purposes in March for a pair of 1.4-Mt/y liquefaction items that the LNG developer needs to construct off the coast of Louisiana. The corporate mentioned the development timeline for the services from engineering to commissioning is between 18 and 20 months — a lot sooner than new onshore export services — and that the initiatives might serve LNG demand as quickly as 2023.

New Fortress mentioned in Could that it deliberate to file allow purposes quickly for six fuel liquefaction services off the Texas coast that will use the identical 1.4-Mt/y design.

Freeport seeks late 2022 restart

Freeport mentioned it hopes to renew full operations of its three-train 15-Mt/y facility in late 2022 after getting the mandatory approval from federal regulators. Within the meantime, the corporate mentioned it’s nonetheless advertising LNG tied to a proposed fourth 5-Mt/y practice, which it expects to commercially sanction in early 2023.

Sempra indicators early offers

Sempra has signed a sequence of preliminary offers supporting a 6.75-Mt/y single-train growth of its Cameron LNG terminal in Louisiana and its as much as 13.5-Mt/y Port Arthur LNG export undertaking in Texas. The corporate’s most up-to-date investor presentation in early Could mentioned the timeline for finishing the initiatives has but to be decided.

Sempra’s high precedence amongst LNG initiatives stays to construct its $2 billion Energía Costa Azul terminal on the west coast of Mexico each on time and on finances. The corporate deliberate for the two.5-Mt/y facility to start out producing LNG in 2024.

Mexico Pacific Ltd. traces up contracts

Mexico Pacific Ltd. LLC has continued to line up binding 20-year off-take agreements tied to its proposed export terminal on the Sea of Cortez in Mexico as the corporate nears its September goal for commercially sanctioning the primary two trains of the undertaking, with a mixed 9.4-Mt/y manufacturing capability. The undertaking would use U.S. feedgas, and the corporate has additionally proposed a 3rd 4.7-Mt/y practice.

NextDecade builds business momentum

NextDecade Corp.’s Rio Grande LNG export undertaking stays within the FERC allowing course of on a number of fronts, together with a request for a two-year extension of a November 2026 deadline for finishing the undertaking. However regulatory hurdles haven’t prevented NextDecade from signing long-term contracts with LNG patrons, together with coveted clients in China.

The developer mentioned in a June investor presentation that it’s focusing on a last funding resolution by the top of 2022 on the primary section, which would come with two trains able to producing 11 Mt/y earlier than an growth of as much as 27 Mt/y.

Lake Charles LNG makes contracting strides

Vitality Switch LP introduced a sequence of agency off-take offers tied to the Lake Charles facility after a two-year lull in business exercise that adopted Shell PLC’s resolution in March 2020 to tug out of the undertaking.

The developer has described these business strides as supporting its objective of reaching a constructive last funding resolution on the undertaking in 2022, with first LNG deliveries anticipated as early 2026. Vitality Switch mentioned it’d cut back the scale of the undertaking from a three-train, 16.45-Mt/y facility to a two-train, 11-Mt/y facility.

Tellurian in financing talks

Tellurian Inc. mentioned it’s in financing talks after securing sufficient business help to achieve a last funding resolution on Driftwood LNG in Louisiana, which might produce about 11 Mt/y earlier than increasing as much as 27.6 Mt/y. The developer in late March gave the go-ahead to its contractor to start out restricted development of the primary section of the LNG undertaking.

Tellurian advancing Driftwood to development would mark a brand new method for creating a U.S. LNG undertaking. The corporate’s technique of utilizing 10-year buyer contracts to cowl the primary section of the undertaking is a departure from the standard method to undertaking financing for LNG initiatives, which have usually had a compensation interval exceeding 10 years.

Golden Go tries to ramp up development

The 18.1-Mt/y Golden Go LNG Terminal is beneath development in Texas and scheduled to start out operations in 2024. The developer has expressed issues that federal allowing snags might delay the undertaking, whereas a request to usher in extra employees to construct the ability is pending.

Delfin broadcasts deal

FERC in January 2022 granted the developer of the Delfin LNG LLC terminal a one-year extension to assemble related onshore services after it struggled to safe enough business help. Delfin mentioned July 13 that it signed a long-term contract with Vitol Inc. protecting 0.5 Mt/y of capability.

Commonwealth LNG awaits allow

Commonwealth LNG LLC hopes to commercially sanction its 8.4-Mt/y undertaking in Louisiana in 2023. The developer utilized for a federal Pure Fuel Act allow in August 2019, and the undertaking is progressing by means of the FERC approval course of.

Alaska LNG undertaking in limbo

The proposed 20-Mt/y Alaska LNG export terminal has confronted persistent difficulties that embrace bother securing clients and a excessive price ticket of about $38.7 billion, even after cost-cutting efforts.

The state-run Alaska Gasline Improvement Corp. has labored to shore up the credentials of the undertaking, which the state would flip over to non-public pursuits after getting a federal mortgage assure that might decrease the price of debt.

S&P International Commodity Insights produces content material for distribution on S&P Capital IQ Professional.

[ad_2]

Source_link