Liquefied pure fuel delivery has a freight market like some other, albeit with much more zeros on the top of its numbers. Day charges in LNG delivery are within the six figures. Income on a single cargo may be within the 9 figures.

“Welcome to the stratosphere of LNG costs,” commented Stifel analyst Ben Nolan on in the present day’s market circumstances.

The European hub value of pure fuel, TTF, hit $84 per million British thermal models (MMBtu) on Monday. “That is near $500 per barrel of oil equal,” famous Oystein Kalleklev, CEO of shipowner Flex LNG (NYSE: FLNG), throughout a convention name on Wednesday.

In LNG buying and selling, it’s all concerning the arbitrage. The landed value for LNG in Europe was $60 per MMBtu on Monday. The natural-gas hub value in Asia, JKM, was at $61 per MMBtu. The U.S. value, Henry Hub, was at $10.

At present fuel costs and delivery charges, Flex LNG estimated {that a} single shipload (172,000 cubic meters) of U.S. LNG might be transported to Asia and bought for an arbitrage revenue of $204 million. A U.S. cargo bought in Europe may carry a revenue of $201 million.

“Though the Henry Hub is at a 14-year excessive, it’s immensely worthwhile to maneuver these cargoes to both Europe or Asia,” stated Kalleklev.

Spot delivery price curler coaster

The typical spot price for contemporary LNG carriers topped $250,000 per day in This fall 2021. Some particular person offers had been reported at over $300,000 per day.

European demand surged final winter even earlier than Russia invaded Ukraine. Then the invasion in February prompted an all-out scramble for LNG to switch Russian pipeline provides. LNG that beforehand went to Asia was pulled to Europe as a substitute.

“Europe has been gobbling up LNG spot cargoes on an unprecedented stage,” stated Kalleklev. “Thus far this yr, about two out of three U.S. LNG cargoes have ended up in Europe, in comparison with one in three final yr.”

The change to extra U.S.-Europe voyages on the expense of U.S-Asia voyages decreased common crusing distance by 15% in Q1 2022 versus This fall 2021, “which launched numerous out there ships out there” and pushed spot charges again down from winter highs, he defined.

Charges then rebounded, with essentially the most fuel-efficient fashions — with “MEGI” or “XDF” propulsion — again to $100,000 per day by Could.

Then got here the June 8 explosion on the Freeport LNG export facility in Texas. “That led to the lack of round 15 to 17 month-to-month cargoes, thus releasing numerous ships, particularly relets [time-chartered ships temporarily put into spot]. And with extra ships out there out there, [MEGI] charges plummeted again to round $60,000-$70,000,” stated Kalleklev.

Since then, the speed curler coaster has continued. MEGI spot charges are again as much as round $120,000 per day. The Flexport LNG CEO stated that charges might be “tremendous sturdy” — within the $200,000s — throughout This fall 2022 when Asian patrons begin reserving extra spot cargoes to deal with peak seasonal demand.

“We’re definitely in for an fascinating winter,” he predicted.

Regular at highs for time-charter charges

The long-term constitution market, which covers the overwhelming majority of LNG vessel employment, has been a lot much less unstable than the spot market.

“The time period market has remained sturdy for this entire interval. It has been very agency, even in intervals of spot-market weak point,” stated Kalleklev.

He put one-year time-charter charges for MEGI LNG vessels at round $170,000 per day, three-year charges at round $140,000 and five-year charges at $110,000. Eighteen months in the past, five-year charges had been virtually half that, within the mid-$60,000s per day.

“These are extraordinarily excessive interval charges for contemporary tonnage,” stated Kalleklev.

The newbuilding market is providing help for the long-term constitution market. The worth of a newbuild MEGI LNG provider was round $180 million final yr. It has since jumped to $248 million.

“This has been pushed by increased materials costs — for nickel and metal — in addition to increased labor costs and a a lot tighter stability on the yards due to the glut of orders, not only for LNG carriers but additionally for container ships.”

An LNG provider ordered in the present day gained’t even be delivered till 2027, he stated. “Truly, the supply time for an LNG ship is now longer than [the construction time] for many LNG export crops.”

The newbuild state of affairs helps the long-term constitution market in a number of methods. First, given the excessive value and exceptionally lengthy supply instances for newbuilds, an organization in want of delivery capability could favor a long-term constitution of an current ship. Second, new export tasks that go for newly constructed vessels will accomplish that by pre-agreeing to long-term charters from the shipowners that place the precise orders. A excessive newbuild value should be supported by a excessive constitution price.

Flex LNG earnings

Flex LNG’s enterprise has adopted the identical multiyear-charter-centric script because the market as a complete.

A yr and a half in the past, the corporate was virtually totally spot-exposed, both by way of index-linked charters or short-term employment. Now, its fleet is sort of totally on fixed-rate long-term charters.

Of its 13 vessels, 12 are on fixed-rate, multiyear employment. Just one, the Flex Artemis, has publicity to the spot market through a variable rent price. Flex LNG is now largely in harvesting mode, paying out dividends, together with a particular dividend introduced Wednesday.

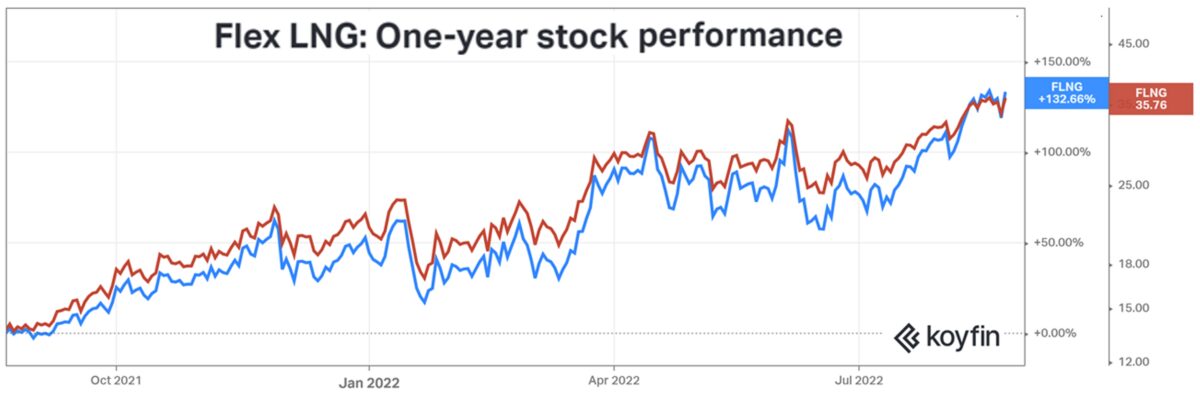

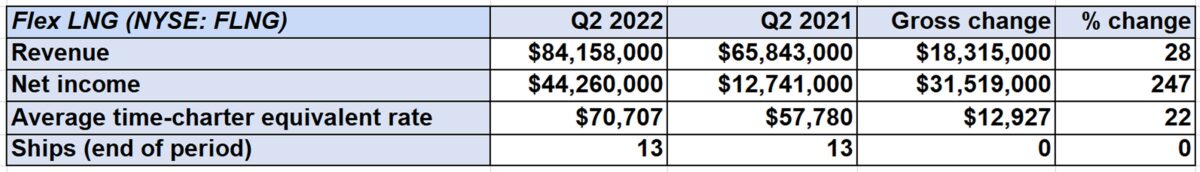

The corporate reported internet revenue of $44.3 million for Q2 2022 in comparison with $12.7 million in Q1 2021. Shares rose 6% Wednesday and closed up 132% yr on yr.

Click on for extra articles by Greg Miller

Associated articles:

[ad_2]

Source_link