[ad_1]

It may appear unhealthy, however the worst that may occur if you purchase a inventory (with out leverage) is that its share worth goes to zero. However if you choose an organization that’s actually flourishing, you’ll be able to make greater than 100%. For example the Awilco LNG ASA (OB:ALNG) share worth is 196% greater than it was three years in the past. That type of return is as strong as granite. It is also good to see the share worth up 43% over the past quarter.

On the again of a strong 7-day efficiency, let’s verify what function the corporate’s fundamentals have performed in driving long run shareholder returns.

Our evaluation signifies that ALNG is probably undervalued!

To paraphrase Benjamin Graham: Over the brief time period the market is a voting machine, however over the long run it is a weighing balance. One imperfect however easy solution to think about how the market notion of an organization has shifted is to check the change within the earnings per share (EPS) with the share worth motion.

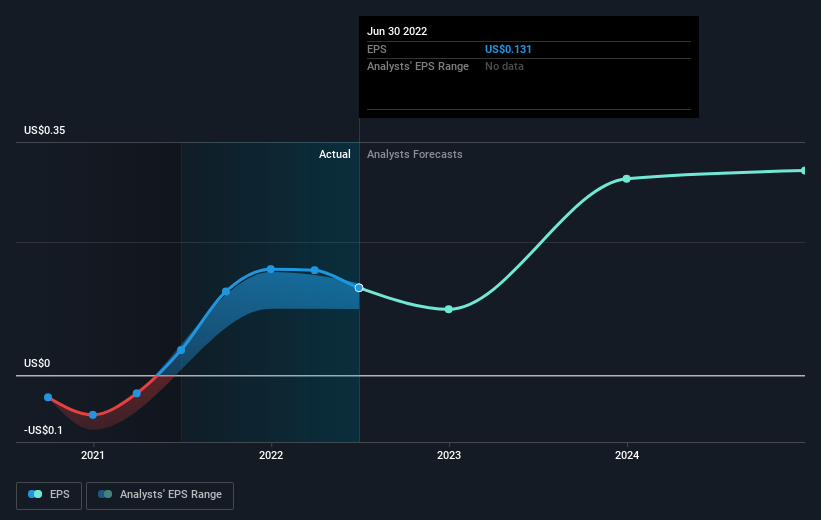

Throughout three years of share worth progress, Awilco LNG moved from a loss to profitability. That type of transition will be an inflection level that justifies a robust share worth acquire, simply as we have now seen right here.

You’ll be able to see beneath how EPS has modified over time (uncover the precise values by clicking on the picture).

It’s in fact wonderful to see how Awilco LNG has grown earnings through the years, however the future is extra vital for shareholders. This free interactive report on Awilco LNG’s stability sheet power is a superb place to start out, if you wish to examine the inventory additional.

A Totally different Perspective

We’re happy to report that Awilco LNG shareholders have obtained a complete shareholder return of 93% over one 12 months. That acquire is healthier than the annual TSR over 5 years, which is 15%. Due to this fact it looks as if sentiment across the firm has been constructive these days. Somebody with an optimistic perspective might view the latest enchancment in TSR as indicating that the enterprise itself is getting higher with time. Earlier than forming an opinion on Awilco LNG you may need to think about these 3 valuation metrics.

After all Awilco LNG might not be the perfect inventory to purchase. So it’s possible you’ll want to see this free assortment of progress shares.

Please word, the market returns quoted on this article mirror the market weighted common returns of shares that presently commerce on NO exchanges.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Awilco LNG is probably over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We intention to carry you long-term centered evaluation pushed by basic information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

[ad_2]

Source_link