[ad_1]

The event of Israel’s large Tamar and Leviathan pure fuel fields has markedly shifted the regional fuel market’s geopolitical dynamics. Israel’s transformation from a fuel importer to an exporter has notably impacted its relationships with neighbouring Jordan and Egypt.

Israeli exports have been pivotal for Egyptian LNG exports, compensating for Egypt’s declining indigenous fuel availability. Jordan, as soon as reliant on LNG imports, reduce its LNG procurement, given its entry to secure Israeli pipeline provides.

In 2022 alone, in line with CEDIGAZ database, Israel’s fuel exports reached 2.9 billion cubic meters (bcm) to Jordan and 6.5 bcm to Egypt, contributing to the easing of the worldwide LNG market pressure. Trying forward, Israel aspires to broaden its fuel export footprint, doubtlessly by means of international LNG exports or a pipeline to Europe.

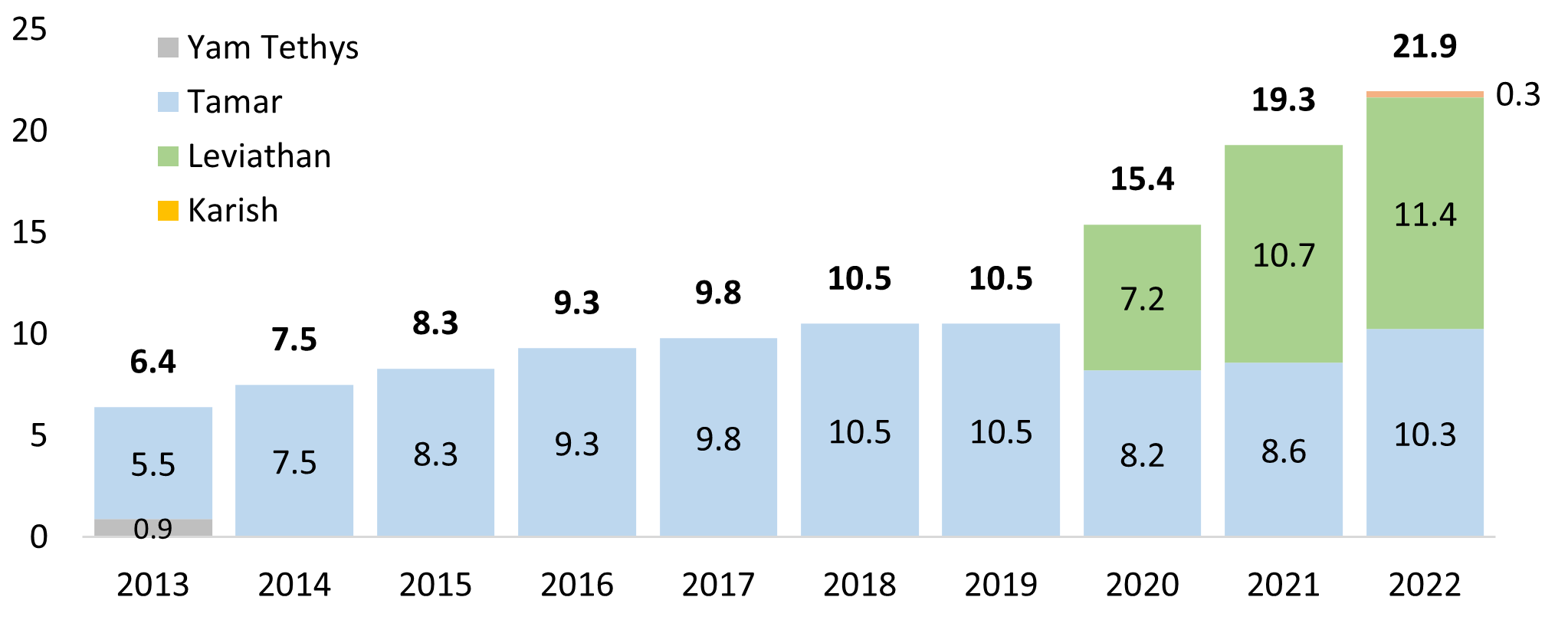

Israeli fuel manufacturing up to now 10 years (2013-2022), bcm

Tamar’s Shutdown and disruption of fuel exports

Nevertheless, the current Israel-Hamas battle has disrupted the regional steadiness. The battle led to a one-month halt in manufacturing on the Tamar area, inflicting a discount in fuel exports to Egypt through the East Mediterranean Fuel (EMG) pipeline. This has sparked analysts to evaluate the dangers of additional disturbances, pondering their doable cascading results on the worldwide fuel market and Israel’s long-term fuel growth endeavours.

Investing Via Instability: The Vitality Sector’s Response to the battle

If the size of the Israel-Hamas battle had been to enlarge, it might doubtlessly disrupt fuel exports to Jordan and Egypt within the close to to medium time period. In a extreme but at present unlikely state of affairs, the place fuel flows to each nations are extensively interrupted, the already stretched LNG market would face further stress.

Future enlargement plans for Israel’s fuel export capabilities may also be impacted. The current pressure in Israel-Turkey relations provides uncertainty to the beforehand mentioned mission of a brand new pipeline from Israel to Turkey.

Regardless of these challenges, main trade gamers like Chevron and BP, alongside ADNOC, are persevering with their funding plans in Israel’s fuel sector, signalling resilience and long-term dedication to the area’s vitality growth.

Supply: Cedigaz

[ad_2]

Source_link