[ad_1]

QatarEnergy has inked one other long-term deal to supply LNG for Europe as Eni SpA continues to interchange Russian pure gasoline provides.

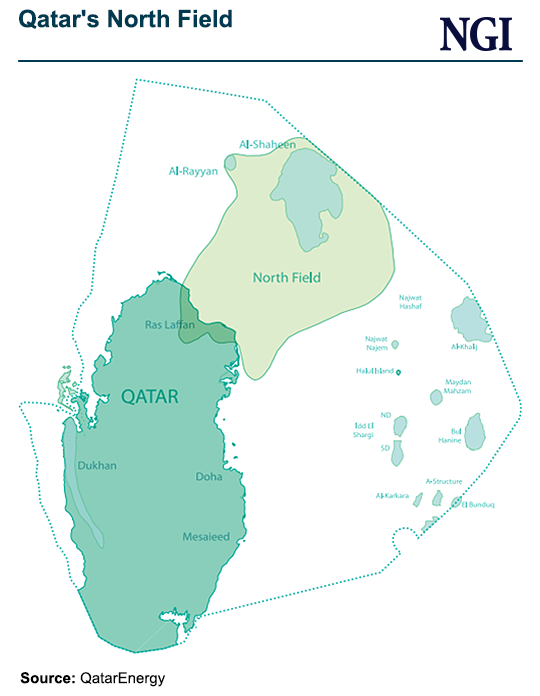

The Italian supermajor has agreed to purchase as much as 1 million tons (Mt) yearly, or the equal of about 53 Bcf/12 months, of liquefied pure gasoline for 27 years from QatarEnergy’s North Subject East (NFE) enlargement challenge. Deliveries are anticipated to start someday in 2026.

Cargoes are to be delivered to Snam SpA’s floating storage and regasification unit moored at Piombino on Italy’s western coast.

[What’s Coming? LNG Insight is now offering NGI’s North American LNG Project Tracker for clients to quickly see developments across the U.S., Canada and Mexico. Download the data sheet now.]

Eni joined the $29 billion NFE challenge final 12 months as an fairness associate together with ConocoPhillips, ExxonMobil and TotalEnergies. The North Subject tasks, which additionally embody North Subject South, have been sanctioned in 2021 and would finally enhance Qatar’s LNG output from 77 million tons (Mt) to about 125 Mt yearly by 2027.

QatarEnergy’s take care of Eni is the third long-term contract for provide to Europe disclosed this month. The agency beforehand introduced 27-year offers for 3.5 million metric tons/12 months (mmty) to each Complete Energies and Shell plc from the North Subject tasks.

The offers are at the moment QatarEnergy’s largest and longest provide agreements with European corporations.

Eni at the moment holds a 0.7 Mt/12 months contract with QatarEnergy that expires in 2024, in line with Kpler knowledge.

Earlier than 2022, Italy beforehand imported round 10% of its gasoline provide from Russia. Italy imported a Russian LNG spot cargo in March from Yamal LNG.

Eni was nonetheless receiving round 80% of its contracted pure gasoline provide from Russia earlier than all gasoline deliveries on the Nord Stream system ended final 12 months. Consequently, Eni’s marketed gasoline volumes, in addition to its revenues, have continued falling.

In the course of the first six months of the 12 months, Eni additionally reported that its pure gasoline gross sales plummeted by 18% year-over-year as a consequence of decrease gasoline demand in Italy and central Europe.

Eni has beforehand focused rising its contracted LNG portfolio from 11 million metric tons/12 months (mmty) in 2023 to 18 mmty by 2026. It plans to shift its contracts to permit 70% of contracted volumes to be delivered on a free-on-board foundation by 2026.

Eni has additionally been snapping up belongings in Africa, Asia and the Center East to bolster its exploration and manufacturing actions by means of the following a number of a long time. It goals to extend pure gasoline to 60% of its complete upstream manufacturing by 2030.

The put up QatarEnergy, Eni Ink 27-12 months LNG Deal for European LNG appeared first on Pure Gasoline Intelligence

[ad_2]

Source_link