[ad_1]

Regardless of a slower than anticipated financial restoration from the Covid-19 pandemic, China progressively regained its place because the world’s largest LNG importer in July, elevating the potential for a winter provide squeeze.

China’s liquefied pure fuel imports from the start of the yr via July totaled 42.2 million tons (Mt), inserting it round 2 Mt greater than Japan throughout the identical interval, in keeping with knowledge from Kpler. Cargoes touchdown in China particularly elevated throughout the second quarter because the nation’s spot shopping for exercise elevated.

Kpler LNG analyst Laura Web page informed NGI that Chinese language LNG demand is predicted to proceed to get better all year long in comparison with its drop in imports final yr. China’s international LNG imports final yr fell to the bottom level since 2019 because it eschewed the spot marketplace for home manufacturing and discounted Russian pipeline imports.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

“At present, we forecast LNG demand to develop by simply over 11% yr/yr (y/y) to 71-72 Mt,” Web page stated.

Rising Spot Purchases

Nearly all of China’s imports throughout the first seven months of the yr got here from its substantial contract holdings and LNG portfolio, however spot purchases outpaced final yr’s price. Throughout 2Q2023, Chinese language spot LNG purchases elevated 58% y/y, totaling 0.1 billion cubic meters (Bcm) or 0.38 Bcf, in keeping with Kpler. Spot purchases additionally continued close to the identical volumes into July.

China had 115 Bcm of annual pure fuel offtake underneath contract on the finish of final yr, round 15 Bcm/yr of which was vacation spot versatile, in keeping with the Worldwide Vitality Company (IEA). Since final yr, Chinese language corporations have used their hefty portfolios to promote a number of contracted U.S. cargoes at a premium to Europe and different elements of Asia.

Japan has traditionally been the world’s largest purchaser of LNG earlier than being briefly overtaken by China in 2021.

Since China started importing LNG in 2006, Australia has largely been its greatest provider, often being eclipsed by Qatar. China has since diversified its LNG sources to incorporate 25 nations and has turn into a big offtaker of U.S. volumes.

U.S. exports to China grew from 0.2 Mt in 2016 to almost 9 Mt in 2021. Nevertheless, the nation’s U.S. imports fell to 2.2 Mt final yr.

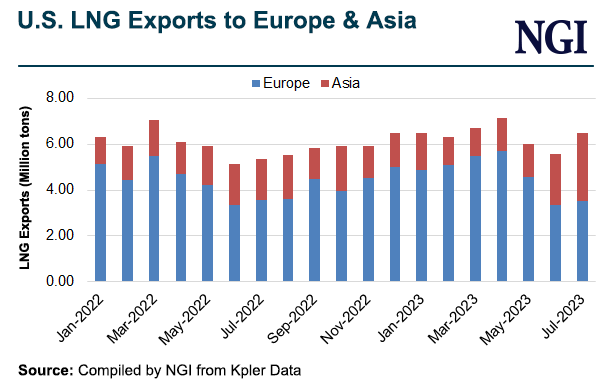

European prospects have continued to import most U.S. cargoes hitting the market for the reason that starting of the yr, however the hole between Asia and Europe narrowed in July. Asia’s value premium over the Dutch Title Switch Facility (TTF) for many of July helped draw 2.5 Mt to Asian ports, whereas 3.43 of U.S. volumes landed in Europe.

Rising, Not Hovering

Regardless of the uptick in LNG imports, Chinese language demand is predicted to remain effectively beneath the file excessive of 80 Mt in 2021, Web page added.

Together with the nation’s extra sources of pure fuel secured over the previous yr, Chinese language fuel demand has been impacted by its extended Covid-19 technique. China’s petrochemical business has been resurgent this yr, accounting for 70% of file demand progress for oil, in keeping with the IEA. Nevertheless, different elements of its financial system are nonetheless lagging.

Rystad Vitality analyst Henrik Fiskada wrote that the long-term affect to China’s manufacturing sector – a big consumer of pure fuel – is clear within the falling costs of worldwide metals and tools prices for heavy business.

“A weak home financial system, paired with sluggish progress in the remainder of the world, has hindered any important restoration,” Fiskadal stated.

China’s lead in LNG imports may also partially be attributed to falling demand from Asia’s two different powerhouse fuel consumers, Japan and South Korea. Japanese and South Korean fuel shares have been comparatively excessive via the yr, serving to the nations meet heightened cooling demand throughout the summer time and not using a important peak in spot purchases.

Web page stated a “draw back” in Japanese and South Korean demand may proceed “on account of weak energy demand and will increase in nuclear energy technology” this yr.

“Regardless of doubtlessly sturdy Chinese language demand this yr, we imagine that general Northeast Asian LNG imports may face a small decline yr/yr, notably given the sharp decline in Japanese imports up to now this yr,” Web page stated.

Volatility Continues

Whereas the energy of China’s potential pull on LNG volumes could also be restricted, the general tightness of worldwide LNG provide headed into the winter is sufficient to maintain European corporations and governments on their toes.

Excelerate Vitality Inc. CEO Steven Kobos stated throughout a latest 2Q2023 name with analysts that China’s potential for winter LNG demand continues to be creating alternatives for short-term LNG suppliers because it creates uncertainty for each Asia and Europe’s provide outlooks.

“China’s LNG imports may fluctuate with an uncertainty vary of over 10 Bcm or 7.2 Mt via the winter,” Kobos stated.

TTF costs jumped considerably earlier within the week on fears that strikes at Australian LNG terminals could improve competitors for spot cargoes as Europe makes its fall push to fill storage earlier than winter.

The submit Uptick in Chinese language Pure Gasoline Imports Locations Additional Stress on World LNG Provide appeared first on Pure Gasoline Intelligence

[ad_2]

Source_link