[ad_1]

Following back-to-back positive aspects, pure fuel futures faltered Wednesday, held in verify by meager export volumes and expectations for the following authorities stock report to indicate continued stout provides in underground storage.

At A Look:

- 50s Bcf storage construct anticipated

- Manufacturing stays wild card

- Climate demand strengthens

The August Nymex fuel futures contract settled at $2.632/MMBtu, down 9.9 cents day/day. September shed 9.5 cents to $2.597.

NGI’s Spot Gasoline Nationwide Avg. slipped 4.0 cents to $2.410.

Wooden Mackenzie information confirmed manufacturing nonetheless off greater than 1 Bcf/d from summer time highs of 102 Bcf/d due to upkeep occasions within the Northeast. Output had dipped under 100 Bcf/d early within the week. However the work was anticipated to show quick in period and manufacturing confirmed no different speedy indicators of putting up with drops.

Futures rallied Monday and Tuesday amid sturdy Southern warmth and forecasts for widespread lofty temperatures within the second half of July. The forecasts held agency – and weather-driven demand is proving strong – however analysts mentioned Wednesday that warmth on the top of summer time can propel costs solely a lot, given it’s anticipated, and the immediate month stays range-bound.

Analysts at The Schork Report, with a tinge of sarcasm, summed it up this fashion: “It’s summer time, and it’s sizzling.”

Analyst Brian LaRose of ICAP Technical Evaluation mentioned Wednesday he would watch “intently to see if the bulls can set off a short-covering rally. To take action, the bulls have three obstacles to beat, $2.774-2.783, $2.839-2.850 and $2.936. Bust via and we will probably be taking goal on the $3.250 neighborhood.

“And if the bulls are less than the duty? The door will stay open for extra sideways-to-lower value motion.”

NatGasWeather mentioned that, “whereas climate patterns are sizzling and bullish general, there stays a lot to the bearish facet, highlighted by sturdy U.S. manufacturing” and “hefty surpluses” of storage provides relative to the five-year common.

LNG exports even have not too long ago hovered round or under 13 Bcf/d – off from spring highs at 15 Bcf/d, the agency famous. That is partially due to varied upkeep occasions at Gulf Coast liquefied pure fuel amenities in June and early this month.

Given these bearish components, NatGasWeather mentioned the following two authorities storage reviews are “solely anticipated to cut back surpluses barely.”

EBW Analytics Group’s Eli Rubin famous that muted LNG feed fuel demand and storage surpluses “are poignant causes for concern. Absent file warmth rolling ahead or unanticipated bullish catalysts, fuel costs might weaken” additional “after the approaching warmth wave fades.”

Storage Estimates

For Thursday’s Vitality Info Administration (EIA) report, NGI modeled a 50 Bcf injection for the interval ended July 7. That may barely cut back the year-on-five-year storage surplus, which stood at plus-366 Bcf as of June 30.

A Reuters ballot confirmed injection expectations for the following EIA print starting from 42 Bcf to 63 Bcf, with a median of 51 Bcf. The Wall Road Journal’s survey discovered a narrower span of estimates and a mean of 52 Bcf.

The year-earlier injection was 59 Bcf, whereas the five-year common is a construct of 55 Bcf, in accordance with EIA.

EIA most not too long ago posted a web injection of 72 Bcf pure fuel into storage for the week ended June 30. It lifted inventories to 2,877 Bcf and put shares far above the year-earlier stage of two,302 Bcf and the five-year common of two,511 Bcf.

Rystad Vitality’s Ade Allen, senior analyst, mentioned storage ranges are anticipated to stay elevated, given uneven however sturdy output “that would danger destabilizing home balances because the market strikes additional into injection season.”

Moreover, he mentioned, “we anticipate exports to common near 13 Bcf/d in July, barring unexpected circumstances.” Extra “strong exports will probably be mandatory” to steadiness the market, “particularly since manufacturing stays resilient.”

Money Costs

Spot fuel costs on Wednesday fell for the primary time in three days. Declines have been modest however widespread after stable positive aspects early within the week.

Chicago Citygate shed 2.5 cents day/day to common $2.370, whereas Henry Hub misplaced 4.0 cents to $2.550 and SoCal Citygate fell 9.5 cents to $3.400.

NatGasWeather mentioned seasonally delicate climate within the Higher Midwest and Nice Lakes this week would give option to hotter situations subsequent week. Elsewhere, warmth already is firmly entrenched.

“The sample for mid- and late July stays impressively sizzling because the East Coast warms into the higher 80s to mid-90s, whereas California to Texas experiences harmful warmth with highs of mid-90s to 110,” the agency mentioned.

Maxar’s Climate Desk mentioned Wednesday that, for the six- to 10-day outlook interval, “above-normal temperatures are largely regular from California to Texas, with the most well liked of the interval being early with higher 90s in Burbank and mid-110s in Las Vegas and Phoenix. Dallas is forecast to be within the low 100s all through the interval.”

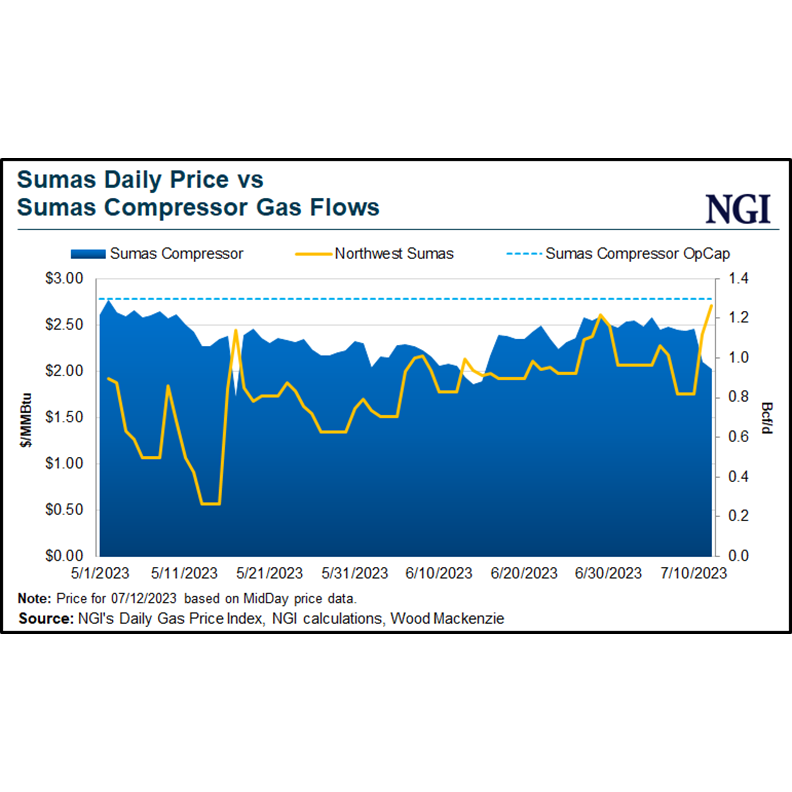

Wooden Mackenzie analyst Quinn Schulz mentioned money costs within the Pacific Northwest “might rise significantly within the coming days as upstream constraints, in addition to forecasted will increase in cooling diploma days (CDD), are anticipated to tighten basic fuel flows.”

Schulz mentioned each main Canadian import hubs – Northwest Sumas and Kingsgate – “collectively tightened by 480 MMcf/d” on Tuesday due to upkeep work this week. “These upward pressures will possible peak on July 15, as forecasted CDDs are additionally anticipated to steadily improve considerably, and peak, by then.”

On Wednesday, Northwest Sumas gained 15.5 cents to $2.860, whereas Kingsgate fell 2.0 cents to $1.960.

The publish Pure Gasoline Futures Fall, Reducing Win Streak Brief Forward of Stock Information; Spot Costs Slip appeared first on Pure Gasoline Intelligence

[ad_2]

Source_link