[ad_1]

Russia’s conflict in Ukraine has helped propel the subsequent wave of U.S. LNG tasks, placing the nation on monitor to export 22.3 Bcf/d of the super-chilled gasoline this decade.

$(“.wp-post-image”).wrap(“”);

Since final 12 months, the Corpus Christ Stage 3 enlargement, Plaquemines and Port Arthur liquefied pure gasoline tasks have all been sanctioned. Together with Golden Go LNG, the Gulf Coast tasks are all beneath development. They might add 8.4 Bcf/d over the subsequent 5 years along with the 13.9 Bcf/d of U.S. LNG export capability already in operation.

Twelve different U.S. export tasks have been accredited and one other eight have been proposed. A handful of the brand new tasks which have been accredited are near transferring forward after a flurry of contracting during the last year-and-a-half sparked by the power disaster. The primary part of the Energía Costa Azul (ECA) and Altamira LNG tasks are additionally being constructed in Mexico that might add one other 800 MMcf/d of export capability that may be fed by U.S. pure gasoline.

The entire growth begs the query of how rising export capability will affect the home market within the years forward and whether or not tasks not but sanctioned can sustain the tempo.

A Clouded Outlook

“The U.S. goes to convey on-line loads of LNG capability, and we now have to be ready for the volatility that comes with that,” mentioned Chesapeake Power CEO Nick Dell’Osso through the firm’s first quarter earnings name.

Final 12 months, when Europe scrambled to purchase extra LNG after Russia reduce off the majority of its provides, worldwide pure gasoline costs hit information. Rising costs abroad factored into Henry Hub futures hitting the very best degree in over a decade.

[Want today’s Henry Hub, Houston Ship Channel and Chicago Citygate prices? Check out NGI’s daily natural gas price snapshot now.]

“Because the U.S. exports extra of its pure gasoline, the nation is prone to import increased gasoline costs consequently,” wrote Clark Williams-Derry, an analyst on the Institute for Power Economics and Monetary Evaluation, in a current evaluation.

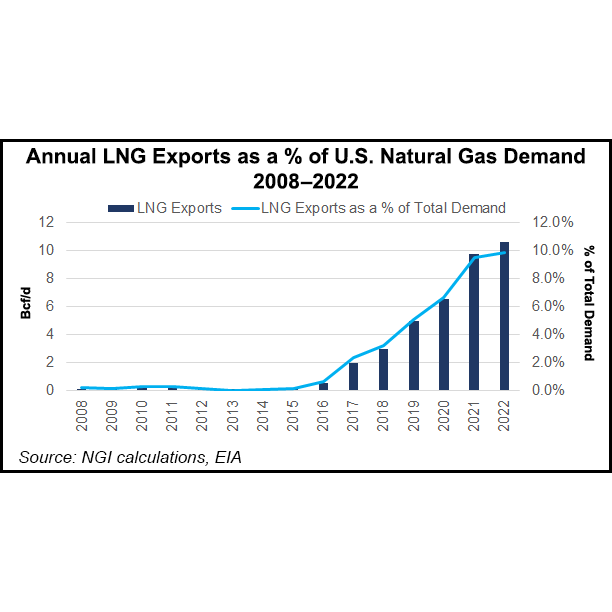

The US already has probably the most LNG manufacturing capability on the earth. Whereas Australia and Qatar exported extra of the super-chilled gasoline final 12 months, U.S. volumes would have been far increased if Freeport LNG hadn’t been knocked offline. LNG’s rising affect on the home market was evident after the Freeport explosion. The blast took out 2 Bcf/d of U.S. gasoline demand and stopped Henry Hub costs from surging previous $10 final summer time.

Nevertheless, the extent to which U.S. gasoline costs may very well be impacted by LNG exports sooner or later will in the end be decided by worth indicators and worldwide demand.

NGI particular contributor Brad Hitch, a veteran LNG and gasoline dealer, mentioned in a current column that American liquefaction development might create a capability for the worldwide gasoline market to stability on swings in U.S. LNG manufacturing.

“So far, modifications in U.S. exports have primarily been pushed by upkeep and unplanned outages, however that’s prone to change,” Hitch wrote. “The bigger the potential to stability international flows turns into, the extra doubtless the trade is to name upon it.”

Swings in U.S. feed gasoline demand and LNG manufacturing would additionally rely upon precisely how a lot extra capability is constructed.

Builders are going through mounting challenges. Rising development prices, a restricted workforce, and a crowded financing panorama, together with potential pipeline constraints and longer-term considerations over enough feed gasoline provides, cloud the export outlook.

“I don’t suppose as a lot LNG will get constructed as individuals suppose,” mentioned NextDecade Corp. CEO Matthew Schatzman. “I believe we’ve overestimated how a lot will truly get constructed. And that’s not due to demand. I believe there are some bodily limitations on how briskly we will go.”

NextDecade is growing the Rio Grande LNG mission in South Texas. The corporate has contracted 60% of the provides it might produce from the mission’s first three trains. It expects to safe financing and announce a last funding resolution (FID) by June.

“I don’t see a complete lot extra FIDs this 12 months,” Schatzman informed NGI. He acknowledged there may be nonetheless a lot work to do to make the mission a actuality, however he believes Rio Grande might be one of many last U.S. greenfield tasks to succeed in FID and transfer forward within the coming years because the power panorama grows extra complicated and the worldwide pure gasoline market has develop into more and more aggressive.

The method of constructing LNG provide capability is prone to decelerate within the years forward, he added, saying tasks might take rather a lot longer sooner or later. Schatzman expects prices to proceed rising, together with for the fourth and fifth trains at Rio Grande.

“The world wants extra LNG, and I believe the stuff being developed at the moment, together with our mission, is there for baseload. It’s not swing capability,” he mentioned. “I believe that it’s going to be more difficult to construct greenfield tasks sooner or later and get them off the bottom until you may have scale, until you’re giant.”

Lifeless Finish

Additional complicating issues was the U.S. Division of Power’s (DOE) current resolution denying a request to increase the deadline for beginning exports from the Lake Charles LNG facility in Louisiana. DOE mentioned the mission failed to indicate good trigger for the extension.

The division reaffirmed its expectations that U.S. LNG tasks ought to be capable to begin exporting the gasoline inside seven years of receiving export authorization. DOE additionally mentioned it might not take into account purposes for extending the seven-year deadline until a mission has each began development and may exhibit that “extenuating circumstances outdoors of its management” are accountable for delays.

Round a dozen LNG tasks deliberate in the USA and Mexico – permitted for roughly 20 Bcf/d of exports – are unlikely to maneuver ahead to development because of the DOE’s new place, based on an evaluation by Rapidan Power Group. Rapidan’s evaluation confirmed that not one of the tasks can meet the graduation deadlines inside their export authorizations or meet the standards to be granted an extension.

“This successfully places tasks at a useless finish,” mentioned Rapidan’s Alex Munton, international gasoline service director. With no legitimate export authorization all through the complete 20-year time period of LNG sale and buy agreements, he added, “it’s inconceivable that lenders and buyers could be prepared to financially assist a mission’s growth”

Progress Sufficient

Excluding these amenities, demand from the tasks already transferring forward in each the USA and Mexico represents greater than 20% of present U.S. dry gasoline manufacturing.

“The 2 tasks which are beneath development in Mexico alone will doubtless have a modest affect on costs and demand,” mentioned NGI’s Patrick Rau, director of technique and analysis.

ECA would pull gasoline from the Permian Basin, whereas Altamira would take gasoline from the Agua Dulce hub in South Texas. Takeaway shouldn’t be an issue for both mission, Rau mentioned, given an ongoing enlargement of the North Baja Pipeline that may feed ECA and extra capability on the Sur de Texas-Tuxpan pipeline for Altamira.

One other 5.6 Bcf/d of Mexican LNG tasks are additionally beneath growth, the vast majority of which might make the most of U.S. feed gasoline. The second part of ECA and Mexico Pacific Ltd. LLC’s Saguaro Energía LNG are the most probably to maneuver forward, Rau mentioned, which might require funding in new pipeline infrastructure.

Rau added that different U.S. amenities being developed would doubtless want extra pipeline capability as effectively – how a lot depends upon whether or not any extra attain FID. Pipeline constraints in Appalachia will restrict takeaway from the area, however export tasks are largely deliberate for the Gulf Coast.

NGI calculations present over 10 Bcf/d of incremental takeaway capability is being developed in Louisiana alone, or what Rau known as a “fairly good head begin” for the export market.

So many export tasks might additionally finally squeeze feed gasoline provides, Rau mentioned.

Pure gasoline manufacturing within the Permian Basin is predicted to peak someday shortly after 2030, and will begin declining a number of years later. The Haynesville and Appalachian Basins could have one other decade plus of “flush drilling stock left,” Rau mentioned, which “isn’t essentially ultimate for LNG tasks that may require offtake agreements for 20 years or so.

“However that’s primarily based on what we all know at the moment,” he added. “A lot can and doubtless will change between at times, particularly on the know-how entrance when it comes to developments that might probably unlock extra reserves, or extra doubtless, convey the price of lesser acreage all the way down to make that extra economically viable.”

Renewables and hydrogen might additionally compete extra aggressively towards pure gasoline on a broader scale over the subsequent 15-20 years, easing the decision on U.S. feed gasoline and home manufacturing.

As exports proceed to develop, Rau burdened the USA may also must develop extra underground storage capability to higher stabilize the home market. He famous that builders have added little or no storage capability during the last decade.

“U.S. storage isn’t only for U.S. consumption anymore, it now serves the worldwide market,” Rau mentioned.

The submit U.S. LNG Export Race Seen Slowing as Market Enters New Period appeared first on Pure Gasoline Intelligence

[ad_2]

Source_link