[ad_1]

TotalEnergies SE stated its LNG gross sales slipped within the first quarter on account of decrease spot volumes linked to a decline in European demand throughout a light winter.

The corporate, a significant world liquefied pure fuel participant, reported promoting 11 million tons of the super-chilled gas in the course of the interval, down 13% sequentially and 17% yr/yr.

The drop in gross sales and decrease commodity costs throughout the board dented working earnings for TotalEnergies’ Built-in LNG section, which fell 25% yr/yr to $2.1 billion. Administration additionally attributed the decline to “distinctive buying and selling outcomes” in 1Q2022, when world pure fuel costs began a meteoric rise as Europe scrambled to interchange provides lower off by Russia after the invasion of Ukraine.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

Because the market stabilized, TotalEnergies’ common LNG worth fell 2% yr/yr to $13.27/MMBtu within the first quarter. That was down 11% sequentially.

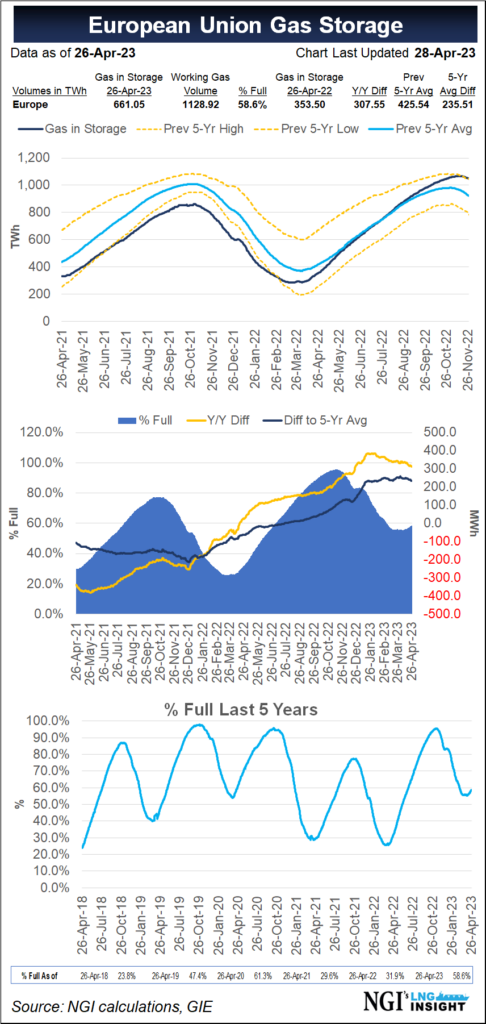

A heat winter and ample LNG deliveries left European inventories this yr to exit the heating season at their highest ranges in over a decade. Storage is at present stuffed to 59% of capability, in comparison with the five-year common of 32%. That’s anticipated to weigh on injection demand for a part of the yr.

LNG stays a robust performer for the corporate, a lot in order that it started reporting separate outcomes for the section and its energy technology operations this quarter. Administration stated earlier this yr that every could be a “pillar” of the corporate’s development going ahead.

Administration expects the corporate’s common LNG gross sales worth to be $10-12 subsequent quarter, weighed down by the drop in commodity costs and the lag impact of costs linked to grease in some contract formulation.

“Given the excessive stock ranges on the finish of winter, European and Asian fuel costs are anticipated to stay secure within the second quarter earlier than rebounding within the second half of 2023, pushed by restocking fuel in Europe earlier than winter and the demand restoration in China, in a context of restricted LNG manufacturing development,” administration stated it its outlook for the interval.

Administration added that second quarter LNG gross sales ought to profit from the restart of the Freeport LNG export terminal on the higher Texas coast, the place the corporate has long-term volumes beneath contract. Freeport was cleared by regulators in March to restart its ultimate liquefaction practice, greater than eight months after it was knocked offline by an explosion.

CEO Patrick Pouyanné additionally stated Thursday after the corporate reported first quarter outcomes that plans to restart work on the Mozambique LNG undertaking have been slowed down by disputes with contractors over prices. The corporate has a 26.5% stake within the undertaking.

Pouyanné stated value discussions are among the many ultimate hurdles for restarting the 12.9 mmty undertaking. Work was suspended in 2021 amid rising rebel assaults and violence within the area. Since then, world infrastructure undertaking prices have risen resulting from inflationary pressures.

The corporate additionally commissioned a report to look at the humanitarian state of affairs within the area that it beforehand stated could be wanted earlier than transferring forward. The report was due on the finish of February.

In different segments, TotalEnergies reported hydrocarbon manufacturing of two.5 million boe/d in the course of the first quarter, up 1% yr/yr.

Put in renewable vitality capability additionally elevated to 18 GW from 10.7 GW within the year-ago interval as the corporate continues to accumulate property the world over and convey on-line new initiatives. General, energy technology was up 10% yr/yr.

TotalEnergies reported first quarter internet earnings of $5.6 billion ($2.23/share), in comparison with internet earnings of $5 billion ($1.87) within the year-ago interval.

[ad_2]

Source_link