[ad_1]

As Waha pure fuel costs languish beneath $1/MMBtu, consideration is more and more turning to Mexico as a potential outlet for incremental fuel volumes from the Permian Basin.

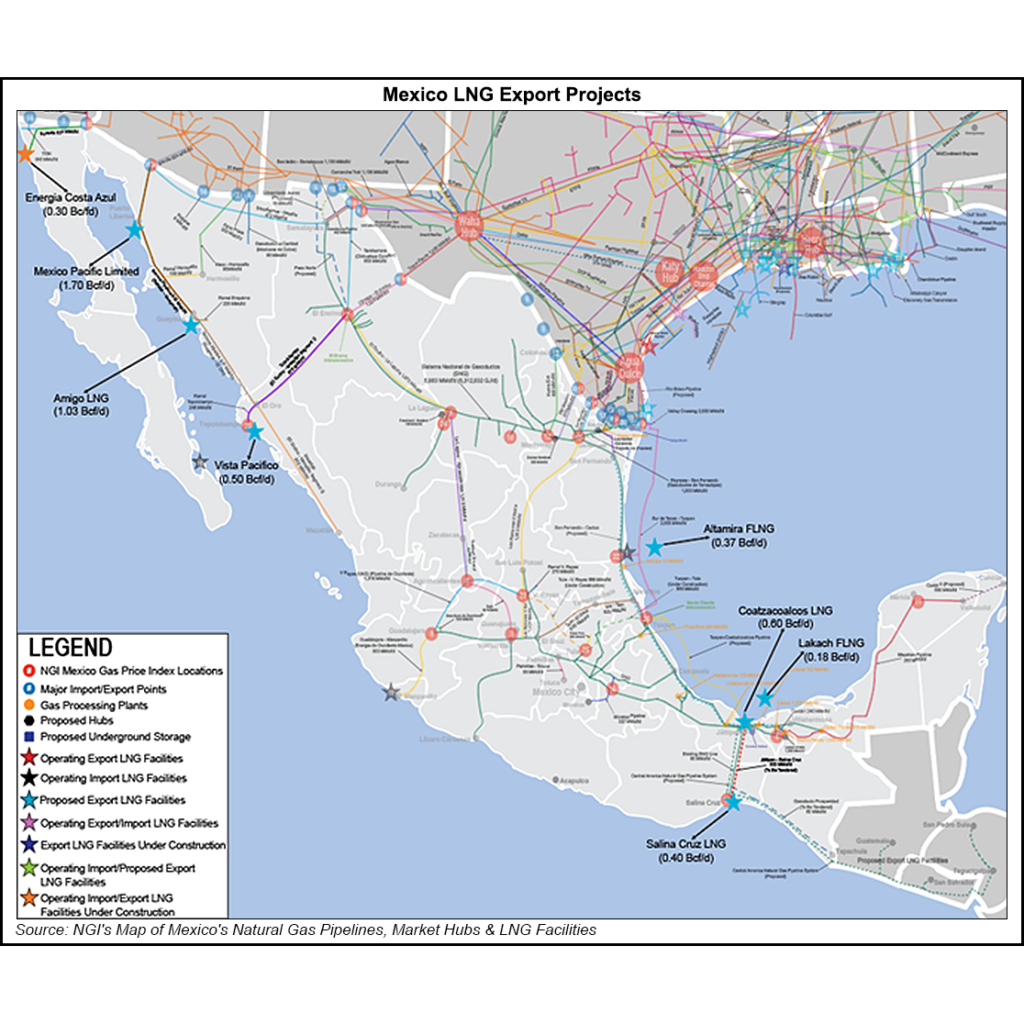

With greater than 6 Bcf/d of LNG export initiatives in various phases of growth, Mexico presents an attention-grabbing alternative to maneuver West Texas fuel to the worldwide LNG market, based on Poten & Companions’ Sergio Chapa, senior LNG analyst.

“The entire gross sales pitch there may be that you simply’re simply re-exporting U.S. pure fuel,” Chapa advised NGI on a current episode of the Hub and Move podcast. “There are a number of cross-border pipelines that ship pure fuel from the Permian Basin and the Waha hub to numerous locations in Mexico.”

Plans are underway to develop the cross-border capability as properly.

Oneok Inc.’s proposed Saguaro Connector pipeline is rising as “a darkish horse candidate” for the subsequent greenfield Permian egress pipe, Tudor, Pickering, Holt & Co. analyst Colton Bean mentioned Monday.

The 155-mile, 48-inch diameter pipeline has a focused in-service date of 2026, and is supposed to attach the Waha hub with Mexico Pacific Restricted LLC’s (MPL) Saguaro LNG export terminal envisaged for Puerto Libertad in Mexico’s Sonora state.

The terminal has but to achieve a closing funding resolution (FID), however MPL has secured binding offtake agreements from the likes of Shell plc, ExxonMobil and China’s Guangzhou Improvement Group.

MPL has “skilled a surge in business exercise” pushed by LNG demand in Asia, Chapa mentioned.

He defined that MPL is securing offtake agreements for about 2 million metric tons/yr every, and providing several types of contractual preparations to satisfy the wants of every offtaker.

BTU Analytics’ Bailey McLaughlin, in a publish final week, broke down 9 deliberate LNG export initiatives in Mexico into three tiers, based mostly on their probability of attaining FID.

The Tier A amenities, each of that are at present below building, comprise Sempra’s Energía Costa Azul (ECA) Part 1 terminal in Baja California and New Fortress Power Inc.’s floating LNG terminal offshore Altamira, Tamaulipas, on Mexico’s East Coast.

The initiatives would have export capacities of about 0.43 Bcf/d and 0.18 Bcf/d, respectively.

MPL’s first section falls into the Tier B class, McLaughlin mentioned. He famous that “present pipeline infrastructure inside Sonora and Chihuahua would solely permit one prepare to run at full utilization.”

Tier C, in the meantime, contains initiatives in earlier phases of growth – particularly Amigo LNG, ECA Part 2, NFE’s Lakach floating LNG challenge, MPL’s second prepare, and the Vista Pacífico challenge proposed by Sempra.

Pure fuel pipeline and LNG export initiatives which have managed to maneuver ahead in Mexico just lately all have one factor in frequent, based on Chapa.

“To achieve success in Mexico, you’ll want to associate with, or be a buyer of the state one way or the other,” he mentioned, “and we’ve seen that every one throughout the board on these LNG initiatives.”

If the LNG terminals proposed for Mexico come to fruition, “Mexico may very well be…in a single day the fourth-largest LNG exporter on this planet,” Chapa mentioned, with the asterisk that “they’re re-exporting U.S. pure fuel.”

[ad_2]

Source_link