[ad_1]

After hovering in 2022, North American pure gasoline costs have sunk this 12 months. However this might change as quickly as this summer time, and positively beginning subsequent 12 months when new U.S. LNG capability comes on-line.

April New York Mercantile Trade pure gasoline futures rolled off the board at $1.991/MMBtu final month, “but it surely’s not clear if we’ve reached the bottom level,” NGI Value & Markets Editor Leticia Gonzales stated Wednesday throughout a webinar organized by the Intercontinental Trade Inc., aka ICE.

“However I don’t suppose we’re going to keep that low for lengthy,” Gonzales stated, noting an unsure manufacturing image and more and more robust pure gasoline energy burns within the U.S. era phase. “We should always get again to a few {dollars} round summer time, after which 4 by subsequent winter after which we see the LNG services come on-line.”

Vp of Analysis at Criterion Analysis James Bevan stated liquefied pure gasoline exports out of america ought to common 13.4 Bcf/d for the 12 months, up 1.56 Bcf/d from 2022. This may be principally due to Freeport LNG in Texas coming again on-line. These projections embrace upkeep at different crops, he stated.

“LNG has been beginning to hearth totally on all cylinders in the previous couple of weeks,” Bevan stated.

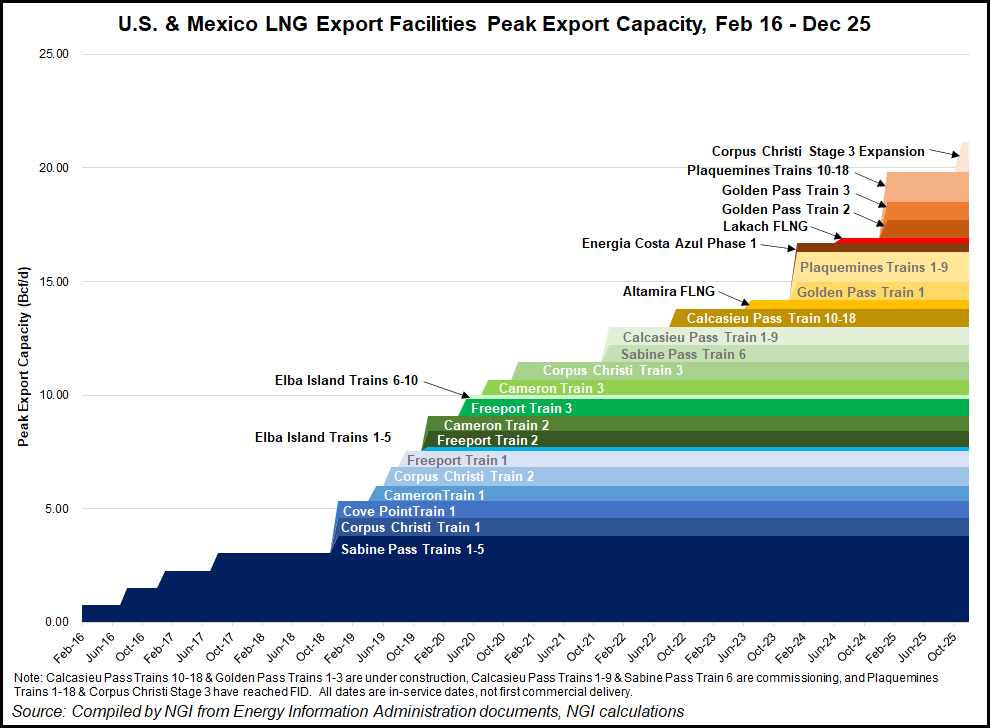

The actual LNG increase begins from subsequent 12 months onward, with the Golden Cross facility anticipated to come back on-line within the spring of 2024. Criterion sees LNG design capability in america rising from about 14 Bcf/d right now to as excessive as 30 Bcf/d by the top of 2028. “There’s a lot taking place proper now,” Bevan stated.

He cited Sempra lately giving the inexperienced gentle to the primary part of the $13 billion Port Arthur LNG export undertaking in Texas. The corporate expects each of the primary part’s two trains, with a mixed capability of 13 million metric tons/12 months (mmty) of LNG, to be on-line by 2028.

Port Arthur was the second U.S. LNG export undertaking to achieve a last funding resolution (FID) this 12 months following a spree of contracting exercise in 2022. Enterprise International LNG Inc. stated in early March that it might go ahead with the second part of its Plaquemines export terminal below growth in Louisiana after securing $7.8 billion in financing.

“Rio Grande looks as if the subsequent up,” Bevan stated.

Mexico Will get Head Begin

Mexican LNG initiatives are additionally slated to make use of U.S. pure gasoline to feed each Asian and European prospects. First sendout from a New Fortress Inc. (NFE) quick LNG undertaking offshore Altamira in Mexico is predicted this summer time.

The undertaking has a liquefaction capability of 1.4 mmty. NFE plans two separate items on offshore jackup rigs, plus a 3rd on the Lakach offshore gasoline growth.

[Driving Demand: How have skyrocketing global natural gas prices pushed LNG projects forward in Mexico and across Latin America? Tune into the Hub & Flow podcast to find out.]

Plans for the primary two services are to supply gasoline from america utilizing spare capability on the two.6 Bcf/d Sur de Texas-Tuxpan pipeline commissioned by Mexican state energy firm Comisión Federal de Electricidad. NFE would then liquefy the gasoline for re-export to international markets.

“Lots of people are taking a look at these initiatives to see in the event you can lower time and value to create new manufacturing,” senior LNG analyst Sergio Chapa of Poten & Companions stated throughout NGI’s Hub & Movement podcast. “These jackup rigs… they’re being labored on in Ingleside, Texas,” Chapa stated. “The sendoff for these for the primary ship goes to be in Could we’re instructed, and it’s going to set sail for Altamira.”

He added that almost all of the momentum for LNG initiatives in Mexico is on the West Coast, utilizing gasoline from the Permian Basin. “There’s a payoff you can export from the West Coast of Mexico to Asia, avoiding the Panama Canal which is a bottleneck in lots of instances for the LNG business.”

Chapa stated Energia Costa Azul was advancing on schedule and that the Mexico Pacific Restricted LLC (MPL) three-train, 14.1 mmty undertaking was seeing lots of industrial exercise.

In late March, MPL and Shell plc signed one other offtake settlement for MPL’s Saguaro Energía LNG export terminal proposed for Puerto Libertad in Mexico’s Sonora State. Sempra’s Energía Costa Azul undertaking in Baja California, in the meantime, is aiming to start LNG manufacturing from the roughly 3 mmty first part by the top of 2024.

Chapa added he anticipated extra FIDs this 12 months in North America, with certainly one of them doubtlessly coming from Mexico. “Mexico’s West Coast may turn out to be an export hub,” he stated, with as a lot as 6-7 Bcf/d of export capability being contemplated.

[ad_2]

Source_link