[ad_1]

Snug April temperatures put downward stress on regional pure fuel forwards throughout the April 6-12 buying and selling interval, with most hubs posting reductions apart from a number of places within the western Decrease 48 and in West Texas, NGI’s Ahead Look information present.

Fastened pure fuel costs at benchmark Henry Hub for Might supply shed 6.0 cents for the interval to complete at $2.096/MMBtu.

Whereas most buying and selling hubs noticed reductions for the April 6-12 buying and selling interval, there have been notable outliers, together with alongside the West Coast. Within the Pacific Northwest, Might mounted costs at Northwest Sumas climbed 29.9 cents to finish at $2.726.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

Forecast maps from Maxar’s Climate Desk as of Thursday confirmed under regular temperatures blanketing the western and northwestern parts of the Decrease 48 for days six via 15 of the projection interval.

“The six- to 10-day interval encompasses a trough over the japanese Pacific and the Northwest, feeding moisture into the Northwest and maintaining temperatures on the cool aspect of regular,” Maxar mentioned.

Farther out within the 11- to 15-day window, the forecaster mentioned the projected sample is one which “has traditionally been a cooler affect for the West and Mid-Atlantic this time of yr.” Consequently, the agency’s newest forecast “options under regular temperatures alongside the West Coast however is close to regular within the East.”

The chilly forecast happens because the Pacific area enters the spring injection season at a major deficit to five-year common pure fuel storage ranges, Power Data Administration (EIA) information present.

As of April 7, the Pacific had 74 Bcf in storage, a 57.5% deficit to five-year common regional stockpiles of 174 Bcf.

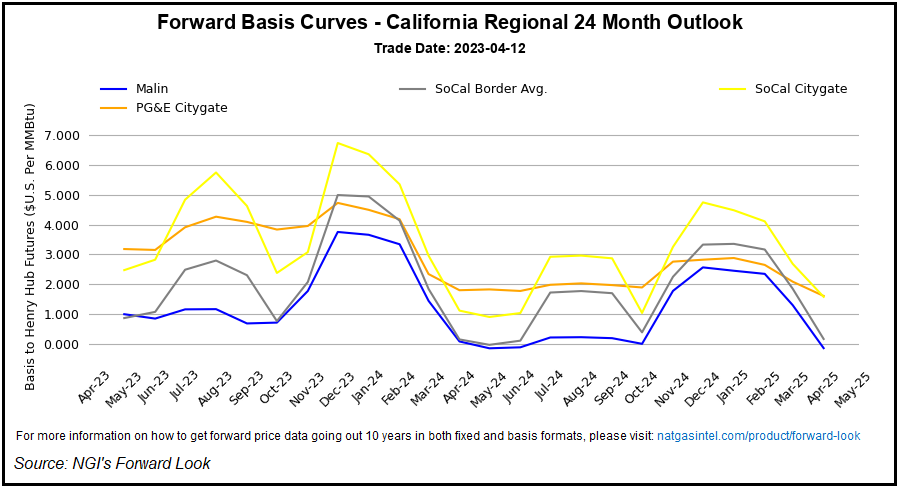

In Southern California, SoCal Border Avg. Might mounted costs surged 26.0 cents week/week to complete at $2.951.

Bodily pure fuel costs in Southern California noticed upward stress throughout the interval amid a brief upkeep occasion on the El Paso Pure Gasoline (EPNG) south mainline, which had notable impacts to pricing at Ehrenberg on Monday and Tuesday, in response to Wooden Mackenzie analyst Quinn Schulz.

“Though this upkeep is completed, SoCal-Ehrenberg money costs stay close to present elevated ranges,” Schulz informed shoppers Wednesday. “This can be led by two components. The primary is that colder forecasts are coming in for California…The opposite issue could also be anticipation of SoCal’s upcoming Line 5000 upkeep, scheduled to happen April 17-28.”

This occasion may “lower collective receipts between Ehrenberg and Blythe by as a lot as 488 MMcf/d,” Schulz mentioned.

Permian Basin hubs additionally noticed notable strengthening, albeit from closely discounted ranges, as quite a lot of pipeline upkeep occasions within the area appeared poised for imminent conclusion.

Earlier within the week, Wooden Mackenzie analysts had highlighted an occasion on the Kinder Morgan Tejas Pipeline (KM Tejas) that was overlapping with restrictions on the EPNG and Gulf Coast Categorical (GCX) methods. The KM Tejas restriction started in the beginning of the month and was prolonged past its unique deliberate conclusion earlier this week, in response to the analysts.

The Wooden Mackenzie analysts warned of “protracted draw back threat” for Waha money costs for the week because of the varied pipeline occasions impacting the area.

Nevertheless, as of Thursday KM Tejas was on observe to return to full capability by the top of the week (April 14), with decreased capability on GCX anticipated to final via Saturday (April 15), the agency mentioned in a subsequent analysis notice.

El Paso Permian mounted costs gained 31.2 cents throughout the April 6-12 buying and selling interval, with the Might contract ending at 97.2 cents. Waha Might mounted costs ended at 93.9 cents, a 31.4-cent acquire.

Not What Bulls Wanted

In the meantime, Nymex futures have struggled to create convincing separation from the psychological $2 degree because the market has been in a holding sample awaiting the arrival of summer time warmth to doubtlessly chip away at ample inventories.

A 16.1-cent rally for the Might pure fuel contract on Monday (April 10), elevating costs to $2.172, noticed little follow-through. A second-straight day/day loss in Thursday’s session noticed the entrance month settle simply above $2 at $2.007.

Nonetheless, the $2 threshold proved resilient in Friday’s buying and selling, with Might going as little as $1.946 earlier than in the end rallying to complete 10.7 cents increased on the day, settling at $2.114 to shut out the week.

From a technical perspective, bulls on Friday managed to guard an essential help threshold pegged by ICAP Technical Evaluation earlier within the week.

“Not the follow-through the bulls wanted,” ICAP analyst Brian LaRose noticed following Wednesday’s 9.3-cent sell-off. “In actual fact, the worth motion for the reason that April expiration can finest be described as an a-b-c construction — a corrective sample.

“Now watching intently to see if the bulls can preserve Henry Hub above the $1.992/$1.944 lows,” LaRose added. “If they can’t, the door could be open for a drop to $1.679, even a take a look at of the $1.432 low put in place again in 2020.”

Chilly temperatures in March helped to trim storage ranges versus historic norms, however “a balmy April may shortly restore oversupply fears within the coming weeks,” EBW Analytics Group analyst Eli Rubin informed shoppers in a latest notice.

This month’s bearish temperature outlook stands in stark distinction to “extraordinarily bullish” climate within the year-earlier interval, Rubin mentioned.

“In our view, storage comparisons to each year-ago and even five-year common ranges could also be distorted in a bearish course on account of significantly low storage trajectories throughout 2018, 2021 and 2022 — three of the previous 5 years,” the analyst mentioned.

The summer time may convey a shift within the outlook for pure fuel, opening up the chance for rising Nymex costs as “bearish influences fade,” in response to Rubin.

“Bearish climate could quickly retreat and even flip overtly bullish into the summer time,” the analyst mentioned. Current EIA studies “are indicative of speedy tightening that may happen if climate turns supportive.

“…Demand power from sturdy LNG can even be pronounced regionally within the South Central, whereas elevated coal-to-gas switching may be extra distinguished within the South Central and Southeast areas.”

[ad_2]

Source_link