[ad_1]

Pure gasoline futures costs bounced round Tuesday, with the prompt-month Nymex contract buying and selling in a comparatively tight vary earlier than in the end settling modestly increased day/day. With LNG demand persevering with to rise and climate forecasts fairly uninspiring, the Might Nymex contract edged up 1.4 cents to $2.186/MMBtu.

At A Look:

- LNG nominations at all-time highs

- Extra tightening stated wanted

- Money costs principally regular

Money costs shifted a dime or much less on the overwhelming majority of North American places. NGI’s Spot Fuel Nationwide Avg. slipped 7.5 cents to $2.400.

Feed gasoline deliveries to U.S. liquefied pure gasoline services are ramping up towards all-time highs, setting the stage for incremental features later this yr as Freeport LNG returns to full capability and Calcasieu Go comes absolutely on-line. NGI information confirmed feed gasoline volumes climbing to 14.61 Dth on Tuesday, up from 13.78 Dth a day earlier.

Although the rising LNG demand is happening within the early days of the spring shoulder season – fairly than the height of winter – the uptrend is lending much-needed help to the market. After slipping under $2.00 in current weeks, futures on Tuesday swung both facet of $2.150.

EBW Analytics Group famous that with robust LNG feed gasoline demand and decelerating manufacturing development, fundamentals could quickly strengthen. Coal-to-gas switching and the regular rise in cooling demand within the coming months could lead to an early inflection level for pure gasoline costs as quickly as subsequent month.

Within the rapid time period, although, the Might Nymex contract faces an enhanced danger of a relapse decrease thanks largely to delicate climate. EBW stated the near-term outlook this month’s “very meager” heating demand may result in the third largest month-to-month injection of pure gasoline into storage over the previous decade. What’s extra, the sturdy injections would come amid traditionally low pricing.

Already, shares are sitting greater than 50% above each final yr and five-year common ranges, in response to the newest authorities stock report.

What’s extra, the April improve in gasoline storage is projected to be 95 Bcf above the five-year common, in response to EBW. Whereas climate performs a predominant function, a post-winter bounce in pure gasoline manufacturing as Permian pipeline upkeep concludes additionally may weigh on storage balances.

That stated, “looser balances could also be largely restricted to the entrance half of April,” EBW senior vitality analyst Eli Rubin stated. “As climate normalizes in late April, elevated coal-to-gas switching, robust LNG and injection demand from native distribution corporations may ratchet the bodily provide/demand stability and assist Nymex gasoline futures set up a sustainable backside.”

Trying a bit additional out, Mobius Threat Group stated the market is prone to preserve an in depth watch on energy technology demand this summer time. Energy burns soared to document ranges final yr – within the face of a lot increased costs – and offered a relentless pull on pure gasoline within the Decrease 48 alongside the expansion in LNG demand overseas.

Current information factors present an excellent higher share of obtainable fossil load shifting to pure gasoline, in response to Mobius. The end result seems to be a decreasing of end-of-season storage expectations.

“Whether or not or not we take a look at the 4 Tcf threshold or not this fall will almost definitely be decided by temperatures within the Southeastern quadrant of the nation,” Mobius’ Zane Curry, director of analysis. “However for now, the market’s consideration is skilled on the truth that energy burn is just lately working 2 Bcf/d yr/yr, or extra, and we have now but to see any materials cooling demand within the Southeast.”

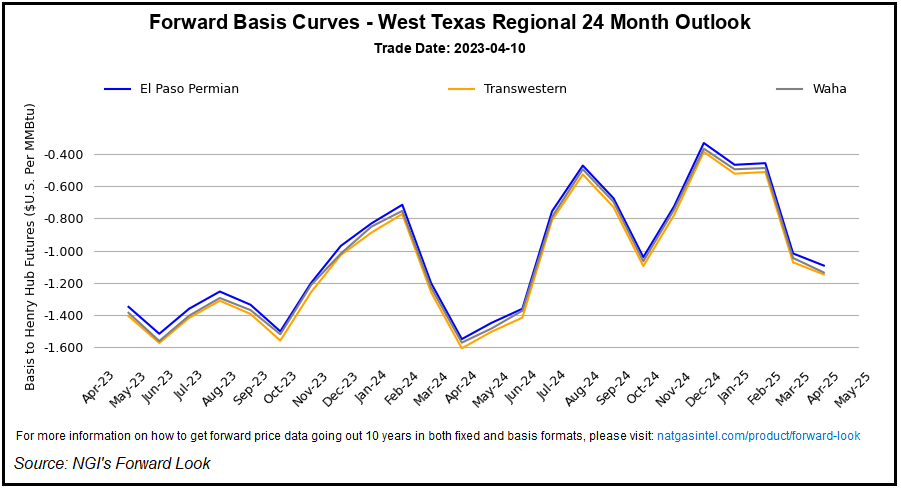

Permian Money Recovers

Absolutely within the throes of spring, prolonged pipeline outages and the ensuing disruptions of gasoline flows in some U.S. areas had little impression on spot gasoline costs given modest demand.

In West Texas, Waha and El Paso Permian moved again into optimistic territory regardless of the surprising continuation of upkeep on Kinder Morgan Inc.’s KM Tejas pipeline. The work was initially scheduled to conclude on Tuesday, however Kinder stated it could go on till additional discover.

Waha next-gas day costs climbed 29.5 cents on the day to common 72.5 cents for Wednesday supply. Costs equally elevated all through most of West Texas.

The features occurred even because the prolonged KM Tejas outage overlapped with the beginning of deliberate upkeep on Gulf Coast Specific Pipeline (GCX). GCX deliberate to scale back its pipeline capability to 1.2 Bcf/d on Tuesday and Wednesday and to 1.6 Bcf/d on Thursday and Friday.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

El Paso Pure Fuel (EPNG) additionally started work Tuesday on its Line 1300. The work, set to proceed till April 18, would shut in westbound flows via the Caprock N constraint, representing a minimize of roughly 520 MMcf/d.

Wooden Mackenzie stated a few of the gasoline not capable of move via KM Tejas was being rerouted to Tres Palacios Fuel Storage. Since KM Tejas’ upkeep started, the Permian Freeway Pipeline interconnects seen by Wooden Mackenzie point out that its deliveries have elevated by round 200,000 MMBtu/d.

“This uptick in deliveries is concentrated in Wharton County, TX, going to Tres Palacios,” stated Wooden Mackenzie analyst Quinn Schulz.

As for pricing, South Texas money wasn’t reflecting the elevated exercise. Tres Palacios spot gasoline ticked up just one.5 cents day/day to common $1.985.

Elsewhere throughout the Decrease 48, Henry Hub money edged up 3.5 cents to $2.190, setting the gradual tempo of motion for different U.S. places.

Within the Midwest, Customers Vitality slipped 2.5 cents to $2.110 and within the Midcontinent, Panhandle Jap dropped 4.5 cents to $1.775.

Money costs within the Northeast fell a bit extra in some places. Niagara plunged 20.0 cents to $1.650 for Wednesday’s gasoline day.

[ad_2]

Source_link