[ad_1]

Editor’s Be aware: This column is a part of an everyday sequence by trade veteran Brad Hitch for NGI’s LNG Perception devoted to addressing the complexities of the worldwide pure fuel market.

However the truth that temperatures in Northwest Europe can keep cool via April or later, March 31 is an efficient date to think about because the “finish of winter” for European fuel markets.

It’s precisely six months after the beginning of the standard European Gasoline 12 months below long-term contract buildings and represents the final day of bodily supply for Winter TTF seasonal contracts.

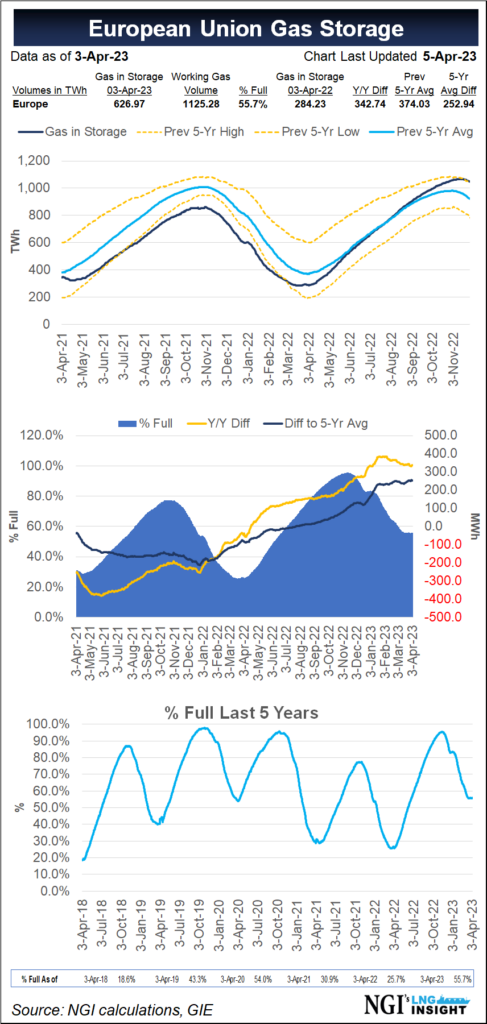

In my final column, we touched on the excessive ranges of storage that Europe is carrying into the summer season injection season. We’re going to proceed the present sequence masking totally different elements of worldwide fuel fundamentals by trying on the context of these storage ranges and their potential impression on the LNG market in the USA and elsewhere.

As a way to assist set the context, it’s in all probability worthwhile to first cowl two extra structural options of the European fuel market.

Iberia vs Northwest Europe

The primary structural characteristic to level out is that there’s minimal pipeline connectivity between the Iberian Peninsula and the nations in Northwest Europe. The tough problem of establishing pipelines below the Pyrenees Mountains has created a chokepoint for pure fuel stream between Spain and France. The fuel interconnection capability between Iberia and France equates to lower than 0.75 Bcf/d of bi-directional stream. Lower than half of that’s used on a constant foundation.

Missing easy accessibility to the bigger European Union wholesale market, and with out significant manufacturing of its personal, Spain constructed its pure fuel trade on the again of Algerian pipeline imports and liquefied pure fuel. Isolation from Northwest Europe means being disconnected from German and Dutch fuel storage, in addition to from Norwegian, Russian and UK imports.

Spain has represented 20% of LNG imports into Europe over the previous few years and has been essentially the most constant purchaser of the super-chilled gas amongst European nations. The implication of this isolation for U.S. fuel market analysts is that actions from Spain and Portugal will impression the decision on U.S. LNG manufacturing throughout the bigger context of worldwide LNG fundamentals somewhat than as a part of market dynamics that play out inside the remainder of Europe.

With that in thoughts, we are going to cowl particulars of Spain and its sometimes lively reloading market a bit later within the sequence after we think about Mediterranean LNG and African producers.

Robust Seasonality

The second factor to contemplate when evaluating the European fuel market is its pronounced seasonality – or extra particularly the heavy use of pure fuel for heating and the absence of the summer season cooling demand peaks that you just see in the USA and different elements of the world.

Winter demand in Germany, France and Austria usually exceeds summer season demand by three to 4 instances at its peak. This might change over time with insurance policies concentrating on the part out of gas-fired heating. For now, although, the function of pure fuel throughout the winter is properly established, and its implications on summer season fuel dynamics are fairly clear. Storage injections are a major a part of the demand for European fuel throughout the summer season.

On the Margin Going Ahead?

With out the existence of a summer season demand peak and no want – and even the power – to inject giant quantities of fuel into storage this season, will LNG proceed to be on the margin for LNG demand and worth formation all through the summer season?

Within the earlier column we famous that Europe was approaching the tip of withdrawal season with extra fuel in storage than any 12 months since 2020. Since then, we’ve seen a sequence of small injections leaving European fuel in storage larger than 2020 by roughly 12 TWh. With out the discount of Russian provide Europe wouldn’t be offering any demand pull for LNG imports in 2023. It might in all probability be a little or no cushion within the occasion of an oversupplied market just like the one in 2020 too.

If Europe wants a lot much less fuel to fill storage in 2023 than in 2022, then it’s going to want some mixture of provide cuts and demand restoration to take care of the identical pull on the LNG market. Let’s think about these prospects in flip.

Non-LNG Imports

Exterior of Russia, the first sources of fuel manufacturing for Northwest Europe are Norway, the UK and the Netherlands. During the last 20 years, Norwegian manufacturing has develop into dominant as Dutch and UK volumes have tailed off.

UK manufacturing specifically is way decrease than it was just some years in the past. Nevertheless, it appears to have stabilized as of late and isn’t anticipated to make an impression this 12 months.

Norway elevated manufacturing by 8 billion cubic meters (282 Bcf) in 2022, with essentially the most dramatic year-over-year will increase coming throughout the summer season injection season.

The Norwegian authorities has at all times maintained a degree of management over most fuel manufacturing through the allow licenses of its largest fields. The manufacturing will increase throughout the summer season of 2022 have been in response to the Russian fuel cuts. The Norwegian Petroleum Directorate has indicated that present ranges are sustainable and more likely to be saved in place for the subsequent few years.

With out a lot change anticipated from different sources of regional fuel manufacturing, the largest distinction in pipeline imports this injection season will come from the lack of most Russian imports that remained final summer season. Russian volumes have been considerably down by April of final 12 months after which dropped precipitously to succeed in present ranges by the beginning of the winter. If Russian pipeline imports keep their present ranges, then Europe could be lacking roughly 111 million cubic meters/day, or over 3 Bcf/d of provide in comparison with final 12 months.

LNG To Steadiness

As I’ve mentioned, European storage ranges are getting into injection season at historic highs, and the injection necessities for the summer season are dramatically decrease.

Europe injected just below 776 TWh into storage in 2022, of which 692 TWh was injected by the tip of September. As a way to attain the utmost of 1,019 TWh achieved in November 2022, Europe would solely have to inject about 444 TWh over the course of this summer season. Leaving out the early winter injections to take care of an apples-to-apples comparability, summer season injections needs to be about 1.3 TWh or roughly 4.7 Bcf/d decrease than in 2022.

When trying on the upcoming summer season, due to this fact, the lowered want for injections ought to offset the year-over-year distinction in Russian imports with somewhat below 1.5 Bcf/d to spare.

This leaves us with two observations. The primary is that full storage by itself will create extra consolation in 2023, however when set in opposition to the roughly 10 Bcf/d of European imports in 2022, it won’t push a lot LNG again in the direction of the USA.

The second is that if LNG accessible for Europe have been held equal to final 12 months, there would solely be sufficient to revive about half of the European demand that was shut-in throughout the summer season of 2022 amid hovering costs. In different phrases, the approaching months can be very fascinating from an analytical perspective.

Northwest Europe ought to as soon as once more be very a lot within the International LNG price-setting combine, however in a much more nuanced manner than earlier than. Relatively than final 12 months’s “purchase it at any worth.” or 2020’s “promote it at any worth” strategy, the LNG market might discover stability on particular pockets of European demand or vice-versa.

In different phrases, when enthusiastic about the prospects for European costs this summer season, we are going to want to consider international LNG provide and demand, and the buildup of floating and in-tank inventories in Asia.

With that in thoughts, the subsequent column will start analyzing the massive Asian demand facilities by looking on the LNG market in China.

Brad Hitch has spent greater than 23 years working in LNG and pure fuel buying and selling from London and Houston. He at present works as an adviser to new market entrants, and he has held senior buying and selling and origination positions at Barclays, Cheniere Vitality Inc., Enron Corp., Merrill Lynch and Williams. With expertise that features establishing one of many first LNG buying and selling desks, he has participated in numerous phases of the worldwide fuel market’s evolution. Throughout his time at Merrill Lynch, he labored as head strategist on the European fuel desk and led an initiative to enter the LNG buying and selling market. Previous to returning to Houston, he labored for Cheniere in London and was primarily answerable for establishing and managing a spinoff buying and selling perform. He holds an MBA from the Wharton Faculty on the College of Pennsylvania and a BA from the College of Kentucky.

[ad_2]

Source_link