[ad_1]

As corporations like Tree Power Options GmbH (TES) and HIF World work to construct large-scale manufacturing and export hubs for hydrogen in the US and Europe, executives mentioned the following era of fuels would possible must be supported by present pure gasoline infrastructure.

TES CEO Marco Alverà, talking on a panel this week at CERAWeek by S&P World, mentioned plans to construct a world hydrogen market would speed up decarbonization efforts, however there are preliminary technical challenges to transporting and introducing the gasoline to markets.

For TES, Alverà mentioned, the answer can be “piggybacking” on gasoline infrastructure, utilizing carbon dioxide (CO2) sequestered in carbon seize initiatives to combine with its hydrogen produced with renewable electrical energy. The outcome can be a net-carbon zero gasoline just like pure gasoline, also known as syngas or e-methane. Combining with CO2 permits e-methane for use in conventional pipeline infrastructure and LNG gear.

[Decision Maker: A real-time news service focused on the North American natural gas and LNG markets, NGI’s All News Access is the industry’s go-to resource for need-to-know information. Learn more.]

“What we’re doing is taking that stranded asset and taking it into the longer term as a endlessly asset, just like the Roman aqueducts,” Alverà mentioned.

As liquefied pure gasoline importers put money into superior turbine know-how that permits for CO2 to be captured from cargoes as they’re regasified, Alverà mentioned most terminals can be able to separating e-methane again into clear hydrogen.

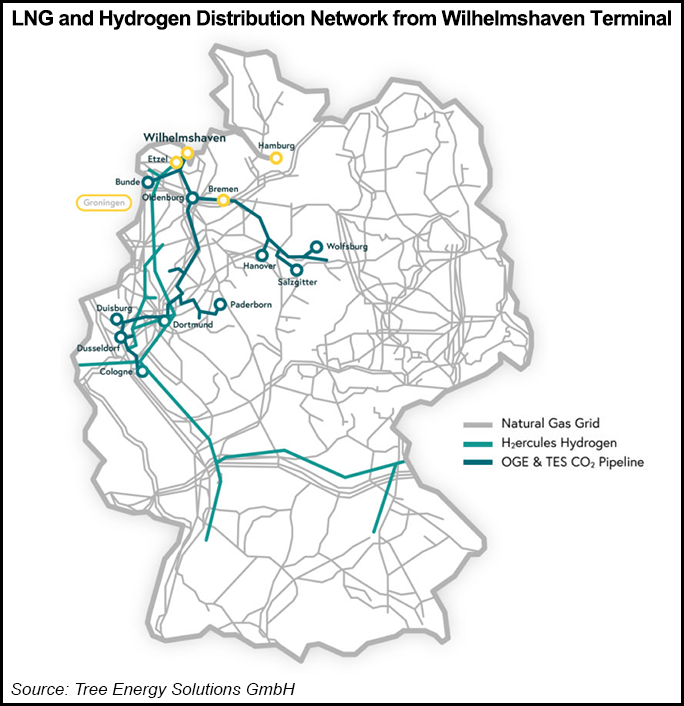

Belgium-based TES additionally has been growing extra LNG import capability for Germany. Its inexperienced power hub deliberate for the port of Wilhelmshaven, Germany, is anticipated to obtain the nation’s fifth floating storage and regasification unit (FSRU) someday this fall.

The FSRU chartered from Excelerate Power Corp. is contracted to supply 5 Bcm/yr of regasification capability for Germany over the following 5 years. Concurrently, TES is planning to put in electrolysers and storage and distribution infrastructure to show Wilhelmshaven right into a key hydrogen distribution level for Western Europe. A remaining funding choice is anticipated by the tip of the yr, with first hydrogen imports focused for 2025.

HIF government director Meg Light, former CEO of Tellurian Inc. and a previous government with Cheniere Power Inc., mentioned producers of other fuels additionally must make the most of plant design and market fundamentals from the LNG trade to launch efficient companies.

“We’re not within the enterprise of making new markets, and that’s why the e-fuels avenue has been so essential,” Light mentioned. “The hydrogen market might turn into a commodity market by itself, however that’s going to take time. So, we have to produce a product that the market is shopping for immediately.”

HIF launched manufacturing at a Chile plant on the finish of final yr that produces hydrogen from the nation’s wind and photo voltaic electrical energy to transform into car gasoline by combining it with CO2. HIF additionally has a tentative settlement with Baker Hughes Co. to develop direct air seize know-how for its Chile website or a proposed challenge for Matagorda County, TX. It additionally disclosed an settlement to order manufacturing capability with Siemens Power AG for gear for use on the potential Texas plant.

Together with entry to renewable electrical energy and the areas of land often required to website renewable initiatives, Light mentioned HIF additionally needed to contemplate the place it may discover a important supply of CO2 to supply its fuels.

“That is what initially drew our consideration to the Gulf Coast,” Light mentioned. “Texas has about 700 million tons a yr of CO2 emissions that must be utilized and captured.”

[ad_2]

Source_link