[ad_1]

Pure gasoline ahead costs escalated throughout the Decrease 48 all through the Feb. 23-March 1 interval, with a continuation of winter storms fueling sharp premiums on the West Coast, in line with NGI’s Ahead Look.

April ahead costs remained low general as benchmark Henry Hub stood Wednesday at $2.819/MMBtu. That has prompted some energy mills to make the swap to pure gasoline from coal to fulfill electrical energy demand. Freeport LNG additionally continues to absorb extra deliveries of gasoline to feed its liquefied pure gasoline terminal. As well as, some technical momentum has come into play in current days.

Nonetheless, it’s harsh late-season chilly, continued pipeline constraints, years of underinvestment in infrastructure and lagging West Coast storage inventories that helped propel April costs in California to greater than double Louisiana’s Henry Hub.

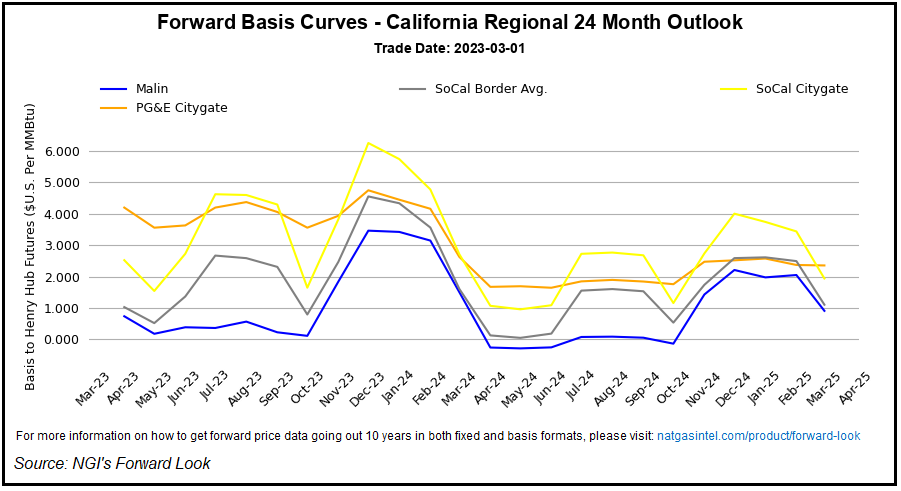

As of Wednesday, PG&E Citygate’s April contract stood at $7.008, up $1.220 via the interval, Ahead Look information confirmed. Costs remained robust throughout the curve, with the total summer season strip (April-October) climbing $1.170 to $7.110. The winter 2023-2024 strip was edging up 98.0 cents to $8.008.

For comparability, the vast majority of U.S. places put up worth features of lower than 50 cents on the entrance of the ahead curve and smaller will increase additional out, Ahead Look information confirmed. Costs have been seen principally within the $3.00-4.00 vary.

Not like the remainder of the nation, although, the West Coast has acquired the lion’s share of bitter winter climate, with extra on the best way. Forecasters stated though a short break from the whiteout situations was anticipated on the finish of the workweek, snow was prone to return over the weekend. This winter blast is the newest in a collection of storms that has pummeled the area, resulting in a pointy downturn in area storage inventories as demand and costs have skyrocketed.

The Power Info Administration (EIA) stated Thursday shares within the Pacific have been down one other 9 Bcf to solely 99 Bcf as of Feb. 24. That is 166 Bcf under year-ago ranges and 176 Bcf under the five-year common.

To place this into perspective, the South Central area, which is house of the overwhelming majority of LNG exports, hit a surplus of 625 Bcf above year-ago ranges and 660 Bcf above the five-year common as of Feb. 24.

Administration for Pacific Gasoline & Electrical Corp., (PG&E) which reclassified 51 Bcf to base gasoline versus working gasoline in 2021, mentioned the document costs this winter and the affect on prospects. CEO Patricia Poppe stated throughout a quarterly name with buyers the San Francisco-based firm is “laser centered on affordability” and analyzing prospects’ payments.

“We’ve got plenty of alternatives to remove waste, enhance our prospects’ expertise, make our system cleaner and extra resilient, all of the whereas lowering prices,” she stated.

Stronger ahead costs additionally have been seen in Southern California, the Desert Southwest and all through the Rockies.

SoCal Citygate April costs rose 75.0 cents via the week to hit $5.333, in line with Ahead Look. The summer season picked up 68.0 cents to common $6.310, whereas the winter 2023-2024 tacked on 96.0 cents to common $8.685.

Within the southern a part of the state, specifically, costs have been subjected to a drastic reduce in provide stemming from pipeline upkeep.

As beforehand mentioned by NGI, the aid the state acquired from the return of El Paso Pure Gasoline’ Line 2000 was quick lived. Sooner or later after that line’s return, Southern California Gasoline (SoCalGas) reduce receipts from Transwestern-Needles by practically 0.5 Bcf/d. This in the end meant that this receipt level was utterly shut in, alongside a 280 MMcf discount in general operational capability for the Northern Zone.

Transwestern rerouted 75 MMcf immediately in the direction of SoCalGas and one other 125 MMcf onto PG&E for supply onto SoCalGas at Wheeler Ridge. Kern River Gasoline Transmission deliveries at Kramer Junction additionally confronted a 162 MMcf day/day enhance.

SoCalGas has not indicated when Line 235 might return to service.

As such, the corporate is prone to lean extra on its storage this summer season, in line with Wooden Mackenzie. SoCalGas whole inventories presently 14 Bcf under the previous five-year common and solely 3 Bcf above the previous five-year minimal.

Northwest Rockies April moved up 56.0 cents to $3.339, and the summer season rose 45.0 cents to common $3.320. The winter 2023-2024 strip averaged 69.0 cents greater via the interval to achieve $6.633.

Down, However Not Out

Although not as substantial as these on the West Coast, the remainder of the Decrease 48 posted worth will increase that have been extra in keeping with current adjustments alongside the Nymex futures curve.

After six days within the black, futures stumbled a bit on Thursday amid a hotter change within the climate fashions. Nonetheless, a pointy reversal within the climate information lent main assist to costs on Friday.

NatGasWeather stated after some massive discrepancies within the International Forecast System (GFS) and European Centre (EC) climate fashions, the 2 datasets aligned higher after the GFS’ noon run on Friday. Each present a lot colder-than-normal situations over many of the japanese two-thirds of the US for March 8-16. What’s extra, the longer-range EC projected unseasonably chilly air lingering via March 25. As such, storage estimates for the top of the month are prone to pattern down towards 1,850 Bcf.

“In fact, the injury inflicted by March chilly isn’t near the identical as January-February, however the sample nonetheless has the potential to lower surpluses modestly,” NatGasWeather stated. “…If the March 17-21 interval can maintain below-normal temperatures over a lot of the U.S. to maintain stronger-than-normal demand in place…the next open and a transfer over $3 could possibly be attainable.”

Regardless, the upcoming chilly snap might put an finish to the streak of below-average storage withdrawals outdoors of the West.

The EIA reported one other smaller-than-normal internet attract Thursday’s report. The company stated whole shares slipped by 81 Bcf, bringing inventories right down to 2,114 Bcf. That is 451 Bcf greater than final yr presently and 342 Bcf above the five-year common.

By area, the Midwest and East led with pulls of 31 Bcf and 28 Bcf, respectively, in line with EIA. Pacific inventories fell by 9 Bcf, whereas Mountain area shares declined by 7 Bcf. The South Central lower of 4 Bcf adopted and included a 3 Bcf pull from nonsalt amenities and a 1 Bcf lower in salts.

Early estimates for the following EIA report level to a different below-average draw. Nonetheless, the market might erase 80 Bcf from the storage surplus versus the five-year common over the following 4 storage stories, in line with EBW Analytics Group. The agency stated that is largely the results of colder March climate, in addition to coal-to-gas gasoline substitution within the energy sector, together with the sluggish restart of Freeport LNG.

The Freeport terminal on Thursday was taking in practically 1.3 Bcf/d of feed gasoline. The ability earlier this week requested federal regulators for approval to start industrial operations from Practice 1. Practice 3 has been restarted and is in full industrial operations. Practice 2 can be within the technique of restarting after the Federal Power Regulatory Fee granted approval final week.

On the availability aspect, manufacturing development seems to have tapered off. Common provide over the previous 15 days was down 0.9 Bcf/d from the primary half of January, in line with EBW. What’s extra, a number of exploration and manufacturing corporations have indicated they plan to scale back exercise in response to the lower cost atmosphere. Chesapeake Power Corp., Comstock Sources Inc., EQT Corp. and Southwestern Power Co. are among the many gassy producers that plan to drop rigs or might achieve this if costs keep decrease for longer.

“These are the primary steps of a bigger enterprise required to steadiness the market this yr,” stated East Daley Analytics’ Robert Wilson, vice chairman of analytics. “A part of the ‘drawback’ in performs just like the Haynesville Shale is that it’s onerous to hit the brakes on development.”

Wilson stated the discount in rigs helps, however the excessive preliminary manufacturing charges maintain gamers like Comstock rising regardless of the rig discount. “We have to take 2 Bcf/d off, so subdued development received’t do it.”

Wilson stated even decrease gasoline costs are wanted to steadiness the market.

As an alternative, the April Nymex gasoline futures contract settled Friday at $3.009, up 24.4 cents from Thursday’s shut.

With futures costs posting features in seven of the final eight buying and selling classes, the bullish tailwind from short-covering could also be fading, in line with EBW.

“Climate swings might ship Nymex gasoline above $3.00 – or again in the direction of the $2.50s” within the coming week, EBW senior vitality analyst Eli Rubin stated.

[ad_2]

Source_link