[ad_1]

Pure gasoline futures cast greater for a sixth consecutive session on Wednesday as merchants targeted on weakening manufacturing and forecasts for cold March situations. The April Nymex gasoline futures contract settled at $2.811/MMBtu, up 6.4 cents day/day. Could rose 8.0 cents to $2.943.

At A Look:

- Analysts see storage pull in 70s Bcf

- Mid-March forecasts present chilly air

- Indicators of easing manufacturing emerge

NGI’s Spot Gasoline Nationwide Avg. superior 53.5 cents to $3.765, powered by positive factors within the West.

Manufacturing on Wednesday fell under 98 Bcf/d, down from latest highs round 100 Bcf/d, in line with Bloomberg estimates. A number of U.S. exploration and manufacturing firms mentioned throughout latest earnings calls they doubtless would cut back output this 12 months following a gentle second half of winter and low costs relative to final 12 months. Regardless of the latest rally, immediate month costs are about half the extent of late 2022.

Decrease costs “function a sign for producers to curtail manufacturing progress to sustainable ranges,” mentioned Rystad Power analyst Ade Allen. He famous that as of mid-February, the extent of pure gasoline in Decrease 48 storage was about 15% above the five-year common, reflecting elevated manufacturing that peaked at a file degree above 102 Bcf/d late in 2022.

EBW Analytics Group’s Eli Rubin, senior analyst, mentioned manufacturing information this week pointed to decreases within the Permian Basin and Haynesville Shale. This helped spur the multi-day rally. Prospects for a comparatively chilly March and the return of the Freeport LNG facility in Texas add bullish tailwinds, he mentioned. Freeport, pushed out of fee after a hearth final summer season, started ramping again up in February and is on observe to return to full service round 2.38 Bcf/d this spring.

Rubin mentioned Freeport feed gasoline demand approached the 1.0 Bcf/d benchmark this week, signaling a full relaunch is nearing. This, he famous, would add considerably to every day demand for home pure gasoline that the export facility will ultimately ship to Europe, Asia and elsewhere.

He mentioned the present rally’s subsequent take a look at is the newest Power Data Administration (EIA) storage report, slated for launch at 10:30 ET Thursday.

Storage Expectations

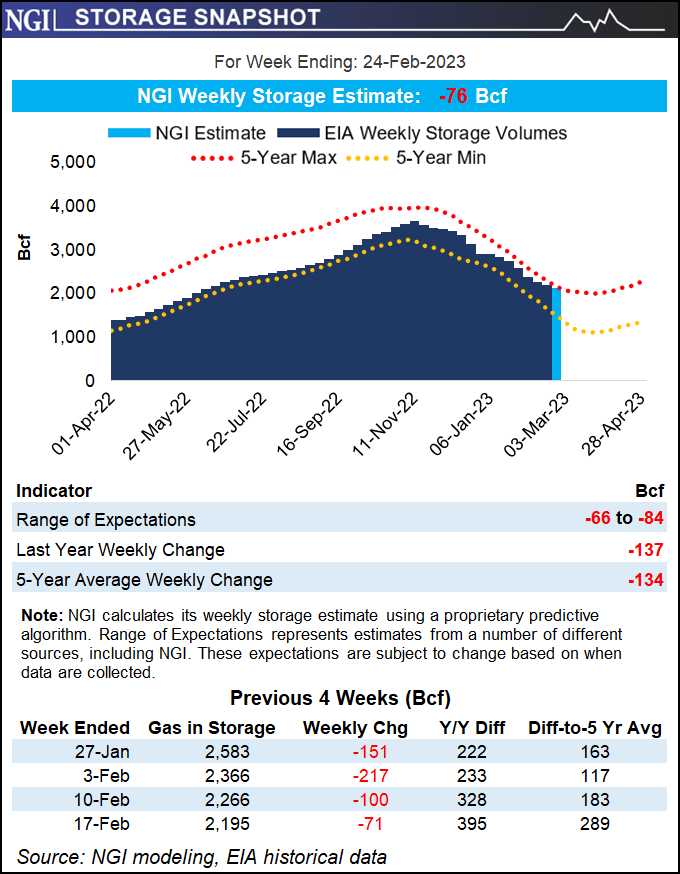

Forward of the report, a Reuters ballot confirmed withdrawal estimates starting from 66 Bcf to 84 Bcf, with a median pull of 76 Bcf. Bloomberg’s survey discovered a narrower span of estimates and landed at a median draw of 74 Bcf. A Wall Avenue Journal survey ranged from attracts of 66 Bcf to 78 Bcf and confirmed a mean draw of 74 Bcf. NGI modeled a 76 Bcf pull.

The estimates evaluate with an precise 137 Bcf withdrawal within the comparable week of 2022, whereas the five-year common pull is 134 Bcf.

EIA reported a withdrawal of 71 Bcf for the week ended Feb. 17. The end result lowered inventories to 2,195 Bcf, however it left shares properly above the year-earlier degree of 1,800 Bcf and the five-year common of 1,906 Bcf.

In the meantime, seasonally weak weather-driven demand, the perpetrator behind a number of anemic storage prints this 12 months, may choose up in March.

NatGasWeather mentioned Wednesday that following hotter developments for this weekend, new forecasts pointed to colder nationwide common temperatures throughout the eight- to 15-day timeframe.

Each the American and European fashions confirmed colder-than-normal temperatures over a lot of the nation for March 8-15, the agency mentioned.

The European mannequin remained “notably colder” than its American counterpart, by round 15-20 heating diploma days, NatGasWeather mentioned Wednesday. This “doubtless has the eye of merchants,” contemplating the European mannequin “traditionally has a bit greater talent rating.”

Subsequent mannequin runs will likely be “intently watched to see which of the 2 main climate fashions concedes to the opposite,” the forecaster added.

Money Costs Cruise

Spot gasoline costs pushed upward throughout the nation on Wednesday, led by positive factors in California and elsewhere within the West anticipated to see unseasonably chilly March climate.

PG&E Citygate jumped $2.740 day/day to common $12.360, whereas SoCal Citygate spiked $3.435 to $11.710.

Within the Rockies, Northwest Sumas gained $2.385 to $10.670 and Opal superior $3.185 to $11.245.

Maxar’s Climate Desk predicted below-normal temperatures would “span the vast majority of the U.S.” for the mid-March interval, with chilly air in components of California and freezing situations within the Rockies, Plains and Midwest.

“Excessive stress filters southward from Canada, supplying colder situations in addition to a drier than regular interval within the Midwest,” Maxar mentioned.

For the rest of this week and the begin to subsequent week, Maxar mentioned its newest forecast trended colder from the West to Texas. Hotter developments are more likely to canvass a lot of the East early within the interval, then shift colder later subsequent week.

“A ridge over the excessive latitudes, together with Alaska, helps to direct colder air southward, with a lot and robust belows being within the West,” Maxar mentioned. “The Japanese half likewise shares within the colder situations,” with the central Decrease 48 “falling a lot under regular and the East cooling to regular and barely under regular on the finish of the interval.”

Forward of that climate, costs within the East additionally climbed Wednesday, with Tenn Zone 6 200L among the many leaders after rising 31.0 cents to $3.535.

[ad_2]

Source_link