[ad_1]

Worth continued to erode in regional pure fuel forwards markets in the course of the Jan. 26-Feb. 1 buying and selling interval as forecasts confirmed this month was poised to hold over the identical warm-dominated themes which have collapsed costs winter-to-date.

March fastened costs at benchmark Henry Hub sank 44.7 cents to finish the interval at $2.473/MMBtu, and regional hubs all through the Decrease 48 adopted go well with by posting fastened worth reductions starting from round 20.0-90.0 cents, NGI’s Ahead Look information present.

A notable outlier was within the Pacific Northwest, the place March fastened costs at Northwest Sumas climbed 67.1 cents week/week to $4.490.

Digital bulletin board notices indicated congestion upstream on the Westcoast Vitality Inc. system in British Columbia in the course of the interval, together with an “unplanned pipeline isolation” within the T-South phase and warnings by the operator of probably “unhealthy” ranges of linepack.

Latest forecasts from Maxar’s Climate Desk, in the meantime, confirmed beneath regular temperatures overlaying western parts of the nation in the course of the 11- to 15-day time-frame in an in any other case delicate sample for the Decrease 48 as a complete.

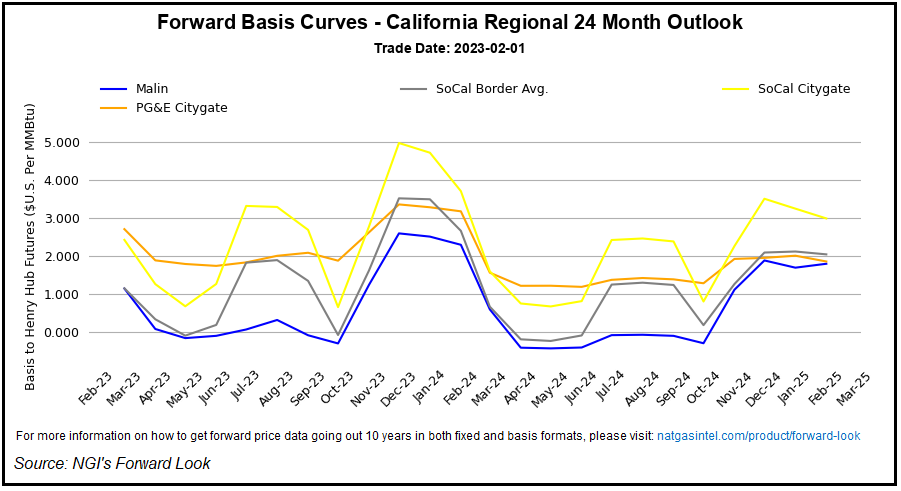

Different Western U.S. demand hubs, regardless of declining general, noticed stronger foundation differentials for the interval. Opal March foundation elevated to plus-90.3 cents, a 20.3-cent achieve week/week. Malin foundation equally gained 25.2 cents to finish at plus-$1.157. PG&E Citygate March foundation added 11.4 cents to achieve plus-$2.719.

Storage Cushion Poised To Develop

Nymex futures remained underneath downward strain in the course of the Jan. 26-Feb. 1 buying and selling interval as forecasts urged wintry circumstances early within the month of February would show fleeting.

Nonetheless, analysts recognized supportive elements at play, together with manufacturing declines, price-induced energy demand and indicators of progress towards a restart on the idled Freeport LNG terminal.

The March Nymex contract on Thursday eased 1.2 cents decrease to settle at $2.456. Costs remained underneath strain on Friday as forecasts provided little that might dispel bearish sentiment. The immediate month fell one other 4.6 cents to shut at $2.410.

“Whereas the preliminary precipitous losses to open the brand new yr had been the results of a structural transition from winter danger premiums to an oversupplied 2023 outlook, latest declines are extra weather-dependent,” EBW Analytics Group analyst Eli Rubin mentioned in a notice to shoppers Thursday. “If climate turns colder in early March, Freeport LNG lastly returns to service and low fuel costs stimulate coal-to-gas switching, the steep bearish run for pure fuel might stabilize within the 30 to 45 day interval.”

The year-on-five-year-average storage surplus swelled to 163 Bcf, or plus-6.7%, as of Jan. 27 following one other lighter-than-average withdrawal within the newest Vitality Info Administration storage report Thursday.

The prospect of a rising storage cushion on usually delicate temperatures was permitting markets to look previous near-term weather-related disruptions, in line with Rubin.

“Icy storms are creating havoc with greater than 400,000 energy outages throughout Texas and greater than 5.0 Bcf/d of manufacturing losses nationally,” Rubin mentioned. “Regardless of the demonstrated challenges from the chilly climate — and renewed dangers to grid reliability on a neighborhood, if not wholesale, degree — forward-looking vitality markets seem largely unperturbed.”

That lack of perturbation coincided with a pleasantly delicate temperature outlook for key weather-driven demand markets by the tip of the weekend, with the comfy circumstances extending into mid-February.

“There’s nonetheless sturdy nationwide demand by means of Saturday as a frigid reinforcing chilly shot sweeps throughout the Nice Lakes and Northeast the subsequent few days,” NatGasWeather advised shoppers Thursday.

The freezing rain and energy outages over Texas added to the near-term wintry circumstances, the agency mentioned.

“However like all situations thus far this winter, a frosty U.S. sample is barely capable of final 5 to 6 days earlier than a a lot hotter sample is fast to comply with,” NatGasWeather mentioned. The most recent forecasts confirmed an “exceptionally heat and bearish sample” on faucet for the upcoming week, ensuing from “sturdy excessive strain ruling the southern and jap halves of the U.S. with highs of 50s to decrease 80s, or 10-30 levels above regular.”

The exceptionally heat outlook into mid-February undercut the prospect of costs stabilizing on a tightening within the provide/demand steadiness, NatGasWeather added. The agency pointed to manufacturing declines and “pure fuel gaining share of the vitality stack attributable to plunging” costs as key drivers of the tighter balances.

Ahead Strip ‘Too Wealthy’?

In the meantime, wanting past the heating season, amid indications of oversupply, the macro perspective doesn’t seem to supply a lot hope on the horizon for bulls.

“Whereas the immediate has approached our preliminary goal of $2.50-2.75, the 2023 and 2024 strip nonetheless appears to be like too wealthy in our view at round $3.26 and $3.70, respectively,” analysts at Tudor, Pickering, Holt & Co. (TPH) mentioned. “Investor conversations are selecting up round the necessity to pressure costs towards shut-in economics to curb extreme stock builds into October.”

The agency’s most up-to-date modeling for 4.3 Tcf in storage by end-October “might current that danger. We see restricted incremental provides coming to meaningfully loosen weather-adjusted market steadiness forward of the summer season,” the TPH analysts mentioned.

The strip might ultimately must drop beneath the $3 mark so as to “pressure sufficient rigs out of the market to push dry fuel provide towards upkeep,” in line with the agency. Even then, “related fuel development continues to outpace demand in our view by means of 2024.”

[ad_2]

Source_link