[ad_1]

Pure fuel remains to be anticipated to dominate the worldwide power combine and help decarbonization into the center of the century regardless of current market volatility, however the world’s present power crunch might be accelerating LNG’s place because the commerce of alternative, in response to researchers from the Fuel Exporting International locations Discussion board (GECF).

In a not too long ago printed International Fuel Outlook report, researchers once more estimated that pure fuel will maintain the biggest portion of the worldwide power combine in 2050, rising from 23% final yr to 26%. Nonetheless, how that fuel might attain end-users sooner or later might be altering extra shortly resulting from current geopolitical occasions.

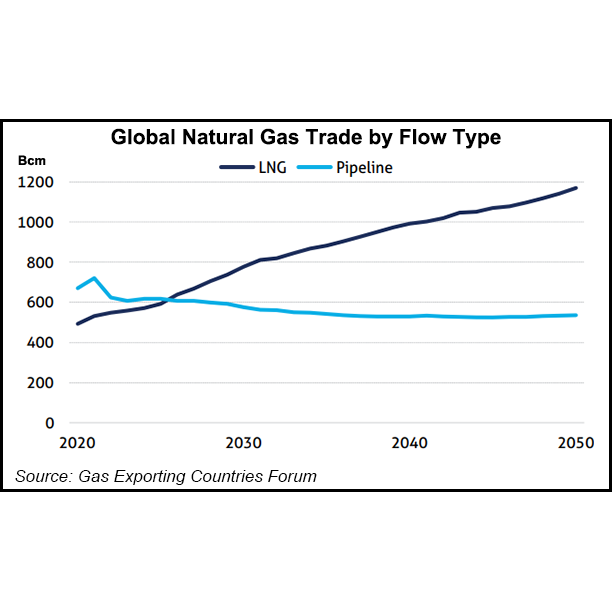

GECF researchers beforehand estimated liquefied pure fuel might account for lower than half of all world fuel transactions in 2030 earlier than pushing to 56% by 2050. Within the newest report, researchers now count on LNG commerce to surpass pipeline volumes as quickly as 2026. LNG commerce is predicted to greater than double traded pipeline volumes by 2050, reaching an estimated 1,170 billion cubic meters/yr (Bcm/y).

“With home manufacturing declining in a number of the Asia-Pacific international locations and Europe, and with pipeline exports to Europe additionally declining, LNG is gaining momentum and turning into the popular pure fuel provide supply,” researchers wrote within the report.

The GECF is a world governmental group headquartered in Doha, Qatar, and made up of 19 member international locations. The group publishes an annual forecast monitoring adjustments and expectations for world fuel markets and manufacturing into 2050.

Since Russia’s invasion of Ukraine final yr, pipeline imports from Russia to Europe have dwindled to a trickle and world costs for LNG have trended upward. GECF researchers famous the shuffle of provide dynamics is also fueling infrastructure investments wanted to fulfill future fuel demand.

Complete LNG export capability grew from 270 million metric tons/yr (mmty) in 2010 to 462 mmty on the finish of 2021. By 2050, LNG export might double to 1,026 mmty. By 2050, LNG regasification capability can be projected to virtually double in comparison with present ranges to round 1,840 mmty.

GECF researchers steered that the acceleration of LNG’s market dominance and rising infrastructure might additionally additional solidify “a world fuel market” before anticipated.

LNG costs are anticipated to stay unstable and markets extremely aggressive, at the least till extra export capability turns into obtainable after 2026. Nonetheless, researchers additionally predicted European, Asian and Latin American costs to converge extra intently as areas transfer to additional combine fuel programs.

“Regional fuel markets, which have weaker connectivity, are anticipated to turn out to be strongly built-in after 2035 as speedy LNG capability growth, transportation and buying and selling networks – together with large-scale export pipeline initiatives – help market integration,” researchers wrote.

Regardless of current concentrate on Europe, researchers estimate Asia will proceed to be the biggest LNG importing area into 2050. Rising international locations, particularly in South and Southeast Asia, will drive LNG development as power demand will increase throughout the areas. Round 60% of the world’s complete LNG regasification can be in Asia Pacific and 20% can be in Europe.

‘An Further Vector’ for Pure Fuel

Whereas the worldwide LNG business is predicted to stay worthwhile into 2030, researchers wrote “diverging trajectories of power transitions for every area and sub-region is perhaps difficult.” LNG business funding is predicted to dip via 2040 as capability turns into obtainable and renewables ramp up.

Pure fuel use in producing electrical energy is predicted to develop extra slowly into 2050 than renewables and different sources. Nonetheless, researchers famous the power transition assured fuel could have an extended life than different fossil fuels.

Using carbon seize utilization and storage (CCUS) is predicted to make pure fuel a viable possibility for decreasing carbon emissions and can enable international locations to transition to hydrogen manufacturing. Fuel use in producing hydrogen with decreased carbon depth, known as blue hydrogen, is predicted to account for 205 Bcm/y of worldwide fuel demand by 2050. Center Jap and European international locations are anticipated to account for 55% of the rise in fuel demand from blue hydrogen.

In 2021, 62% of the world’s hydrogen was produced from pure fuel with inexperienced hydrogen – zero carbon or net-carbon hydrogen made by electrolysis – made up lower than 1% of worldwide manufacturing. In 2022, the International CCS Institute reported that 40 hydrogen services outfitted with CCS are at numerous levels of growth.

“Blue hydrogen era can be a further vector for elevated fuel use, given international locations’ efforts to scale up the deployment of low-carbon hydrogen in power programs,” researchers wrote. “Blue hydrogen can be engaging because of the maturity of the expertise, decrease value and synergy with pure fuel infrastructure.”

[ad_2]

Source_link