[ad_1]

World oil demand is falling, however pure fuel prospects, together with for LNG, will depend upon the velocity of the power transition, with rising consumption in rising economies anticipated to be offset by the developed world’s decrease carbon sources, in accordance with BP plc.

The BP Power Outlook 2023, the annual report by the supermajor, focuses on Accelerated, Internet Zero and New Momentum situations. The outlook will not be a forecast, nor what BP wish to occur, however relies on current applied sciences.

Two main developments final 12 months upended the 2022 forecast, the Russia-Ukraine conflict and the U.S. Inflation Discount Act, mentioned BP’s chief economist Spencer Dale. He mentioned the implications of the outlook throughout a webcast.

[2023 Natural Gas Price Outlook: How will the energy industry continue to evolve in 2023? NGI’s special report “Reshuffling the Deck: High Stakes for Natural Gas & The World is All-In” offers trusted insight and data-backed forecasts on U.S. natural gas and the global LNG markets. Download now.]

An Power Trilemma

“From an power perspective, the disruptions to Russian power provides and the ensuing international power shortages appear prone to have a cloth and lasting affect on the power system,” Dale mentioned. “World power insurance policies and discussions lately have been centered on the significance of decarbonizing the power system and the transition to internet zero. The occasions of the previous 12 months have served as a reminder to us all that this transition additionally must take account of the safety and affordability of power.

“Collectively, these three dimensions of the power system – safety, affordability, and sustainability – make up the power trilemma. Any profitable and enduring power transition wants to handle all three components of the trilemma.”

BP’s Outlook makes use of three fundamental situations: Accelerated, Internet Zero and New Momentum. The situations span a variety of the attainable outcomes over the subsequent 30 years.

“The persevering with rise in carbon emissions and the rising frequency of maximum climate occasions lately spotlight extra clearly than ever the significance of a decisive shift towards a net-zero future,” Dale mentioned.

Power demand is seen evolving over the subsequent three many years, with using fossil fuels declining, changed by a rising share of renewables and electrification. BP is forecasting rising alternatives in low-carbon hydrogen, bioenergy, in addition to carbon seize, use and storage.

“Oil demand declines over the outlook, pushed by falling use in street transport because the effectivity of the automobile fleet improves and the electrification of street autos accelerates,” in accordance with BP. “Even so, oil continues to play a significant function within the international power system for the subsequent 15-20 years.”

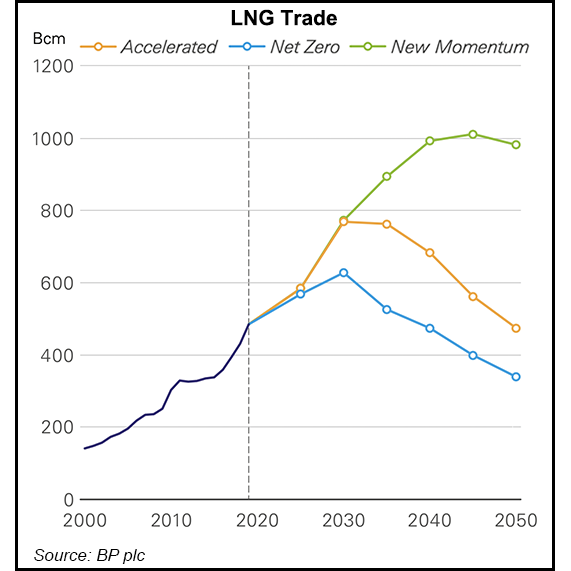

Within the close to time period, BP expects the liquefied pure fuel commerce to climb sharply, however the “vary of uncertainty widens put up 2030 with persevering with demand…in rising markets as they develop and industrialize, offset by falling import demand in developed markets as they transition to decrease carbon power sources.”

Over the subsequent 10 years, BP is predicting the LNG commerce to extend by round 60% in New Momentum and Accelerated situations, and by one-third in Internet Zero.

“A lot of this development is pushed by rising fuel demand in rising Asia (China, India, and different growing Asian markets), as these nations change away from coal and, outdoors of China, proceed to industrialize. LNG imports are the primary supply for this rising use of pure fuel, accounting for 65-75% of the rise in fuel consumed in rising Asia out to 2030 throughout the three situations.”

Past 2030, LNG Questions

Nonetheless, the LNG outlook is “extra unsure post-2030.”

Starting within the early 2030s, BP expects fuel demand to say no within the Accelerated and Internet Zero situations by rising electrification and the fast development in renewable power.

“The decline is simply partially offset by the rising use of pure fuel to supply blue hydrogen,” economists mentioned. “By 2050, pure fuel demand is round 40% decrease than 2019 ranges in Accelerated and 55% decrease in Internet Zero.

In BP’s New Momentum forecast, international fuel demand might proceed to develop out to 2050, “pushed by rising use in rising Asia and Africa. A lot of this development is within the energy sector because the share of pure fuel consumption in energy technology in these areas grows and general energy technology will increase robustly.”

Within the New Momentum situation, worldwide fuel consumption in 2050 “is round 20% above 2019 ranges,” in accordance with BP.

“The vary of the distinction in international fuel demand in 2050 throughout the three situations, relative to present ranges, is bigger than for both oil or coal, highlighting the sensitivity of pure fuel to the velocity of the power transition.”

LNG exports would proceed to be dominated by america and the Center East, BP is forecasting, with the “prospects for Russian LNG exports scarred” by the conflict.

“The expansion in international LNG demand out to 2030 is met by a considerable growth of exports from the U.S. and Qatar,” economists mentioned.

“Development in U.S. LNG exports account for greater than half of the rise in international LNG provides out to 2030 in New Momentum and Accelerated and round two-thirds of general development in Internet Zero. Rising exports from the Center East account for a lot of the rest.”

BP is forecasting that by 2030, america and the Center East collectively would account for round one-half of worldwide LNG provides, in contrast with round one-third in 2019.

The decline in LNG exports within the second half of BP’s Outlook, within the Accelerated and Internet Zero situations, “is borne disproportionately by the U.S.,” economists mentioned.

“U.S. LNG exports fall by greater than a half between 2030 and 2050 in these two situations, reflecting the rising competitors and the upper transport prices for U.S. provides to the remaining demand facilities in Asia relative to the price of LNG from the Center East and Africa.”

In the meantime, Australian LNG exports decline post-2030 “in all three situations, reflecting rising prices and constraints on upstream pure fuel manufacturing in Australia.”

Carbon Price range ‘Working Out’

Concerning the transition to net-zero carbon, Dale mentioned there have been severe issues. The Outlook identifies facets of the transition which can be widespread throughout the primary situations to assist form “core beliefs” about how the power system might evolve over the subsequent 30 years.

“The carbon price range is operating out,” Dale famous. “Regardless of the marked improve in authorities ambitions, carbon dioxide emissions have elevated yearly” because the United Nations local weather accord was reached in late 2015, aside from 2020, when Covid slammed demand.

“The longer the delay in taking decisive motion to scale back emissions on a sustained foundation, the higher are the possible ensuing financial and social prices,” Dale mentioned. “Authorities help for the power transition has elevated in quite a lot of nations, together with the passing of the Inflation Discount Act in america.

Nonetheless, mentioned Dale, the “scale of the decarbonization problem suggests higher help is required globally, together with insurance policies to facilitate faster allowing and approval of low-carbon power and infrastructure.”

[ad_2]

Source_link