[ad_1]

The American Petroleum Institute (API) emphasised the U.S. function as an vitality chief because it outlined steps lawmakers ought to take to “make, transfer and enhance” the oil and fuel trade at a latest occasion.

“Prior to now yr, the worldwide vitality disaster, pushed by surging post-pandemic demand outstripping provide and exacerbated by Russia’s invasion of Ukraine, has proven that the world wants American vitality management now greater than ever,” stated CEO Mike Sommers earlier this month.

Sommers referred to as on the 118th Congress to elevate restrictions on pure fuel and oil improvement in federal waters to satisfy rising demand within the post-Covid-19 period.

[2023 Natural Gas Price Outlook: How will the energy industry continue to evolve in 2023? NGI’s special report “Reshuffling the Deck: High Stakes for Natural Gas & The World is All-In” offers trusted insight and data-backed forecasts on U.S. natural gas and the global LNG markets. Download now.]

He was joined by API’s Frank Macchiarola, senior vp (SVP) of Coverage, Economics and Regulatory Affairs.

“We’re calling for options that assist transfer American vitality,” Macchiarola stated. He cited specializing in essential infrastructure tasks within the nationwide curiosity, supporting pipeline security, “accelerating LNG exports, and itemizing provide chain bottlenecks to make sure the free move of vitality and commerce.”

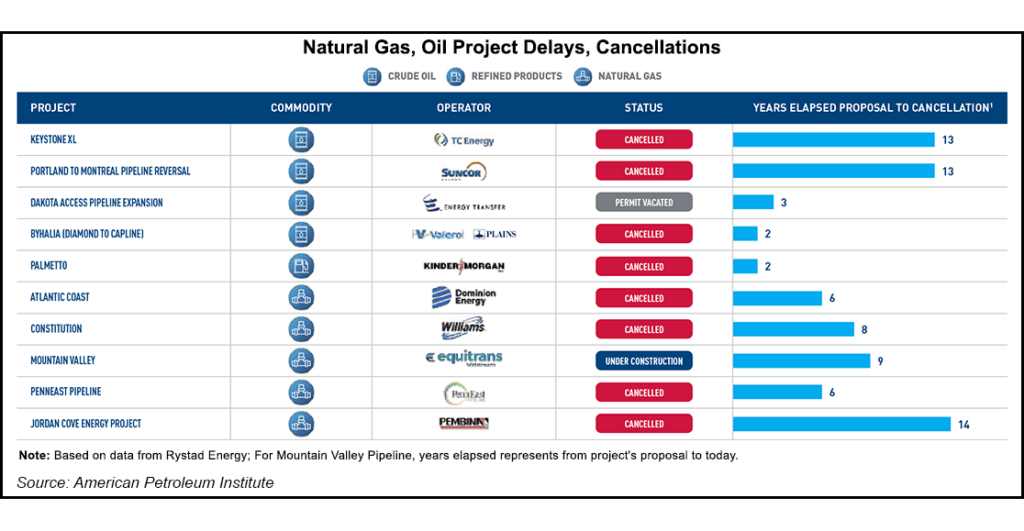

The API, which issued a 2023 State of American Power Report on the occasion, famous that during the last 15 years, 10 main pure fuel and oil infrastructure tasks in Appalachia have been canceled or delayed. These tasks, if pushed ahead, would have supported 4.6 Bcf/d in manufacturing and represented about $34 billion in capital expenditures, based on API.

The image for U.S. LNG permits has been even bleaker, API stated in its report.

The U.S. Division of Power (DOE) takes about 25 instances longer to approve permits for tasks designated for non-free commerce settlement (FTA) international locations than it does for tasks which might be searching for to export liquefied pure fuel to international locations that maintain a FTA. Allowing maintain ups have left about 20.9 Bcf/d of non-FTA allow functions up within the air, the group stated.

Nonetheless, firms don’t sanction tasks with out sufficient contracting.

API’s plan to maneuver LNG tasks, nonetheless, seeks to simplify and expedite the method. The group referred to as for Congress to “amend the Pure Fuel Act to streamline the evaluation course of for all LNG tasks to a single approval by the U.S. Division of Power.”

Governmental Ups And Downs

That stated, Sommers added that the political rhetoric from the Biden administration is regarding, significantly “about the truth that they don’t consider we’re going to wish oil and fuel in 10 years…Why would somebody construct a brand new facility if the federal government is saying that we’re not going to wish these amenities sooner or later?”

The API, nonetheless, was inspired by the outcomes of the Biden administration’s Inflation Discount Act (IRA), famous Macchiarola. IRA incentives for leasing within the Gulf of Mexico (GOM) could posit excellent news for the trade. Sen. Joe Manchin (D-WV), he famous, “ensured that we’d have two lease gross sales this yr,” with one in March, and one other within the fall.

Federal GOM dry pure fuel manufacturing has declined in recent times partially becaus of cheaper drilling onshore. The GOM additionally has getting old wells and rising manufacturing prices, based on the U.S. Power Info Administration (EIA). EIA stated late final yr it anticipated new tasks would solely partially offset manufacturing declines transferring ahead.

With the IRA, nonetheless, “We’re hopeful that the availability that ties wind lease gross sales to grease and fuel lease gross sales, actually pushes the administration to incorporate extra lease gross sales within the Gulf going past 2023,” Macchiarola stated.

Different bonuses for the trade within the IRA includ the growth of the Inside Income Service Part 45Q tax credit score for carbon seize and sequestration. API famous, although, that extra clarification is required.

API reported that elevated pure fuel use has contributed to a 60% discount within the U.S. electrical energy era sector on account of energy crops switching from coal to fuel, and extra reductions may come from the carbon seize incentives included within the IRA, as long as the tax credit are applied effectively.

Addressing NEPA

API additionally advocated for allowing reform to be on the prime of the ticket for U.S. lawmakers to deal with in 2023. This would come with revising the Nationwide Environmental Coverage Act (NEPA) and making certain environmental critiques are accomplished inside two years.

NEPA’s impacts attain farther than oil and fuel infrastructure, API famous. Wind farms, airports and traffic-related infrastructure are all impacted when environmental impression statements take “four-and-a-half years to finish, and 25% of accomplished impression statements” can take greater than six years, based on API.

“In all, $157 billion in vitality funding is ready within the NEPA pipeline, and a two-year NEPA evaluation time restrict may spur $67 billion in vitality funding,” the report reads.

Sommers added that U.S. oil and fuel manufacturing, whereas anticipated to proceed to get better from the Covid-19 hunch in 2023, could also be barely stymied by provide chain points, workforce challenges and the exploration and manufacturing corporations’ elevated fiscal self-discipline amid “tough financial circumstances.”

Prior to now yr, oil and fuel producers have added “184 new rigs, so manufacturing goes up, and we’re producing about 12.1 million b/d.

“There are a few circumstances within the market proper now that proceed to hinder American oil and fuel improvement…individuals are having hassle getting the workforce that they should proceed manufacturing,” Sommers stated.

“They’re additionally dealing with provide chain points, significantly in relation to metal, which is a key part to drilling exercise,” the CEO added.

API stated it might suggest President Biden rescind metal tariffs that had been enacted in the course of the Trump administration, which have an effect on about $7 billion/yr in metal imports. Power firms, based on the group, spend $9.5 billion/yr on metal for drilling, and $4.8 billion/yr on metal for pipelines.

One main issue impacting the trade “is the shortage of entry to capital,” Sommers stated.

The CEO famous that the Federal Reserve Financial institution of Dallas is suggesting that “entry to capital is a key part for why drilling hasn’t been the place it must be.”

Power analysts are projecting that in 2023, North American exploration and manufacturing firms could also be extra financially disciplined than in 2022 amid decrease commodity costs and tightened free money move, based on Moody’s Traders Service.

[ad_2]

Source_link