[ad_1]

Merchants despatched pure fuel futures decrease on Tuesday, at the same time as manufacturing declined and climate forecasts pointed to stronger consumption. The February Nymex fuel futures contract settled at $3.258/MMBtu, down 18.9 cents day/day. March shed 16.5 cents to $3.057.

At A Look:

- Forecasts present growing demand

- Manufacturing slips, freeze-offs loom

- Analysts see weak storage consequence

NGI’s Spot Fuel Nationwide Avg., in distinction, gained 36.5 cents to $5.725 as new chilly fronts fashioned and threatened to drive recent rounds of heating demand.

The outlook Tuesday from Maxar’s Climate Desk confirmed below-normal temperatures blanketing a lot of the Decrease 48 within the six- to 10-day and 11- to 15-day durations.

For the 11- to 15-day window, fashions trended colder over the prior 24 hours, in response to the forecaster. The sample would ship “belows into the South throughout the mid-period and far to robust belows within the Rockies, Plains, Midwest and at instances within the East.”

Within the six- to 10-day, Maxar referred to as for an “amplified sample” that includes a “trough over the West and ridge over the East Coast. The trough over the West is related to below-normal temperatures, together with a lot belows within the Inside West and powerful belows in elements of the Rockies, Plains and western Midwest.”

General, the forecast confirmed, nationwide heating demand would mount late this month and into early February, ending a pattern of principally benign climate thus far in January.

Manufacturing on Tuesday additionally eased from across the century mark to close 98 Bcf/d, reflecting partially upkeep work within the Permian Basin, in response to Wooden Mackenzie.

Within the close to time period, nonetheless, demand proved mild, notably compared to the snowstorm-laden December, and bearish sentiment weighed on markets because it has a lot of the new yr.

“On the demand aspect, gentle climate to kick off the yr has seen home consumption tail off considerably because the winter storm in December 2022,” Rystad Vitality analyst Ade Allen mentioned Tuesday.

Regardless of the output pullback Tuesday, Allen added, total robust manufacturing “continues to hinder costs,” with the present month estimated to common 100 Bcf/d – placing January on par with report ranges reached final yr.

Freeport Skepticism Simmers

In the meantime, one essential potential demand stimulant is the anticipated return of the Freeport LNG export facility in Texas. Administration of the liquefied pure fuel plant mentioned this week that they had sought regulatory approval to start the reopening course of. Executives had beforehand mentioned they hoped to relaunch by late January and rapidly construct as much as 2 Bcf/d of capability. Freeport would draw fuel from home provides and offset just lately comfortable U.S. heating demand.

Nevertheless, given prior regulatory delays, analysts remained doubtful. “Uncertainty lingers,” Allen mentioned. “We preserve our present forecast – a restart no sooner than March 2023. Indicators of an earlier restart” would supply an “upside catalyst for prompt-month pricing.”

Noting the current spate of benign climate, Allen joined a refrain of different analysts who additionally count on one other weak storage print with Thursday’s Vitality Info Administration (EIA) stock report. Ample storage ranges proceed to weigh on costs, too, he mentioned.

[Want to know how global LNG demand impacts North American fundamentals? To find out, subscribe to LNG Insight.]

Early estimates for the week ended Jan. 20 submitted to Reuters discovered analysts on the lookout for a mean lower of 78 Bcf. NGI predicted a pull of 81 Bcf. That compares with a withdrawal of 217 Bcf a yr earlier and a five-year common decline of about 185 Bcf.

EIA printed a lower of 82 Bcf for the week ended Jan. 13. The consequence in contrast meekly to the five-year common draw of 156 Bcf and the year-earlier pull of 203 Bcf. It lowered inventories to 2,820 Bcf however left shares above the five-year common of two,786 Bcf. It adopted a uncommon January injection of 11 Bcf reported every week earlier.

In the meantime, given the potential for chilly blasts and manufacturing interruptions that always accompany freezing situations, some analysts see near-term potential for restoration within the futures market. From a technical standpoint, on condition that front-month costs are almost half of December’s highs, costs could possibly be bottoming, in response to ICAP Technical Evaluation analyst Walter Zimmermann.

“Natty is affordable essentially and technically,” Zimmermann mentioned.

Strengthening Spot Costs

Money costs different by area, however robust good points within the West powered the nationwide common larger.

Northwest Sumas within the Rockies jumped $1.760 day/day to common $17.175, whereas Opal superior $1.725 to $17.885. Within the Northwest, Malin cruised forward $2.650 to $18.040.

Along with chilly air in elements of the West, Nationwide Climate Service (NWS) information confirmed stormy climate within the South, together with attainable heavy rains and tornadoes in Texas and snow within the Midcontinent on Tuesday. The situations had been anticipated to push to the East Wednesday and Thursday, although freezing temperatures weren’t anticipated in most areas.

Chilly air within the Mountain West and northern Plains, nonetheless, was forecast to unfold over the Nice Lakes and the Northeast by the weekend, setting in movement a stretch of widespread winter climate and stronger nationwide heating demand for late this month and early subsequent, in response to NWS.

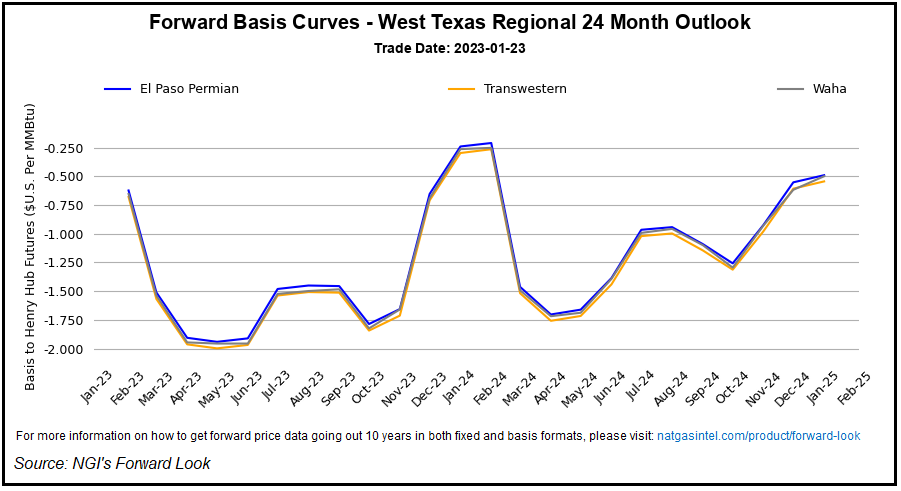

In West Texas, in the meantime, warnings from regulators to brace for storms mixed with upkeep work to curb manufacturing within the Permian Basin.

This helped drive a big decline in manufacturing in Tuesday’s estimate, mentioned Wooden Mackenzie analyst Laura Munder. She mentioned output fell 2.3 Bcf/d to 98.3 Bcf/d. Munder additionally famous manufacturing declines within the Midcontinent, North Louisiana and the Northeast. Costs in West Texas bounced larger on Tuesday. Waha rose 34.0 cents to $2.945 and El Paso Permian gained 48.0 cents to $2.990.

[ad_2]

Source_link