[ad_1]

U.S. pure gasoline costs have had a remarkably tender winter to date, however the entire of 2022 tells a very completely different story.

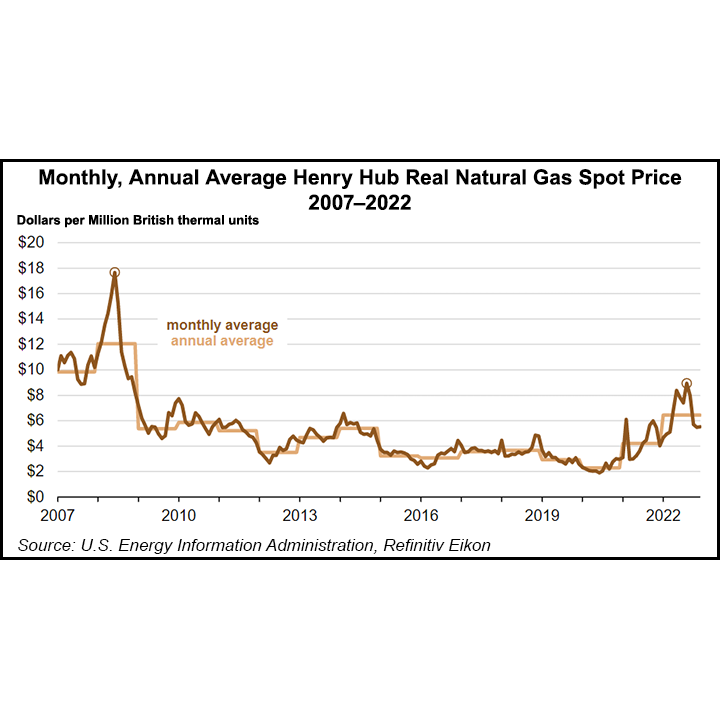

In 2022, the wholesale U.S. pure gasoline spot value at Henry Hub averaged $6.45/MMBtu, the very best degree since 2008, in keeping with the Vitality Data Administration (EIA) primarily based on information from Refinitiv Eikon.

This was up 53% from 2021, the fourth-largest yr/yr enhance in pure gasoline costs on document, behind solely 2000, 2003 and 2021. Volatility was additionally off the charts. Each day, the Henry Hub spot pure gasoline value ranged from $3.46 to $9.85/MMBtu, EIA stated.

Costs assorted from quarter to quarter, with Covid-related points after which Russia’s invasion of Ukraine closely influencing pricing.

Throughout the first quarter of 2022, declining U.S. pure gasoline manufacturing as a consequence of freeze-offs in January and February and excessive internet withdrawals of pure gasoline from storage precipitated the pure gasoline value to extend.

Then got here Russia’s invasion of Ukraine. Continued excessive demand for U.S. LNG exports in Europe and weather-driven demand for pure gasoline in the US led to Henry Hub value ranges in February and March of between $4.03/MMBtu and $6.70/MMBtu. Regardless of these value fluctuations, the $4.67/MMBtu common spot value was decrease within the first quarter of 2022 than throughout the remainder of the yr, EIA stated.

Pushed by energy sector demand, the Henry Hub spot value elevated above $9.00/MMBtu in early June, earlier than it fell by 40% by July 4 due to the shutdown of the two.6 Bcf/d Freeport liquefied pure gasoline export terminal.

Henry Hub started to rise once more in July and peaked on August 22, 2022, at $9.85/MMBtu amid hovering costs in Europe. This was 60% larger than the every day Henry Hub pure gasoline spot value firstly of the yr, EIA stated.

Pure gasoline costs decreased late within the third quarter due to rising manufacturing and above-average storage injections in September. An injection of 111 Bcf pure gasoline into storage for the week ended Oct. 14 marked the fifth consecutive triple-digit enhance and continued a uncommon autumn pattern of narrowing deficits to historic averages.

By November, working pure gasoline in underground storage was near the earlier five-year common. The Henry Hub pure gasoline spot value reached an annual low of $3.46/MMBtu on November 9, down 65% from August 22, in keeping with EIA.

Regional Variations

Capability constraints affected pure gasoline costs all year long on a regional degree. Costs at key Appalachian buying and selling hubs continued to stay at a $0.68/MMBtu common low cost to Henry Hub, in keeping with NGI information. This was as a consequence of restricted pipeline takeaway capability within the area.

The spot value on the Waha Hub in West Texas averaged $1.26/MMBtu beneath Henry Hub in 2022, largely as a consequence of restricted pipeline takeaway capability within the area and to durations of pipeline upkeep that decreased takeaway capability.

The Permian Basin, which feeds the Waha buying and selling hub, is the second largest gasoline producing area in the US after Appalachia and is rising. East Every day Capital is forecasting 4.6 Bcf/d of U.S. gasoline provide development by the top of 2023, led by related gasoline out of the Permian Basin.

Pure gasoline manufacturing within the Permian Basin greater than doubled up to now 5 years and reached a excessive of 16.7 Bcf/d in 2021, in keeping with the EIA. Further pipeline tasks out of the Permian Basin have been introduced that may increase pipeline takeaway capability by about 4.2 Bcf/d by the top of 2024.

In the meantime, a number of pricing hubs within the western United States averaged over $48/MMBtu above Henry Hub on December 21 as a consequence of colder-than-normal temperatures and regional pipeline constraints.

[ad_2]

Source_link