[ad_1]

With gentle climate persevering with unabated throughout massive swaths of america through the Jan. 12-17 interval, pure fuel ahead costs tumbled, in line with NGI’s Ahead Look.

The biggest worth declines had been seen on the West Coast, the place a a lot wanted break from the torrential downpours was set to happen. AccuWeather stated the pause in main rain and mountain snow occasions ought to final by means of the tip of January.

Whereas storms might proceed to roll throughout the northern Pacific within the coming weeks, a zone of excessive strain is forecast to construct at most ranges of the ambiance alongside the U.S. West Coast. This setup may pressure the storms to swing to the north and away from tropical moisture earlier than plunging southward over the inside Southwest, moderately than alongside the California coast.

The altering climate sample would enable the bottom to dry out and streams to recede step by step, in line with AccuWeather. Nonetheless, the runoff would proceed to fill space lakes and reservoirs over the subsequent couple of weeks.

This must be a boon to hydroelectric energy era, which has struggled over the previous couple of years due to the drought. With much less pure fuel doubtless wanted for energy era, ahead costs cratered.

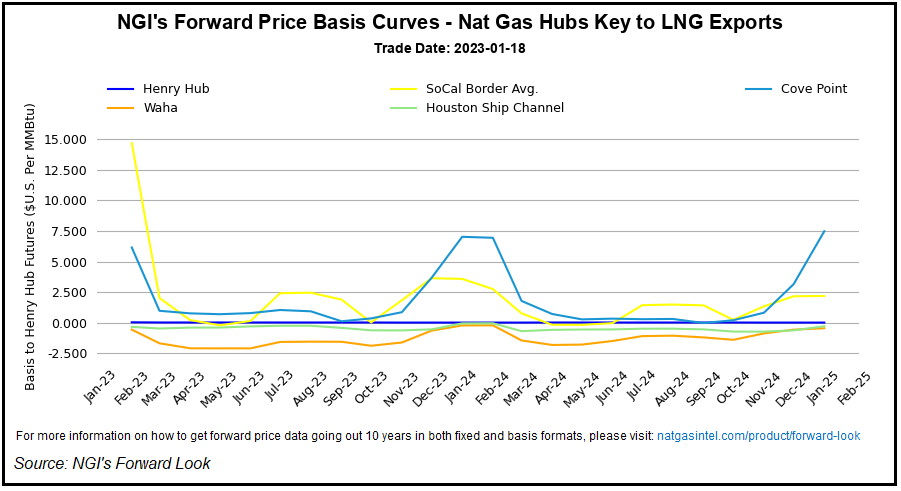

PG&E Citygate February costs plunged $7.940 by means of the interval to succeed in $17.817, Ahead Look knowledge confirmed. The summer season strip (April-October) averaged $1.010 decrease at $5.450, whereas the winter 2023-2024 strip (November-March) averaged $1.300 decrease at $7.111.

In Southern California, February costs on the SoCal Border Avg. dropped $7.670 from Jan. 12-17 to succeed in $18.017, whereas the summer season strip dropped 96.0 cents to $4.320. Winter costs had been down $1.140 to $6.755.

Whereas climate has moderated within the West, provide constraints might maintain the important thing to returning costs within the area to a buying and selling vary that higher aligns with the remainder of the nation.

Kinder Morgan Inc. stated repairs on Line 2000 of the El Paso Pure Fuel Pipeline system must be accomplished by the tip of January. Nonetheless, the Pipeline and Hazardous Supplies Security Administration would wish to approve the restart, which may take time. The pipeline has been shut since August 2021 following a lethal explosion close to Coolidge, AZ.

There are upkeep occasions underway on different pipelines within the area, which even have restricted fuel flows out of the Permian Basin.

That stated, hefty worth drops prolonged into the Desert Southwest and Rockies as effectively. Opal February costs fell $7.940 by means of the interval to succeed in $15.761, in line with Ahead Bathroomokay. Opal summer season costs had been down 35.0 cents to $3.060, whereas costs for the subsequent winter had been down $1.070 to $5.883.

By comparability, benchmark Henry Hub costs for February fell 38.0 cents to $3.331, Ahead Look knowledge confirmed. Notably, that is on par with the summer season strip. Additional out the curve, winter 2023-2024 costs dropped 16.0 cents to $4.246.

Is Winter Actually Over Already?

Although it’s nonetheless too early to name off winter, the blowtorch heat skilled to this point in January, together with the gentle begin to the season, has been a bearish affect over the market. After deficits of greater than 300 Bcf late final summer season, the market had grown jittery about provide this winter. Freeport LNG initially was anticipated to return to service earlier than the tip of the yr, and the sturdy pull on pure fuel was seen probably resulting in a shortfall if demand proved greater than regular. Futures costs shot up accordingly, reaching $10 within the late summer season.

Since then, nevertheless, a string of above-average storage injections within the fall together with principally modest attracts this winter – and a uncommon January injection in addition – have squashed any provide fears. What’s extra, there’s ongoing uncertainty that Freeport would start delivery liquefied pure fuel by the tip of January, a timeline it continues to focus on.

On Thursday, the Vitality Info Administration (EIA) delivered extra bearish knowledge. The EIA reported an 82 Bcf withdrawal for the week ending Jan. 13, which landed on the deeper finish of a variety of estimates forward of the report however nonetheless was moderately “wimpy” total, in line with NatGasWeather.

Traditionally talking, the draw was far wanting final yr’s 203 Bcf withdrawal for the same interval and the 156 Bcf five-year common. As such, the two,820 Bcf of whole working fuel in storage stood solely 19 Bcf under year-earlier ranges and 34 Bcf above the five-year common, in line with EIA.

Damaged down by area, the East and Midwest every reported a 38 Bcf draw, whereas the Mountain area pulled out 6 Bcf. Pacific shares slipped by 3 Bcf.

The South Central area, in the meantime, reported back-to-back web injections. This time, the two Bcf web addition included a 12 Bcf improve in salt storage and a ten Bcf draw from nonsalts, EIA stated.

Much more bearish than the newest storage stat is that analysts count on one more gentle draw within the subsequent EIA report as effectively.

Early estimates pointed to a draw within the 60-80 Bcf vary, which might examine with the year-earlier pull of 217 Bcf and the five-year common of 185 Bcf. As such, analysts gave the impression to be bumping up their estimates for the tip of October. Some reached above 4.0 Tcf.

“The market appears to be pricing that in,” stated Enelyst’s Het Shah, managing director of the web power chat.

Mobius Threat Group stated there would have to be some persistence in an upcoming chilly shot for the market to alter course. When wanting again over the previous decade, the Houston agency stated, there have been durations from the second half of January by means of February/March which were chilly sufficient to think about this risk. Nonetheless, it could doubtless require the stability of winter to come back in 100-200 heating diploma days colder than regular to immediate market contributors to revisit the relevance and affect of predicted extra provide this summer season.

“Except stock on the finish of winter manages to dip again under 1.6 Tcf, market bears might maintain the higher hand for a lot of 2023,” Mobius pure fuel analyst Zane Curry stated. “This degree may simply be breached if temperatures from mid-January by means of end-March are as chilly as they had been in 2013, 2014 and 2015.”

And it’s potential. Curry famous that in 2013, this 11-week interval had a 1.3 Tcf withdrawal, adopted by 2014 at a 1.6 Tcf draw, after which 2015 at a draw of 1.2 Tcf.

Mobius is presently modeling a place to begin for the injection season of two.8 Tcf. “Nonetheless, one should additionally take into account a yr like 2016 when solely 600 Bcf was withdrawn over this identical 11-week interval,” Curry stated. “Winter isn’t over but, and Mom Nature will decide our path ahead, similar to she has to this point in markets from the West Coast, to Europe and all over the place in between.”

Certainly, the approaching chilly snap has confirmed to be a difficult one to foretell primarily based on current climate mannequin runs. As of Friday afternoon, the European ensemble trended barely hotter for the approaching two weeks. Notably, many of the misplaced demand was seen within the Jan. 25-30 interval, which now’s again to seasonal as an alternative of barely bullish, in line with NatGasWeather.

“Nonetheless, what the pure fuel markets doubtless mattered most was warmer-than-normal temperatures gaining territory over many of the southern and japanese U.S. Feb. 2-5 in a bearish setup,” the forecaster stated.

EBW Analytics Group LLC stated a key concern within the coming chilly sample is that the majority of anomalous chilly is targeted on the central United States. The japanese third of the Decrease 48 is predicted to extend fuel consumption solely barely.

That stated, the February contract stays technically oversold, in line with EBW. The elemental flip colder, coinciding with a technically oversold market, is usually a recipe for a short-term bounce, rising the dangers of a near-term push greater for February.

“With fuel manufacturing up 6 Bcf/d yr/yr and Freeport offline, storage surpluses might proceed to develop even throughout modestly supportive colder February climate,” EBW power analyst Eli Rubin stated.

The February Nymex fuel futures contract settled Thursday at $3.275 after which dropped one other 10.1 cents on Friday to shut out the week at $3.174.

[ad_2]

Source_link