[ad_1]

The bid values Origin at $18.4 billion.

Picture: iseekplant

Australia’s Origin Vitality has once more prolonged the unique due diligence interval for its takeover consortium comprising of Canada’s Brookfield Asset Administration and United States-based gasoline provider MidOcean Vitality, managed by US funding large EIG Companions.

Picture: ASX

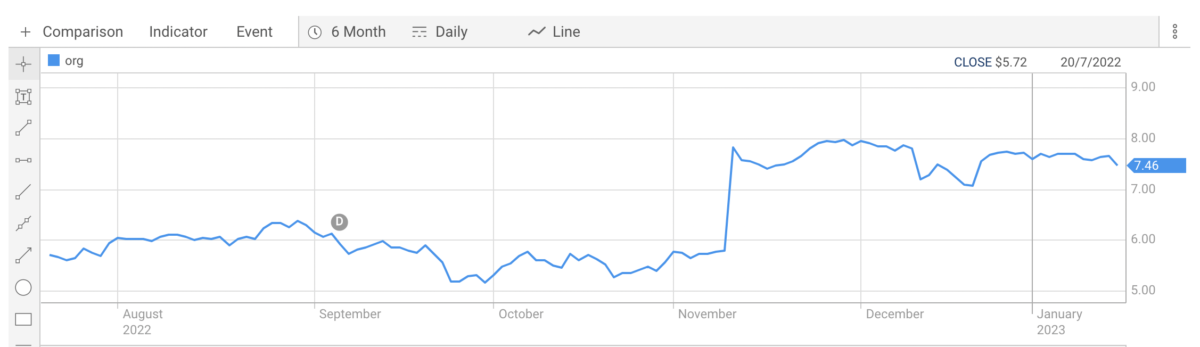

In November, the consortium introduced its $9-a-share money provide, which continues to characterize a big premium on Origin’s present share costs. On the time, Origin’s board stated it could “unanimously advocate” shareholders vote in favour of the $18.4 billion takeover bid, which might rank among the many largest private-equity-backed buyouts of an Australian firm.

Nonetheless, considerations across the deal are rising, given that is the second time the consortium’s unique due diligence interval has been prolonged. It was first prolonged in December, and that interval will now push out to January 24.

Origin’s temporary assertion to the Australian Inventory Trade (ASX) supplied no cause for why the extension was requested, nor any timeline for when Brookfield and EIG are anticipated to finalise.

As a part of the takeover, the consortium stated it deliberate to divide Origin’s enterprise and make investments one other $20 billion by 2030 to assist the gen-tailer’s transition to wash vitality.

Within the break up, Brookfield would take Origin’s vitality era and retailing companies whereas MidOcean would purchase Origin’s gasoline enterprise, together with its 27.5% a stake in Australia Pacific LNG.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.

[ad_2]

Source_link