[ad_1]

With a quick chilly snap penetrating deep into Texas this week, pure fuel spot costs had been blended as demand elevated as heating hundreds rose in key markets. NGI’s Weekly Spot Gasoline Nationwide Avg. climbed 11.5 cents from Jan. 9-13 to $5.575/MMBtu.

Nymex pure fuel futures, in the meantime, failed to interrupt out of the sub-$4 vary it fell into earlier this month. The February contract settled Friday at $3.419, off 27.6 cents on the day and down practically 50 cents from the beginning of the week.

In a market the place LNG information can typically dominate headlines, climate maintained its grip on costs this week. A parade of moist climate programs continued to maneuver throughout the West, taking purpose at California and inflicting flooding and in any other case chaos regardless of in any other case average temperatures.

AccuWeather mentioned the storms would proceed via subsequent week. Though wreaking havoc in the best way of flooding and mudslides, the heavy rains and snow proceed to chip away at long-term drought circumstances within the area. Rounds of gusty winds from the storms into early subsequent week will typically vary between 40 and 60 mph at most areas however might be domestically larger and double that over among the ridges and peaks.

The forecaster mentioned there are indications that storms might arrive much less steadily later this month with the potential for a break altogether for a time.

“The storms on observe to affect California into early subsequent week won’t be related to a real atmospheric river just like the occasions from earlier this month,” AccuWeather Meteorologist Reneé Duff mentioned.

Despite the fact that temperatures had been comparatively gentle amid the messy sample, costs strengthened amid ongoing pipeline restrictions transferring fuel into the area. PG&E Citygate traded in a variety from $15-30, averaging 63.0 cents larger on the week at $19.580. SoCal Citygate costs had been up solely 10.0 cents at $21.260.

A number of areas farther north in Oregon, in addition to throughout the Desert Southwest and into the Rockies softened week/week. El Paso S. Mainline/N. Baja tumbled $1.205 to $20.105, and Northwest Sumas dropped $1.670 to $13.080.

Elsewhere throughout the nation, benchmark Henry Hub was dragged decrease amid a brief dip in liquefied pure fuel feed fuel deliveries. Costs averaged 19.5 cents decrease at $3.465.

Within the nation’s midsection, value decreases of as much as 25 cents had been widespread, a pattern that prolonged farther east. On the East Coast, although, a quick chilly snap boosted costs there. Algonquin Citygate jumped $1.435 to $5.600, and Transco Zone 6 non-NY edged up 32.0 cents to $3.340.

Fizzling Futures

Delicate climate all over the place east of the Rockies continued to strain Nymex futures, particularly as climate fashions failed to indicate with certainty {that a} colder change would happen anytime quickly.

Bulls had been banking on Thursday’s climate knowledge that confirmed frigid Canadian air dropping into the Decrease 48 and blanketing the northern half of the nation by the ultimate week of January. Nevertheless, these hopes had been shortly dashed when Friday’s knowledge confirmed backed off the depth of the chilly climate system.

“An unsure climate sample for late January is driving rising jitters heading into the lengthy vacation weekend,” mentioned EBW Analytics Group LLC’s Eli Rubin, senior vitality analyst.

Rubin identified that impartial forecaster DTN’s most-likely forecast provides 53 gas-heating diploma days and 15 Bcf/d of fuel demand from Week 1 to Week 3. Whereas fundamentals counsel renewed softening on a seasonal foundation, dealer positioning forward of climate dangers might form near-term value motion, in keeping with the analyst.

That mentioned, there are few (if any) provide issues for the rest of winter. Fueling bearish momentum this week was the Vitality Data Administration’s (EIA) newest stock report, which confirmed a never-before January injection.

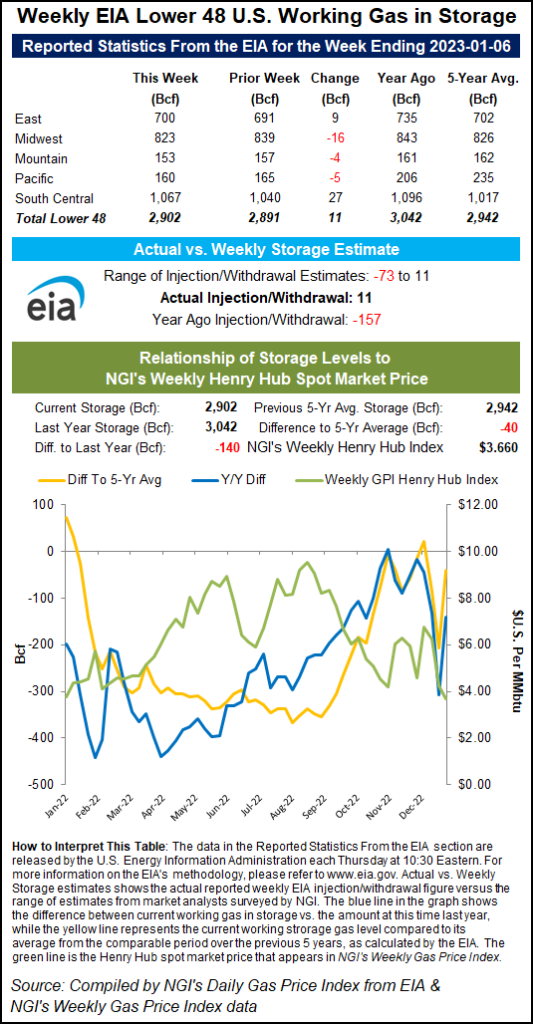

The EIA mentioned shares within the South Central area alone jumped 27 Bcf, whereas the East added 9 Bcf. The Midwest posted the biggest withdrawal at 16 Bcf, and the Mountain and Pacific areas recorded single-digit declines.

Complete inventories for the week ending Jan. 6 rose to 2,902 Bcf, which is 140 Bcf under year-earlier ranges and 40 Bcf under the five-year common, in keeping with EIA.

Rubin mentioned the most recent EIA’s report was essentially the most bearish weekly January storage report studying in historical past. What’s extra, by the top of Week 3, storage might attain greater than 200 Bcf above the five-year common and 300 Bcf above year-ago ranges. This may possible present “a enough storage cushion to keep up downward strain for Nymex futures on a seasonal foundation.”

The market might get no less than some assist earlier than spring arrives. EBW famous that final 12 months, a persistently chilly 1Q2022 – punctuated by a mini-Arctic blast and manufacturing freeze-offs in early February – laid the groundwork for a gradual restoration into late winter and 14-year excessive fuel costs throughout the summer season.

That mentioned, distinctive January 2023 heat might construct a 300 Bcf 12 months/12 months surplus by early February. And, by the top of Week 3, there are only some weeks left earlier than winter chilly begins to fade.

“Gasoline manufacturing is up 6 Bcf/d versus 2022 and Freeport stays offline. Whereas a colder flip and manufacturing rebound can’t be dominated out, odds favor additional declines into late winter,” Rubin mentioned.

Money Costs Slide

Spot pure fuel costs had been down sharply on Friday, dragged decrease by weak demand amid largely average temperatures.

West Coast costs led the best way, with California areas tumbling from the $20-plus ranges seen earlier within the week. PG&E Citygate spot fuel plummeted $10.270 day/day to common $16.185 for the four-day fuel interval via Tuesday. The SoCal Border Avg. dropped $7.740 to $17.510.

Stable value decreases prolonged into the Desert Southwest and throughout the Rockies as effectively. Opal money fell $5.300 to $16.075, and El Paso San Juan slid $7.045 to $7.750.

The sell-off in West Coast money markets occurred regardless of a continuation within the parade of storms that had dumped a number of inches of rain and snow all through the area. The Nationwide Climate Service (NWS) mentioned the messy climate sample was forecast to stay in place via the weekend with a trio of storm programs barreling towards the area.

“California will likely be notably vulnerable to flooding since they’ve obtained anomalous quantities of rain over the previous few weeks,” NWS forecasters mentioned.

In the meantime, El Paso Pure Gasoline Pipeline (EPNG) on Thursday alerted prospects that the bodily work on Line 2000 is anticipated to be accomplished by the top of January. As soon as that’s accomplished, EPNG will likely be submitting a request to the Pipeline and Hazardous Supplies Security Administration (PHMSA) to carry the strain restrictions via the road and return it to business service.

“In fact, that is conditional upon PHMSA’s approval,” Wooden Mackenzie analyst Quinn Schulz mentioned.

EPNG additionally identified that when PHMSA receives the request, it will require a while to overview it. This implies that expectations must be tempered throughout such a course of, in keeping with Schulz.

The analyst famous that given California’s latest storage struggles, that is welcome information as stock for Southern California (SoCal) is at its previous five-year minimal ranges, whereas adjusted Pacific Gasoline & Electrical Corp. (PG&E) stock sits close to its previous five-year minimal.

As of Thursday (Jan. 12), “SoCal’s stock sits at about 61 Bcf, whereas adjusted PG&E stock is at roughly 73 Bcf as of Jan. 11,” Schulz mentioned. “Upon PHMSA’s approval, this could imply that about 0.55 Bcf/d of westbound capability on EPNG’s south mainline would return via the L2000 constraint.”

Upstream within the Permian Basin, costs adopted swimsuit and posted losses of a number of {dollars} at some areas. El Paso Permian dropped $4.710 to $2.690, whereas Waha fell $4.465 to $2.520.

Elsewhere, most different U.S. areas posted value decreases of lower than $1.00 on the day. Henry Hub slipped solely 11.5 cents to $3.435, whereas Florida Gasoline Zone 3 fell 38.5 cents to $3.530.

Northeast factors rallied forward of a quick chilly entrance hitting the area this weekend. Tenn Zone 6 200L money jumped $3.150 to $7.065, and Transco Zone 6 NY shot up 85.5 cents to $4.045.

[ad_2]

Source_link